Download Pintu App

Metaplanet Shares Jump 15% After Bitcoin Purchase, Strong Results in First Quarter

Jakarta, Pintu News – Metaplanet, a Japanese company, recently recorded a 15% jump in share price to 712 JPY, after announcing the purchase of 1,004 Bitcoins (BTC) worth $104 million. This increase was also fueled by the announcement of first-quarter revenue that reached a record 877 million Japanese yen ($6 million). With its aggressive Bitcoin strategy, Metaplanet is now in the spotlight on the Tokyo Stock Exchange, outperforming industry giants such as Toyota, SoftBank, and Nintendo in trading activity.

Bitcoin Strategy Drives Growth

The latest Bitcoin (BTC) purchase by Metaplanet comes as the price of Bitcoin (BTC) could potentially close the week above $105,000. Since the beginning of 2025, Metaplanet has increased their Bitcoin (BTC) holdings by 4.4 times, totaling 7,800 BTC. The company is using a moving warrant program to finance this expansion, which allows for the issuance of equity without a discount or fixed strike price.

Since January 2025, Metaplanet has added 6,038 BTC to its portfolio. The company is now the 11th largest holder of Bitcoin (BTC) in the world, surpassing even El Salvador. With this aggressive strategy, Metaplanet is close to achieving its short-term target of holding 10,000 BTC, with a cost basis per Bitcoin (BTC) of ¥712.5 million ($91,343).

Also Read: Top 5 Blockchains with the Largest TVL: Ethereum’s Dominance and Solana’s Rise!

Financial Results and Market Position

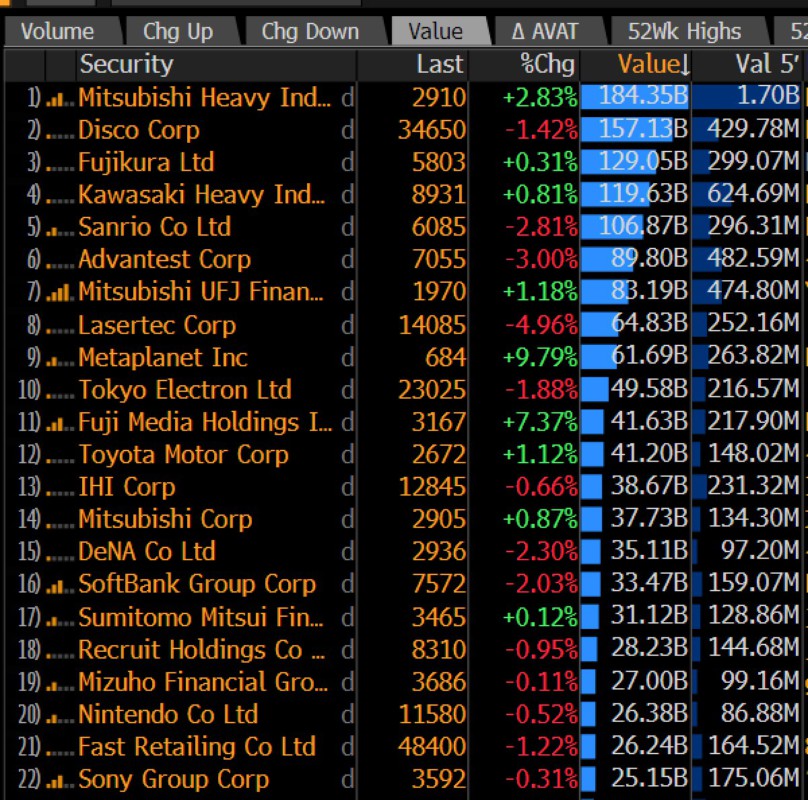

A record-high first quarter revenue of 877 million Japanese yen ($6 million) demonstrated the success of Metaplanet’s Bitcoin (BTC) strategy. The company’s stock has become one of the most liquid in Japan, with daily trading volume reaching ¥61.69 billion (approximately $425 million). This puts Metaplanet ahead of other major companies such as Toyota and Nintendo in terms of trading volume.

On Monday, Metaplanet shares were listed as the ninth most traded stock in Japan. This performance shows high investor confidence in the company’s Bitcoin (BTC) strategy. With BTC returns reaching 189.1%, Metaplanet now outperforms MicroStrategy in Bitcoin (BTC) strategy, according to Blockstream CEO, Adam Back.

Market Outlook and Challenges

With Moody’s downgrading the US credit rating, the overall crypto market is experiencing uncertainty. However, Metaplanet continues to show resilience with a strong Bitcoin (BTC) strategy. Bitcoin (BTC) price is currently hovering around $103,500, facing strong rejection at $105,000.

If it can cross the limit, the price of Bitcoin (BTC) could reach a new record. Metaplanet’s performance amidst market uncertainty demonstrates the company’s strength and growth potential. With a strategy focused on Bitcoin (BTC), Metaplanet is not only increasing the value of its assets but also positioning itself as a leader in digital financial innovation.

Bright Future for Metaplanets

With a stellar first quarter and an aggressive Bitcoin (BTC) strategy, the future looks bright for Metaplanet. The company has not only managed to increase its Bitcoin (BTC) portfolio but also set new standards in the management of digital assets in the stock market. Investors and market watchers will be keeping a close eye on Metaplanet’s next move.

Also Read: Will Dogecoin (DOGE) Break $0.25? Check out the Analysis!

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. MetaPlanet Stock Jumps 15% on Fresh 1004 BTC Purchase. Accessed on May 19, 2025

- Featured Image: Metaplanet

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.