Download Pintu App

3 Main Reasons Binance Hasn’t Listed Pi Network Yet!

Jakarta, Pintu News – Pi Network, one of the up-and-coming alternative cryptocurrencies, has struggled with price increases and has yet to be successfully listed on Binance, one of the world’s largest crypto exchanges.

Here’s an in-depth analysis of the three main reasons that might stand in the way of Pi Coin gaining a place on the platform.

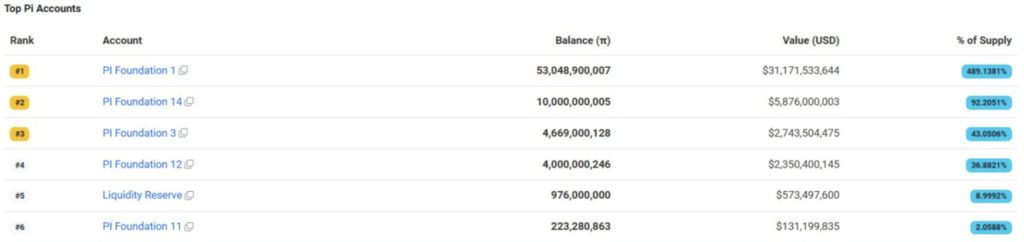

Pi Coin Centralization

Pi Network faces major challenges related to its centralized ownership structure. Pi Network’s policies and management, which tend to be controlled by a single entity or small group, raise concerns about security and transparency. This is in contrast to cryptocurrencies such as Bitcoin (BTC) or Ethereum (ETH) which have a more decentralized structure.

Read also: Pi Network’s Price Plummets Despite Surpassing 120 Million Downloads – What’s Going On?

These concerns reduced investor and user confidence, which in turn influenced Binance’s decision not to inaugurate Pi Coin immediately. In addition, this centralization may limit the Pi Network’s ability to adapt and evolve according to dynamic market needs.

Without the ability to effectively innovate and meet changing industry standards, Pi Coin may continue to have difficulty in attracting wider interest.

Lack of Usability

One important factor that determines the success of a cryptocurrency is its usefulness in real life.

Unfortunately, Pi Coin has yet to demonstrate significant practical applications that could support mass adoption. This is in contrast to other cryptocurrencies like Ripple (XRP) that are already integrated in cross-border payment systems.

The lack of platforms or services that support the widespread use of Pi Coin makes it less attractive to users and investors. Without a clear use case, it’s difficult for Pi Coin to build a strong ecosystem that can attract the interest of major exchanges like Binance.

Lack of Liquidity

Liquidity is of key importance for any asset in the financial markets, including cryptocurrencies.

Read also: Tether Unleashes $1 Billion on Tron, Closing In on Ethereum’s Lead!

Pi Coin is currently facing challenges in terms of liquidity, which means there are difficulties in buying or selling large amounts without significantly affecting the market price. This is a risk for traders and investors who may want to enter or exit their positions quickly.

This lack of liquidity also reflects low trading volumes, which can be an indicator of a lack of investor interest.

Exchanges like Binance tend to look for assets that have high liquidity to ensure that they can provide efficient and profitable trading services to their users.

Overall, although Pi Network is showing potential by entering a critical demand zone and facing a possible price increase, there are still some significant obstacles to overcome before it can be listed on Binance.

Centralization, lack of usability, and lack of liquidity are the main factors currently hindering Pi Coin’s progress within the wider crypto ecosystem.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Pi Network Price Analysis: 3 Reasons Why Binance is Not Listing Pi Coin. Accessed on May 7, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.