Download Pintu App

Stablecoins hit a record $231 billion, but growth is starting to slow down

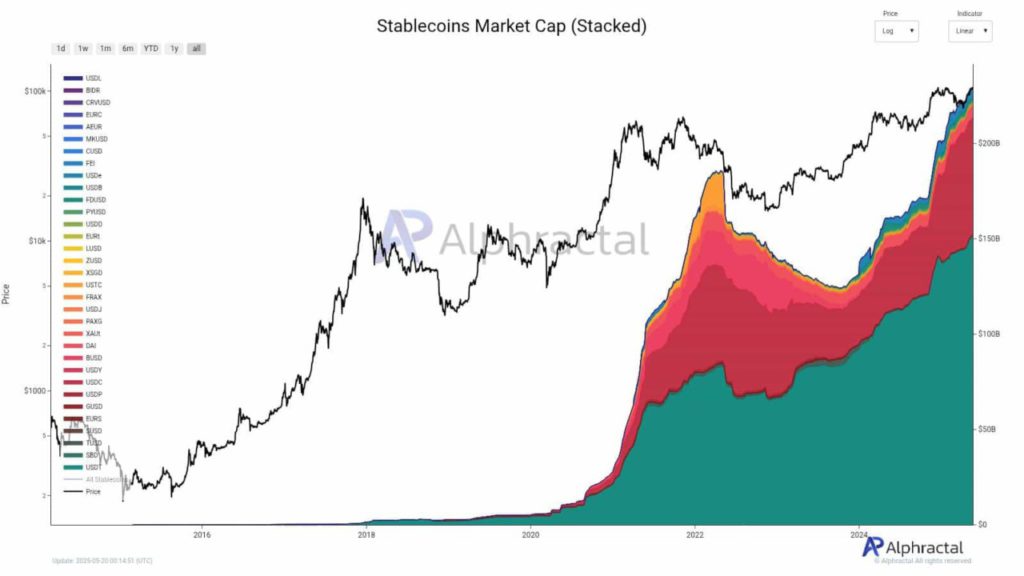

Jakarta, Pintu News – While the market capitalization of stablecoins has reached a record high of $231 billion, there are warning signs emerging as the pace of growth over the past 90 days begins to show a slowdown. Amidst broader crypto market conditions, stablecoins are often an early indicator of market sentiment and liquidity. This slowdown comes at a critical time, given its history of increased stablecoin growth often preceding major market rallies.

Stablecoins and Liquidity Dynamics

Although the supply of stablecoins has reached new peaks, its growth structure shows a fragmented picture. Tether (USDT) still dominates the market, while new competitors such as FDUSD and PYUSD still have relatively small market shares.

While the liquidity in the system is sizable, it is unevenly distributed, which could signal selective market confidence rather than a full-blown bullish wave. This suggests that while there is liquidity, not all cryptocurrencies are feeling the same impact.

Read More: Bitcoin Sets New Price Records: What Are the Implications for the Crypto Market?

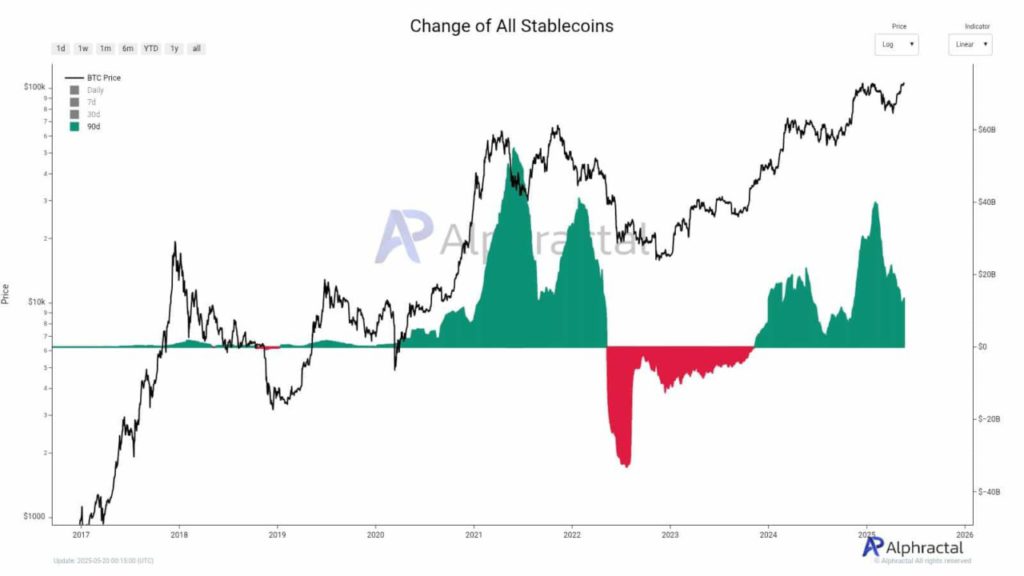

Momentum that Started to Stall

While the overall stablecoin market continues to grow, changes in the last 90 days have shown a decline, indicating hesitation from capital allocators. This decline is in line with a period of consolidation in the altcoin market, indicating a lack of aggressive risk appetite. This is not a complete reversal, but may mark the peak of the cycle unless there is an increase in fund inflows. Historically, pauses like this often precede an acceleration or plateau in market prices.

Repeating the 2021 Pattern

The current structure of stablecoin inflows, particularly the stagnation in 90-day momentum, is similar to the plateau that occurred mid-2021, just before stablecoin expansion picked up again and pushed Bitcoin (BTC) to new records. If history repeats itself, a new uptick in stablecoin growth could be the trigger for a broader market rally. However, until that happens, caution remains the priority.

Conclusion

Having reached the highest market capitalization yet experiencing a slowdown in growth, the stablecoin market is currently at a crossroads. Market watchers and investors may need to consider the current dynamics to anticipate possible scenarios that will occur in the crypto market.

Read More: Bitcoin and Dogecoin Set New Price Records Amid Crypto Market Trends

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Stablecoins hits $231B market cap but growth slows down; what now?. Accessed on May 21, 2025

- Featured Image: Generated by Ai

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.