Download Pintu App

3 Potential Factors Driving Ethereum (ETH) Price to IDR82 Million by 2025 According to Analysts!

Jakarta, Pintu News – The price of Ethereum (ETH) experienced a sharp surge of 43.6% between May 7 and 14, 2025, reaching around $2,600 (Rp42.87 million). While still far from its 2021 peak of $4,868 (IDR 80.31 million), analysts believe that this momentum could be the start of a larger upward trend. Some macro and technology indicators signal the possibility of Ethereum reaching $5,000 by 2025, although challenges still lie ahead.

ETF Potential and Institutional Support

One of the main drivers that could drive up the price of Ethereum is the possible approval of an ETH-based Exchange-Traded Fund (ETF) by the United States Securities and Exchange Commission (SEC). The approval of ETFs, especially those that allow in-kind asset creation and include staking options, is believed to attract more institutional investors. Although the volume of Ethereum ETFs still lags far behind Bitcoin, regulatory moves like this could be a big catalyst.

However, recent data shows that interest from institutions is still low, reflected by the net outflow of $4 million from ETH ETFs in two days. Compared to the $121.5 billion Bitcoin ETF market, this suggests ETH still has a lot of work to do to earn a place in institutional portfolios. Nonetheless, Ethereum remains the only Bitcoin ETF alternative that has a realistic chance in the current market.

Also Read: Bitcoin (BTC) Potential to Break New Record Highs in May

Scalability Improvement Through Pectra Upgrade

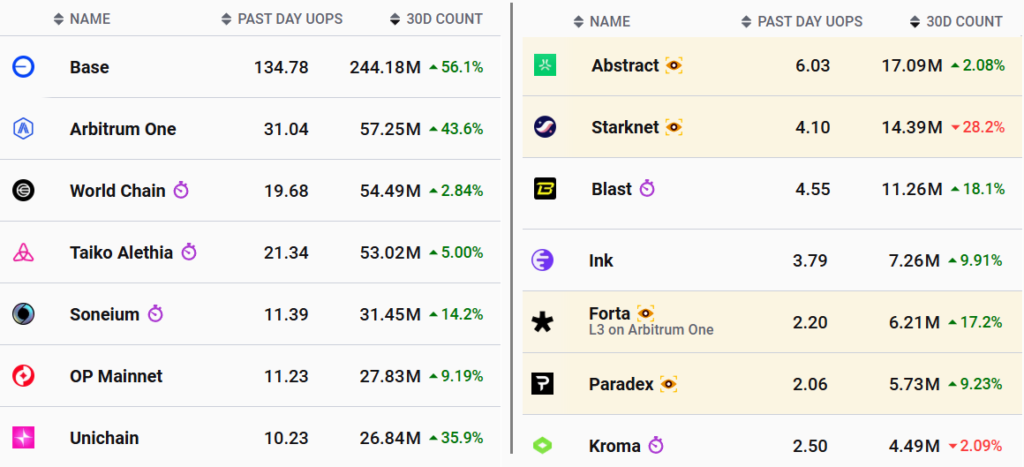

Ethereum recently rolled out a network update called Pectra that improves data transmission efficiency. The update boosted the activity of the second-layer (layer-2) network, with transactions increasing by 23% in a month. The base network led the way with more than 244 million transactions in 30 days, according to data from L2beat.

This growth is important to revive the network’s deflation mechanism, which was hampered by the focus on scalability through rollups. Previously, Ethereum implemented a burn system to reduce supply, but its effectiveness declined due to reduced network activity. If layer-2 usage continues to increase, demand for ETH could surge again, strengthening price fundamentals.

Integration of Artificial Intelligence (AI) and Smart Contract Activities

The adoption of artificial intelligence (AI) technology is also a potential catalyst for Ethereum. Ethereum’s layer-2 infrastructure has found favor with AI systems like ChatGPT for managing funds through multisignature contracts. This allows autonomous agents to make payments, settle balances, and allocate funds into decentralized finance (DeFi) applications.

While it is uncertain whether this trend will fully develop, a potential tenfold increase in smart contract activity from today could lead to a price spike. When combined with institutional interest and clearer regulatory policies, an ETH price target of $5,000 seems more realistic to achieve by 2025.

Conclusion

While the path to Ethereum’s $5,000 price remains challenging, a combination of macro and technological factors provide reasons for optimism. Potential ETF approval, network improvements through the Pectra upgrade, and AI integration with smart contracts leave ETH well-positioned for price growth in the medium term. For investors and market watchers, these developments are worth monitoring closely.

Also Read: Ukraine Considers Bitcoin as a National Strategic Reserve

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. 3 reasons why Ethereum price could rally to $5,000 in 2025. Accessed May 16, 2025.

- Featured Image: FX Empire

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.