Download Pintu App

Bitcoin (BTC) Breaks $105,000, What’s Behind the Price Increase?

Jakarta, Pintu News – Bitcoin (BTC) hit a new record of $105,000 on May 12, 2025 after the United States and China reached a temporary agreement to reduce import tariffs.

This deal not only eased tensions between the world’s two largest economies but also provided a significant boost to global markets and risky assets such as cryptocurrencies.

Check out the full information in this news!

US-China Tariff Deal and Its Impact on the Market

On Monday, the two countries announced that they would lower import tariffs for 90 days to allow more time for further talks.

The United States will reduce import tariffs from 145% to 30%, including tariffs on fentanyl, while China will lower its tariffs on American goods from 125% to 10%. The deal is expected to take effect on May 14.

This news was welcomed positively by global financial markets. Bitcoin (BTC), as a risky asset, experienced a significant surge in price, reaching $105,231.94. This increase suggests that investors see the tariff deal as a positive step that could reduce global economic uncertainty.

Also read: 3 Major Causes of Moo Deng (MOODENG) Price Jumping 728% in 30 Days!

Technical Analysis and Price Outlook of Bitcoin (BTC)

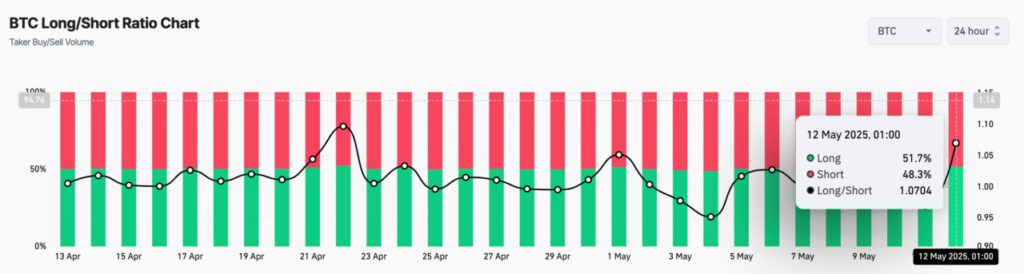

Although the price of Bitcoin (BTC) has reached extremely high levels, there are some indicators that suggest that there may be an impending price drop. Bullish derivatives activity suggests that many investors expect the price to continue rising.

However, on the daily chart, Bitcoin’s (BTC) Chaikin Money Flow (CMF) started to show a decline, creating a bearish divergence with the price. This divergence suggests that buying pressure is starting to weaken, which could potentially lead to a price drop to $101,070. Investors and traders should pay attention to these indicators to make informed investment decisions amid highly volatile market conditions.

Also read: Stablecoin Market to Reach $3.7 Trillion by 2030, Citi Bank Shares Analysis!

The Role of the US and China in the Future of Global Finance

The talks between the US and China not only focused on tariffs but also covered other important issues such as fentanyl trade. The US Secretary of the Treasury, Scott Bessent, stated that both sides agreed not to engage in economic decoupling. This agreement indicates the possibility of closer economic cooperation in the future.

Moreover, with the US and China showing willingness to continue discussions during this three-month window, there is hope that this will open up more opportunities for global economic stabilization and growth. This also gives investors more confidence that risky assets such as Bitcoin (BTC) may continue to find support in the financial markets.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Bitcoin Price Surges Amid US-China Tariff Deal. Accessed on May 13, 2025

- CryptoTimes. Bitcoin at $105k Amid US-China Tariff Relief, SEC Roundtable. Accessed on May 13, 2025

- Featured Image: Generated by Ai

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.