Download Pintu App

Solana Is Getting Scooped Up Fast — Big Money Moves In Ahead of the Altcoin Boom!

Jakarta, Pintu News – Although the “altcoin season” hasn’t officially started yet, Solana (SOL) is starting to attract increasing attention from institutional investors, with major accumulations taking place in May 2025.

Recent reports and analysis show that Solana is attracting capital flows from institutions and experiencing increased activity from new developers, accompanied by positive signals from on-chain data.

Altcoin Season Awaits, but Solana Already Attracts Big Investors

The data shows that altcoin spot trading volumes are still lower than the levels in January 2025 and throughout 2024.

Read also: 3 Cryptos to Hunt Before Donald Trump’s Gala Dinner This Week!

In fact, it is still far from its peak in 2021. This signals that the altcoin market as a whole has not yet achieved enough dynamism to start a strong growth cycle.

“We still have a while to go before we see interest in altcoins as high as it was in the previous rally,” said Nic Puckrin, co-founder of Coin Bureau.

However, in the midst of this situation, Solana (SOL) emerged as a bright spot by attracting the attention of institutional investors.

Specifically, some institutions have increased their SOL holdings before the altcoin season started.

According to OnchainLens, one whale recently added 17,226 SOL to its portfolio, while investing $1 million in FARTCOIN and $300,000 in LAUNCHCOIN.

Another Whale withdrew 296,000 SOL from FalconX and staked immediately, demonstrating an accumulation trend and long-term commitment to the Solana ecosystem.

In addition, DeFi Development Corp also increased its Solana holdings by more than 170,000 SOLs, bringing the total value to over $100 million. At the same time, SOL Strategies also bought more than 122,524 SOLs during May.

These moves reflect a high level of confidence from institutional investors in Solana’s long-term growth potential.

The Solana Ecosystem is Growing

In addition to increased interest from institutional investors, the Solana ecosystem is also showing positive signals.

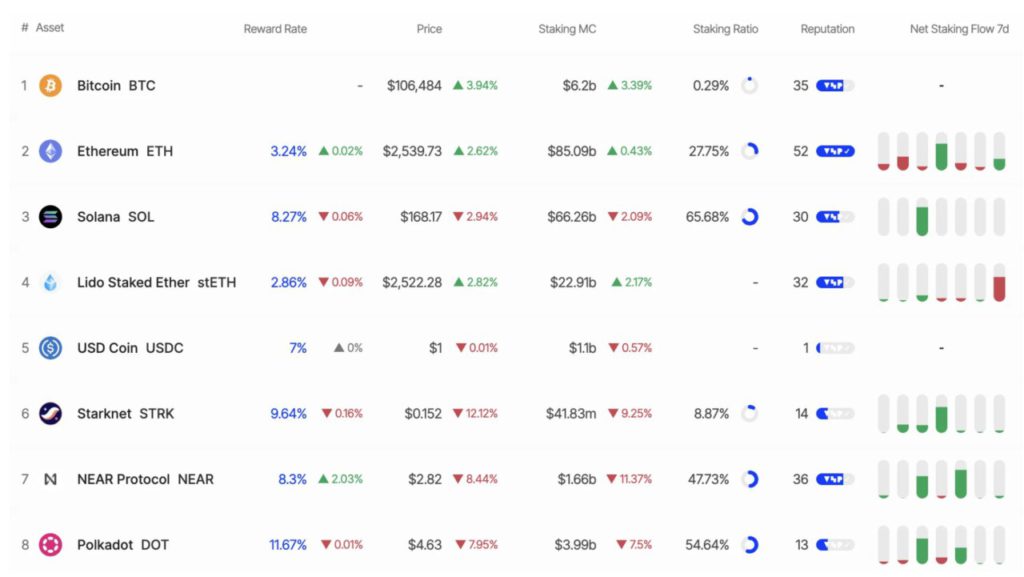

Currently, around 65% of the total SOL supply is on-stake, reflecting the level of community confidence in Solana’s long-term stability and potential.

As previously reported, Solana managed to record $1.2 billion in app revenue in the first quarter of 2025.

The figure reflects a 20% growth over the previous quarter’s $970.5 million. This was Solana’s best-performing quarter in 12 months, indicating a strong ecosystem recovery after a tumultuous year.

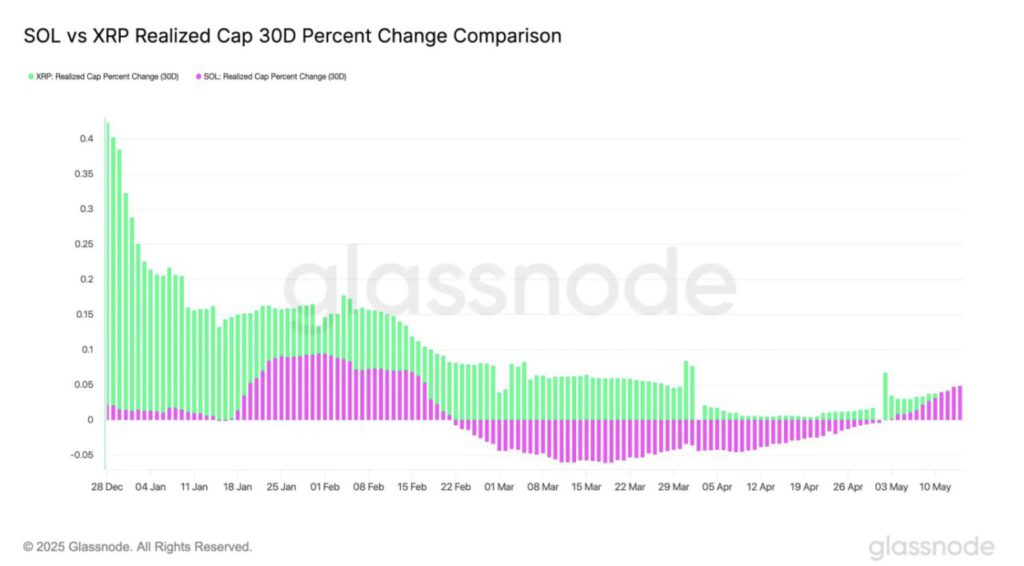

In addition, data from Glassnode revealed that real capital flows into SOL over the past 30 days have returned to the positive zone, with a growth rate comparable to XRP (XRP).

Read also: XRP futures hit $1.5 million on day one, ready to jump to $3?

These signals suggest that on-chain demand for Solana is recovering, although the altcoin market in general has yet to really pick up.

Solana Reflects Ethereum’s Performance in 2021

Recent analysis from jon_charb ‘s X account shows that Solana’s all-time high price in early 2025 bears a striking resemblance to Ethereum’s (ETH) movements in 2021.

In particular, SOL experienced a significant price spike earlier this year-similar to Ethereum’s spike before the 2021 altcoin season began.

If history repeats itself, Solana may be in an accumulation phase ahead of a new growth cycle, especially as institutional investors continue to pour capital into its ecosystem.

This similarity further strengthens confidence in SOL’s potential and opens up the possibility that this blockchain could become a leader in the upcoming altcoin season.

However, it should be noted that the current altcoin market is still in the early stages of recovery. Spot trading volumes that are still lower than their peak show that market sentiment is still cautious.

However, the pace of accumulation by institutional investors and positive developments in the Solana ecosystem suggest that SOL is preparing for a big surge when market conditions start to favor it.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Solana Accumulation Heats Up: Institutions Bet Big Ahead of Altcoin Season. Accessed on May 21, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.