Download Pintu App

Will Dogecoin (DOGE) Break $0.25? Check out the Analysis!

Jakarta, Pintu News – Dogecoin (DOGE) is again testing key levels as enthusiasts look to break through the $0.25 resistance. With liquidation data showing buying dominance and some supportive on-chain indicators, Dogecoin’s (DOGE) chances of surpassing that price seem to be growing.

Short Liquidation Dominates, Buying Pressure Increases

On-chain liquidation data shows a strong tendency of buyers. On May 18, the liquidation of short positions reached $387,000, while the liquidation of long positions amounted to only $65,000. This shows that the pressure to buy Dogecoin (DOGE) is getting stronger, providing impetus for the price to continue rising.

With the predominance of short liquidations, this indicates that many market participants who had previously bet on a Dogecoin (DOGE) price drop were forced to close their positions. This often creates a domino effect that can push the price even higher, especially if supported by positive market sentiment.

Also Read: Bitcoin Approaches Golden Cross: Bullish Signal Amid US Debt Concerns

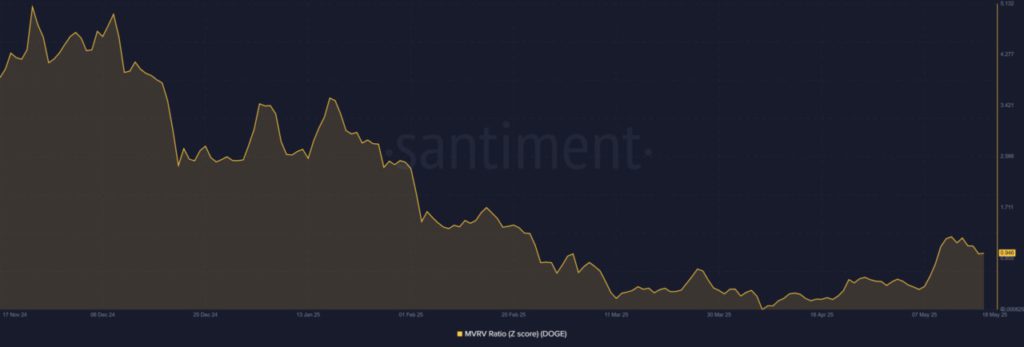

MVRV Score Indicates Growth Potential

Dogecoin’s (DOGE) MVRV score currently stands at 0.94, well below the 2.5 threshold often associated with overvalued conditions. This MVRV score measures the ratio of market capitalization to realized capitalization, giving an idea of the profitability of the average holder.

With the MVRV score still below 1, it shows that Dogecoin (DOGE) is still undervalued and has enough room for price growth. Investors and traders may see this as an opportunity to enter before the price experiences a more significant increase.

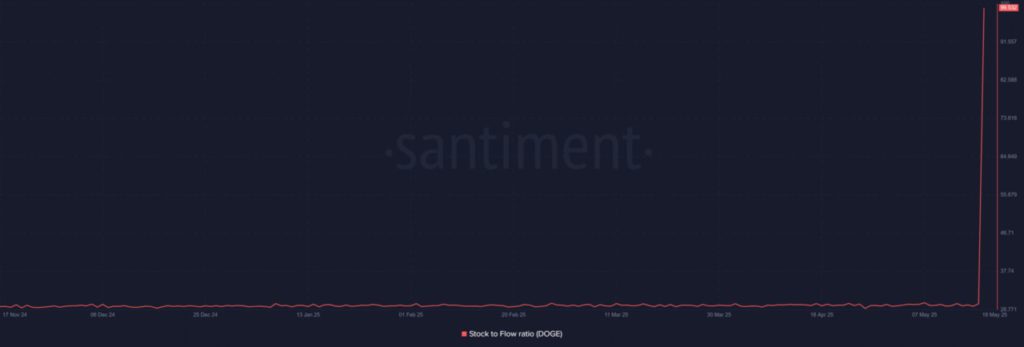

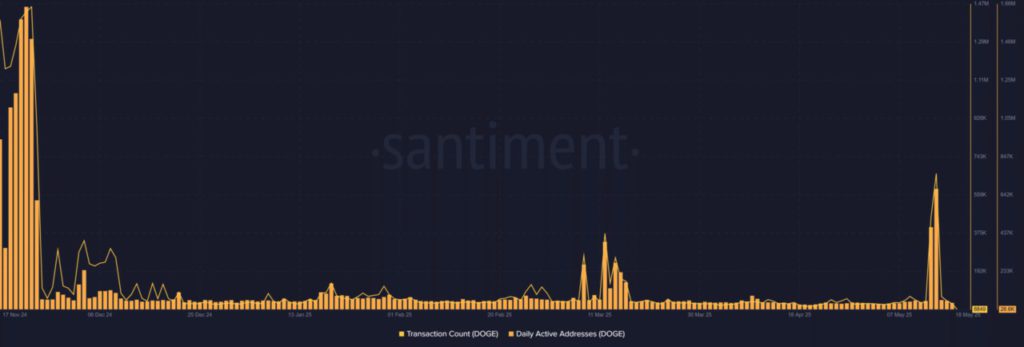

Volatility Concerns and Network Activity

Dogecoin’s (DOGE) Stock-to-Flow ratio has reached a very high figure of 99.53, signaling that the growth in circulating supply has slowed or even stopped. This increases the perception of scarcity which can affect price volatility.

Despite concerns about volatility, network activity shows mixed dynamics. Daily active addresses briefly surged to over 500,000 in early May, but have since dropped to just 28,600. Similarly, the number of transactions also declined from the monthly peak to just 8,800 transactions.

Conclusion: Dogecoin (DOGE) Potential to Break $0.25

With support from heavy short liquidation pressure, an MVRV ratio that suggests it is undervalued, and a steady increase in Open Interest (OI), Dogecoin (DOGE) has strong potential to not only break $0.25 but also maintain a position above it. These factors, along with the currently positive market sentiment, could be the catalysts that push Dogecoin (DOGE) to reach higher price levels.

Also Read: XRP Strengthens After V-Shaped Recovery, Next Price Target IDR56,000?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Dogecoin: Can bulls push its price past $0.25? Yes, but first DOGE must…. Accessed on May 19, 2025

- Featured Image:

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.