Download Pintu App

Metaplanet now holds more bitcoin than El Salvador, aims for 10,000 BTC by 2025

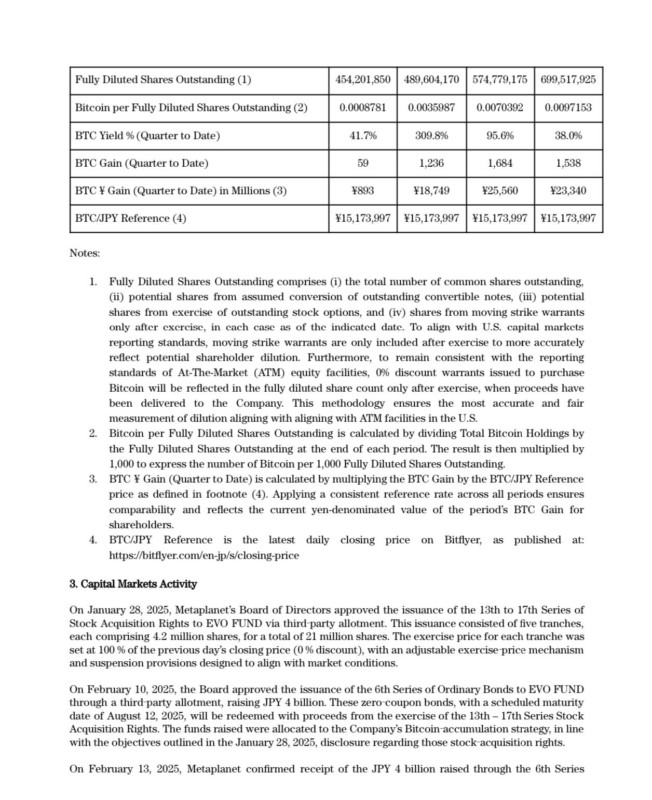

Jakarta, Pintu News – On May 12, Japanese company Metaplanet announced the purchase of an additional 1,241 Bitcoin (BTC), bringing their total holdings to 6,796 BTC. At current market prices, this total is worth over $700 million, surpassing the amount held by El Salvador at 6,174 BTC (valued at $642 million).

Comparison with El Salvador

El Salvador started their Bitcoin (BTC) acquisition plan in 2021, while Metaplanet only started last year. With more than six months left until the end of 2025, and still about 30% short of the target, Metaplanet could potentially surpass the 10,000 BTC target if their aggressive buying trend continues. The company is using a capital raising model that involves issuing debt and equity, similar to that used by Strategy (formerly known as MicroStrategy).

Also Read: Potential for XRP, Kaspa, and Solana in the Next Altcoin Cycle According to Analysts!

Metaplanet’s Aggressive Buying Strategy

Metaplanet has set an ambitious target of owning 10,000 BTC by the end of 2025. With an aggressive buying strategy, the company is on track to achieve or even surpass that target. This strategy not only increases the company’s digital assets but also provides significant returns for shareholders. On an annualized basis, Metaplanet’s stock has increased by 1,800%, while on a YTD (year-to-date) basis, its share price is up 58%.

Impact on Markets and Shareholders

The significant increase in Metaplanet’s share value shows that their strategy of accumulating Bitcoin (BTC) has yielded very favorable results. Compared to Strategy, which has 568,840 BTC, Metaplanet offers higher returns despite having less Bitcoin (BTC).

YTD, MSTR Strategy shares are up 28%, while Bitcoin (BTC) itself is only up 6%. This shows that Metaplanet has outperformed both Strategy and Bitcoin (BTC) in terms of share price growth.

Conclusion

Bitcoin (BTC) adoption by corporations and countries has been an important catalyst for Bitcoin (BTC) price growth. With over 3 million BTC, or approximately $330 billion, held by institutions and countries, it shows a rising trend in the acceptance of Bitcoin (BTC) as a corporate asset. Metaplanet, with its aggressive strategy, has not only increased its digital asset portfolio but also delivered significant value to its shareholders.

Also Read: New York Mayor Appoints Crypto Advisor After Corruption Case Dropped

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Ambcrypto. Metaplanet now holds more Bitcoin than El Salvador, targets 10k BTC by 2025. Accessed on May 13, 2025

- Featured Image: UEEX

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.