Download Pintu App

The Impact of the US-China Trade Agreement on Gold and Bitcoin

Jakarta, Pintu News – On May 12, 2025, the United States and China announced an agreement to lower import tariffs for 90 days, marking a significant step in easing trade tensions between the world’s two largest economies. The move sparked mixed reactions in global financial markets, particularly in commodities such as gold and digital assets such as Bitcoin (BTC).

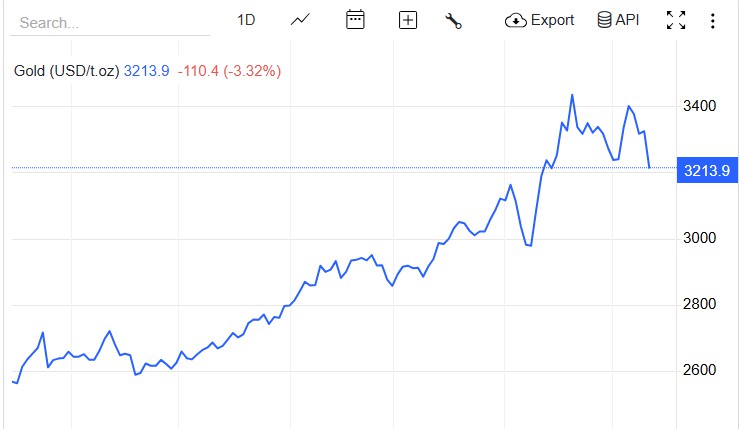

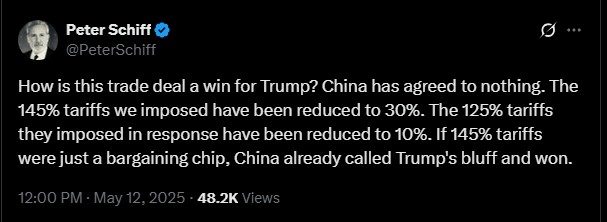

Gold Price Declines as Trade Tensions Ease

Gold prices have decreased by more than 3%, from $3,323 per ounce to around $3,215 per ounce, following the announcement of the trade deal between the US and China. This decline reflects reduced investor demand for safe haven assets such as gold, along with increased market optimism for global economic stability. The strengthening of the US dollar is also putting pressure on gold prices, as it makes the precious metal more expensive for holders of other currencies.

Analysts expect that gold prices could continue to come under pressure in the short term, especially if US economic data shows steady growth and contained inflation. However, lingering uncertainties regarding long-term trade negotiations and global monetary policy may limit further gold price declines.

Also Read: Bitcoin Approaches Rp1.74 Billion: Trend Analysis and Challenges May 2025

Bitcoin Price Stability Amid Market Changes

Meanwhile, Bitcoin (BTC) showed price resilience by remaining stable at around $102,389, despite reaching an intraday high of $105,525. This stability shows that investors still see Bitcoin as an attractive alternative asset, despite changing geopolitical and global economic risks. Bitcoin’s stable performance is also supported by increasing institutional adoption and investor interest in digital assets.

However, analysts warn that Bitcoin faces strong resistance around the $109,000 level, which is the previous record high. Further gains may require additional catalysts, such as positive developments in cryptocurrency regulation or increased adoption of blockchain technology globally.

Conclusion

The trade deal between the US and China has affected global financial markets in different ways. Gold prices have declined due to reduced demand for safe haven assets, while Bitcoin has shown stability amid changing market sentiment. Investors are advised to continue monitoring the progress of trade negotiations and other global economic indicators in making investment decisions.

Also Read: 3 Altcoins that Catch Analysts’ Attention Amid Positive Market Sentiment: Significant Growth!

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Bitcoin.com News. Gold Slips as US-China Trade War Thaws; Bitcoin Holds Steady. Accessed May 13, 2025.

- Featured Image: Generated by AI

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.