5 XAGUSD Signals Surge 3%: Silver Breaks IDR840,000, New Volatility?

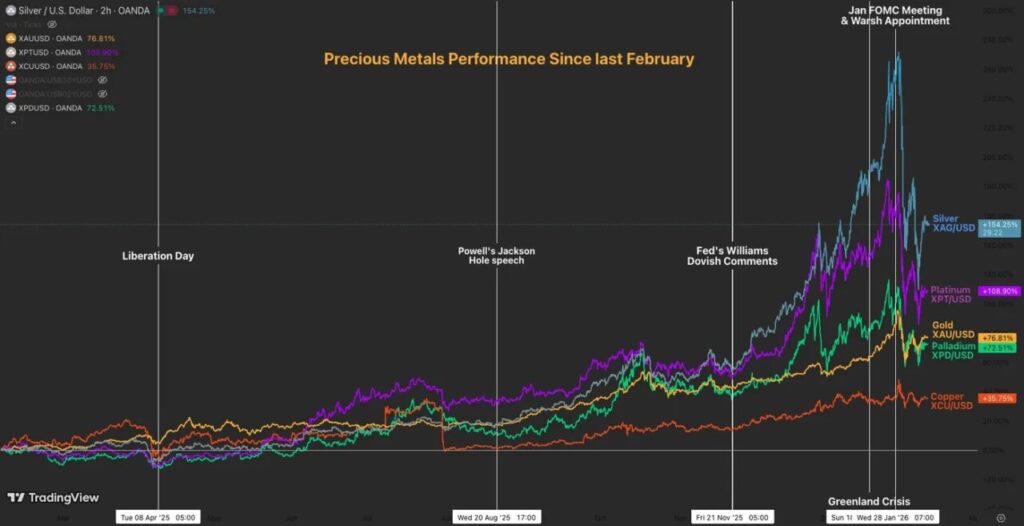

Jakarta, Pintu News – World silver prices (XAGUSD) recorded a sharp surge and opened trading with a gap higher amid a shift in global market sentiment. This movement came after the previous pressure eased and market participants returned to seeking hedge assets amid economic uncertainty. Assuming an exchange rate of 1 USD = IDR16,771, any significant increase in global silver prices directly impacts IDR valuations as well as the strategies of commodity traders, including investors who are also active in the crypto and cryptocurrency markets.

1. XAGUSD Gap Up: What does it Mean for the Trend?

Silver prices opened higher than the previous close, creating a technical gap that usually reflects a strong change in sentiment in a short period of time. If the silver price is around USD 50 per ounce, it is worth around IDR 838,550 per ounce, showing great sensitivity to fluctuations in the US dollar.

Gaps like this often occur when there are macro catalysts, including dollar weakness or expectations of monetary policy changes. But in technical analysis, gaps can also be followed by short-term corrections before a new trend is confirmed. Traders need to pay attention to whether the price is able to stay above the breakout area or close the gap.

Also Read: 5 Shocking Facts About Jeffrey Epstein’s Influence in Silicon Valley

2. US Dollar and Bond Yield Factors

The movement of XAGUSD is heavily influenced by the dynamics of the US dollar and United States government bond yields. When the dollar weakens, silver prices tend to rise as it becomes relatively cheaper for international buyers.

If the price of silver rises from USD 48 to USD 50 per ounce, an increase of USD 2 is equivalent to approximately IDR 33,542 per ounce. These changes show that small fluctuations in the dollar can create significant movements in the rupiah, especially for domestic market participants trading dollar-based contracts.

3. Key Support and Resistance Levels

In technical analysis, the nearest resistance area is at the previous high zone which is a test point for the continuation of the bullish trend. If XAGUSD is able to break the resistance consistently, then further upside opportunities are open.

Conversely, the support area is at the level of the gap formed, which is now a test area for the validity of the trend. If the price drops back and closes the gap, then a consolidation or correction scenario may occur before a new direction is established.

4. Silver, Gold, and Crypto Market Relationship

Silver’s movements often correlate with gold as a safe haven asset. When uncertainty increases, investors tend to allocate funds to precious metals as well as digital assets such as Bitcoin and Ethereum .

In recent years, cryptocurrencies such as Ripple and Pepe Coin have also shown reactions to the same macro sentiment changes as precious metals. Although volatility characteristics differ, risk-on and risk-off patterns are often seen similarly between crypto and commodities.

5. Trader’s Strategy and Risk Management

XAGUSD price spikes can provide opportunities, but also increase the risk of intraday volatility. Traders are advised to monitor technical indicators such as RSI and volume to ascertain the strength of the trend.

Risk management remains a key factor, especially when using high leverage. In both commodity and crypto markets, volatility can move quickly so the use of stop-losses and proportionate position sizes are important to maintain portfolio stability.

Overall, XAGUSD’s surge suggests potential short-term bullish momentum with the support of favorable macro sentiment. However, validation of the trend remains dependent on the price’s ability to hold above the breakout level and market response to global economic developments.

Also Read: 5 Interesting Facts Behind the 2.5 BTC Transfer to Genesis Bitcoin Wallet

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

Gold-Based Crypto: When Physical Assets Meet Crypto Technology

As blockchain technology develops, gold can now be owned not only in physical form such as jewelry or bars, but also in digital form through gold-based crypto assets.

One of the most popular is Tether Gold (XAUt), a physical gold-backed ERC-20-based stablecoin, where 1 token represents 1 troy ounce of pure gold. The gold is stored in vaults in Switzerland and each token is directly linked to certified gold bullion. The system uses automated algorithms to efficiently manage the allocation of gold and Ethereum addresses.

XAUt tokens are available and traded on various crypto exchanges. XAUt is also an attractive alternative for those looking to hedge against inflation or global economic uncertainty, while remaining within the digital asset ecosystem.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Buying and selling crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities

Reference

- MarketPulse. Silver (XAG/USD) Gaps Higher – In-Depth Analysis. Accessed February 11, 2026.