Download Pintu App

Pi Network Surges 17% on May 14 — Is This the Breakout PI Holders Have Been Waiting For?

Jakarta, Pintu News – Pi Network (PI) has surged by 86% in the past week, briefly trading at $1.09 (13/5/25) and showing strong recovery potential after underperforming in April.

This rise puts the altcoin in a position to recover the losses incurred in March, as it is currently still holding above the crucial $1.00 support level. This latest rally has caught the attention of investors and sparked optimism for future price movements.

Then, how will the Pi Network price move today?

Pi Network Price Rises 17.5% in 24 Hours

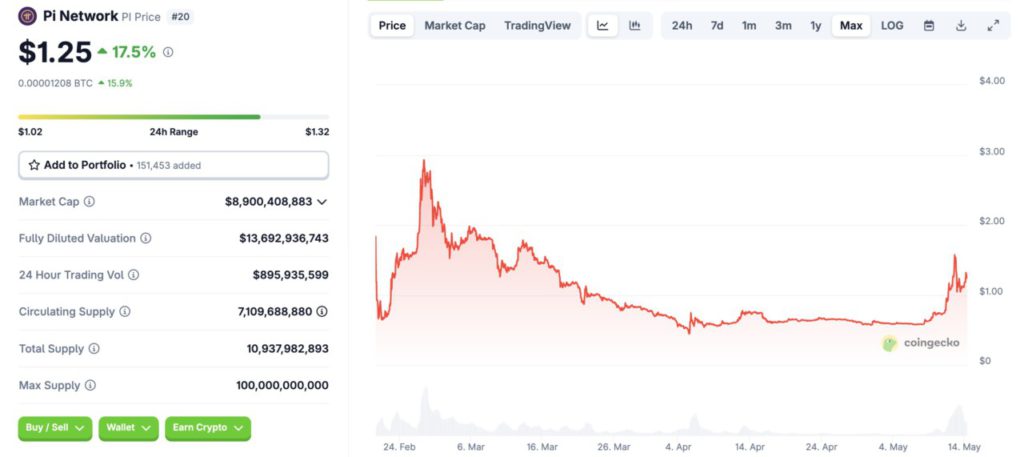

On May 14, 2025, the price of Pi Network (PI) was recorded at $1.25, having risen 17.5% in the last 24 hours. If converted into the current rupiah ($1 = IDR 16,572), then 1 Pi Network is IDR 20,715. Within the daily range, the PI price moves between $1.02 and $1.32.

Read also: Pi Coin Price Prediction: Is Pi Network on its Way to the $2 Level?

The current market capitalization stands at around $8.9 billion, while the fully diluted valuation stands at almost $13.7 billion. The current circulating supply is about 7.1 billion PIs, out of a total supply of 10.9 billion, with the maximum supply set at 100 billion.

Pi Network Still Has Room to Grow

The Relative Strength Index (RSI) for Pi Network has surged past the 70.0 threshold, signaling that the asset has entered an overbought zone. This indicates that the bullish momentum is starting to reach saturation point, which historically can signal a possible reversal.

Overbought conditions are often followed by a market correction as the overheated market starts to cool down and investors tend to take profits.

However, it’s worth noting that some assets can remain in the overbought zone for a long time without declining. If PIs experience a similar situation, then it could be that prices remain stable without a sharp decline.

Looking at the overall momentum, the Chaikin Money Flow (CMF) indicator for the Pi Network is well above the zero line, indicating a strong inflow of funds.

Although the CMF did experience a dip, this is not expected to last long, mainly due to favorable market forces.

Read also: Pi Network Soars to $1, Outperforming Litecoin and Bitcoin Cash!

While there may be short-term fluctuations, the general market sentiment – reinforced by the positive CMF readings – indicates that the Pi Network’s bullish momentum is still holding. It could potentially sustain its upward movement, as long as overall market conditions remain favorable for crypto assets

PI Price Shows Strength

Quoting the BeInCrypto report (5/13/25), the price of Pi Network was at the level of $1.09, an increase of 86% in the last seven days, with strong support in the range of $1.00. This psychological support point is very important for the future performance of altcoins.

Although the indicators are showing mixed signals, the probability of PI dropping below $1.00 seems low. If it is able to hold above this level, Pi Network has the potential to continue its uptrend towards its $1.34 target, with further potential up to $1.64.

However, this scenario is only possible if the existing bullish momentum continues in the next few days.

Conversely, if Pi Network experiences significant selling pressure from investors, the altcoin could lose support at the $1.00 level. A drop below this tipping point could push PI prices down to $0.87 or even $0.78, which would invalidate the bullish outlook and signal a possible trend reversal to the negative.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Pi Network’s 86% Rise This Week Helps Secure $1 As Support; What’s Next? Accessed on May 14, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.