Download Pintu App

Metaplanet’s Q1 Revenue Reaches $6 Million, With 88% Coming From Bitcoin (BTC)!

Jakarta, Pintu News – Metaplanet has just announced its financial report for the first quarter of fiscal year 2025. The company recorded total revenue of ¥877 million (~$6.0 million), an 8% increase from the previous quarter.

Most of the revenue, 88% or ¥770 million (~$5.2 million), came from harvesting Bitcoin (BTC) option premiums. The remaining ¥104 million (~$712,200) was earned from the hotel operations segment, signaling a significant shift in financial focus.

Check out the full information here!

Bitcoin Strategy Drives Revenue Growth

The Bitcoin Earning strategy introduced in the fourth quarter of 2024 is now the main driver of Metaplanet’s revenue. This strategy has helped the company achieve an operating profit of ¥593 million (~$4.0 million), up 11% from last quarter and setting a new company record.

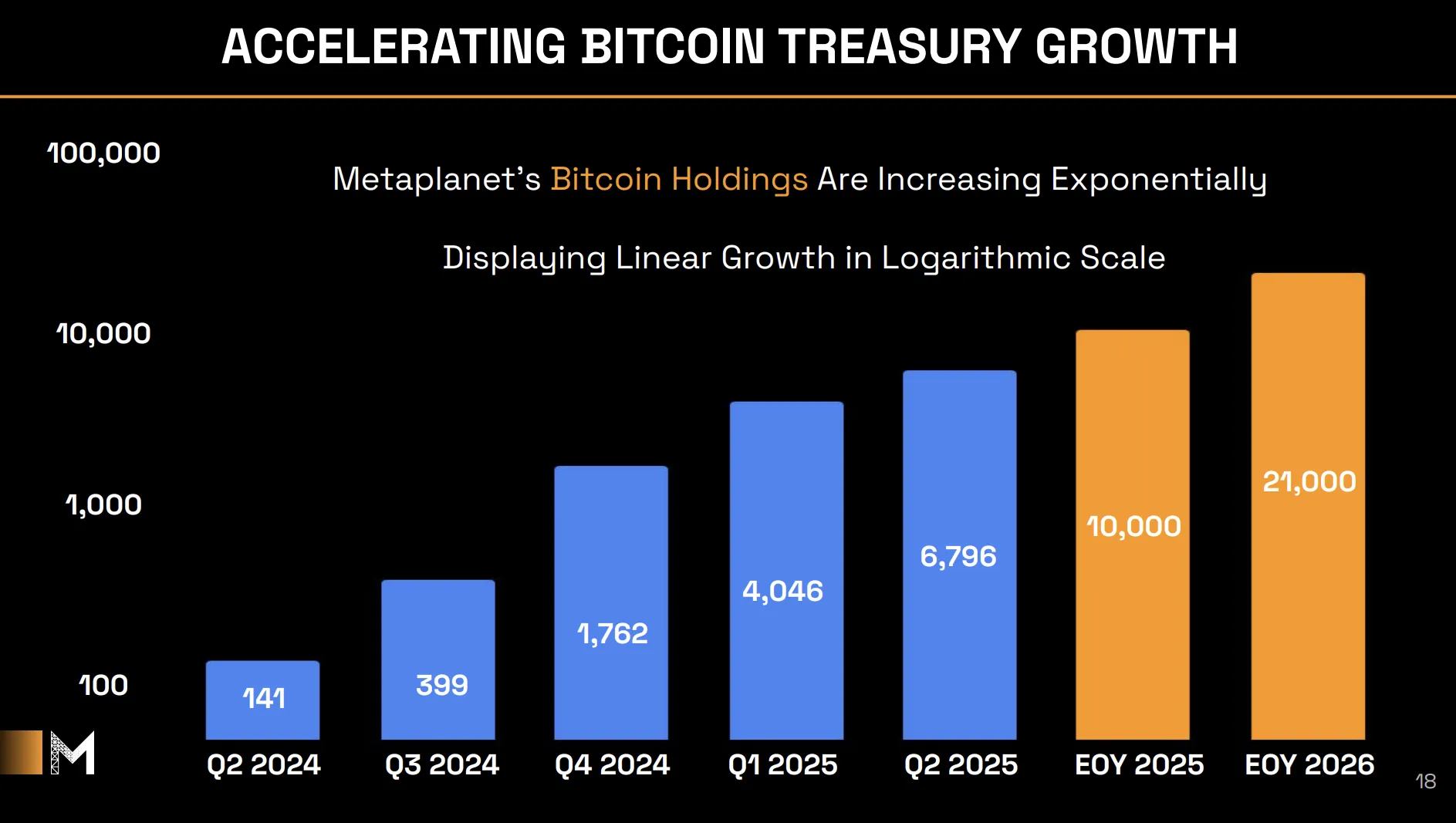

Metaplanet’s total assets increased 81% to ¥55 billion (~$376.6 million), while net assets jumped 197% to ¥50.4 billion (~$345.1 million). This growth was supported by Bitcoin (BTC) purchases of 1,241 BTC, bringing the company’s total Bitcoin (BTC) holdings to 6,976 BTC, more than El Salvador’s national reserves.

Also read: 3 Memecoin Presale Coveted by Whales that Could Skyrocket 10x in May!

Record and Ambitious Financial Targets

Despite recording a valuation loss of ¥7.4 billion due to lower Bitcoin (BTC) prices at the end of March, the value of Bitcoin (BTC) has rebounded. As of May 12, Metaplanet had unrealized gains of ¥13.5 billion. CEO Simon Gerovich declared this the strongest quarter in the company’s history.

For 2025, Metaplanet is targeting a Bitcoin (BTC) yield of 232%. The yield target for the third and fourth quarters of 2025 is 35%. This growth has placed Metaplanet as the 11th largest public Bitcoin holder in the world and the leading Bitcoin treasury company in Asia.

Read also: MetaMask Considers Token Launch, Is $MASK Coming Soon?

Share Growth and Investor Base

Metaplanet shares, which are listed under the code 3350.T, have seen a significant rise. According to Google Finance data, the stock has appreciated by 70.91% since the beginning of the year to date.

BeInCrypto reports that the share price has grown more than 15 times since April 2024, when Metaplanet made its first Bitcoin (BTC) purchase. The number of shareholders has also dramatically increased by 500% in one year.

In the first quarter of 2025, the company reached 64,000 shareholders, reflecting a massive expansion of its investor base. This growth demonstrates investors’ growing confidence in the company’s strategy.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Metaplanet Q1 Earnings 2025: Bitcoin Revenue. Accessed on May 16, 2025

- Featured Image: UEEX

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.