Download Pintu App

Bitcoin Approaches Rp1.74 Billion: Trend Analysis and Challenges May 2025

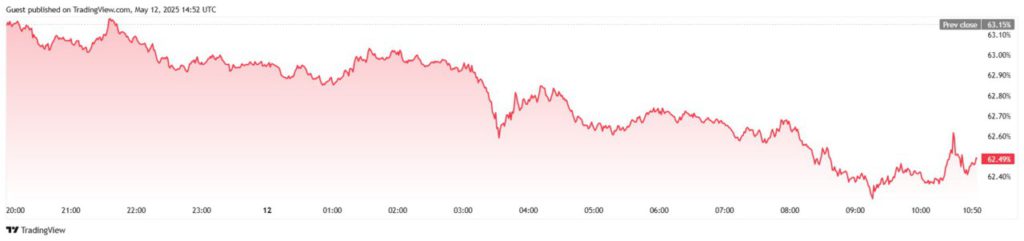

Jakarta, Pintu News – Bitcoin (BTC) recently experienced a significant price spike, reaching Rp1.74 billion (US$105,500) on May 12, 2025. This increase was triggered by a trade deal between the United States and China that reduced import tariffs for 90 days, creating optimism in global financial markets. However, despite the initial spike, the price of BTC later corrected to around Rp1.69 billion (US$102,818), indicating that volatility is still high in the cryptocurrency market.

Impact of US-China Trade Deal on Crypto Market

The announcement of tariff reductions by the US Treasury Secretary, Scott Bessent, pushed the price of Bitcoin up sharply. The deal is considered a positive step in easing trade tensions between the world’s two largest economies, which had previously caused uncertainty in global markets. As a digital asset that is often considered a hedge against economic uncertainty, Bitcoin benefited from this positive sentiment.

However, despite the initial surge, Bitcoin price was unable to maintain its highs and experienced a correction. This suggests that the market is still cautious and waiting for further confirmation regarding the stability of trade relations between the US and China. In addition, other factors such as monetary policy and global economic conditions also affect the price movements of cryptocurrencies.

Also Read: Can Gaming PCs be Used to Mine Bitcoin (BTC)? Here are the Facts in 2025

Technical Analysis and Resistance Levels

Technically, Bitcoin faces strong resistance around Rp1.80 billion (US$109,000), which is an all-time high. Despite the positive momentum, analysts warn that reaching and maintaining this level requires strong fundamental support and sustained positive market sentiment. Technical indicators such as RSI and MACD are showing overbought conditions, which could trigger a price correction in the short term.

In addition, increased trading volume during price spikes indicates high interest from investors, but also increases the risk of volatility. Traders and investors are advised to monitor support levels around IDR1.65 billion (US$100,000) and IDR1.60 billion (US$97,000) as a reference for their trading strategies.

Medium-Term Outlook and Risk Factors

In the medium term, the outlook for Bitcoin remains positive, supported by increasing institutional adoption and clearer regulatory developments in various countries. However, risks remain, including potential geopolitical tensions, monetary policy changes by major central banks, and the dynamics of the crypto market itself. Investors should consider these factors in their investment decision-making.

In addition, the development of blockchain technology and the integration of cryptocurrencies in the traditional financial system could be long-term growth drivers. However, challenges such as cybersecurity, stringent regulations, and market volatility remain key concerns for market participants.

Conclusion

Bitcoin’s price surge of up to Rp1.74 billion reflects the market’s response to positive developments in global trade relations. However, high volatility and technical challenges suggest that investors should remain vigilant and conduct thorough analysis before making investment decisions.

By taking into account fundamental and technical factors, as well as global geopolitical and economic developments, investors can create a more informed and measured strategy in the face of cryptocurrency market dynamics.

Also Read: Robert Kiyosaki Highlights Potential Market Crisis, Calls Bitcoin (BTC) Superior to Gold

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Frederick Munawa / Bitcoin.com. Bitcoin Briefly Tops $105K As Markets Rally on China-US Trade Deal. Accessed May 13, 2025.

- Featured Image: Generated by AI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.