Download Pintu App

Will TRUMP break $15.98 after consolidation? Here’s the outlook for June 2025!

Jakarta, Pintu News – The cryptocurrency market is abuzz again with the price movement of the TRUMP token undergoing consolidation. With pressure from massive accumulation and liquidation of short positions, many are wondering, will TRUMP manage to break through the existing resistance?

Technical Analysis: TRUMP Consolidation

TRUMP is currently in a consolidation phase inside a symmetrical triangle pattern, with resistance at $13.84 and support rising since mid-April. TRUMP’s price was recorded at $13.14 with a gain of 5.89% in the last 24 hours. This structure suggests a possible rupture of the pattern due to the approaching apex of the triangle.

The narrower volatility signals uncertainty among buyers and sellers, but the bullish pressure indicated by the formation of higher lows gives buyers an advantage. This pattern suggests that if TRUMP can break the $13.84 resistance level, the next upside target is near $15.98. The upside is supported by massive accumulation by whales and increased liquidation of short positions building upward pressure.

Read More: Bitcoin Sets New Price Records: What Are the Implications for the Crypto Market?

Risks of Short-Term Sellers

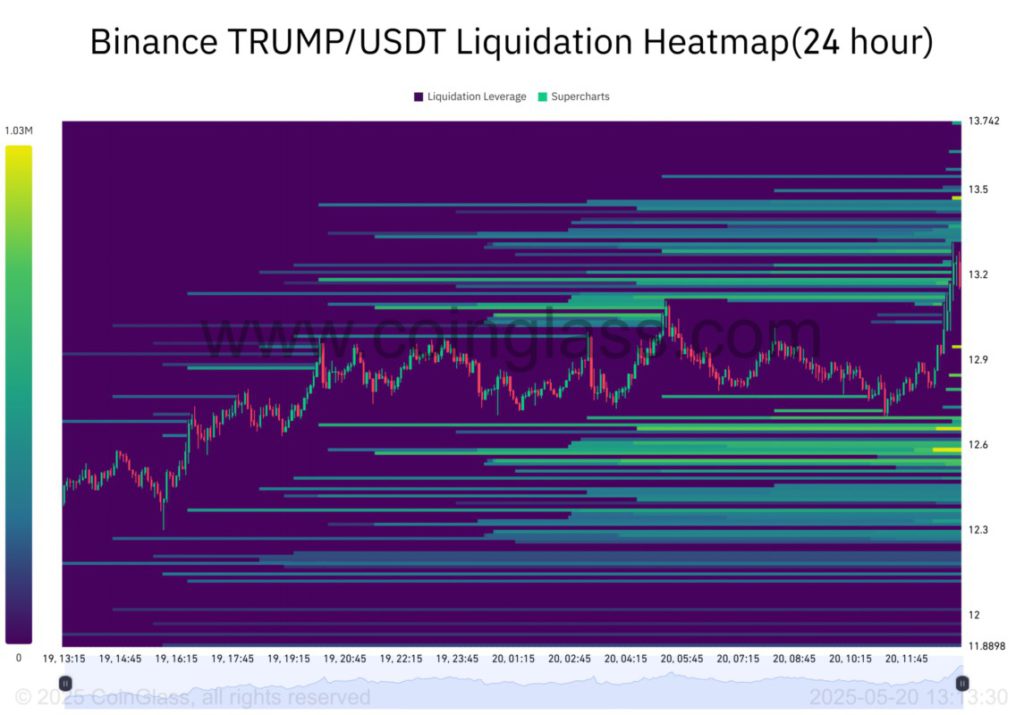

The 24-hour liquidation heatmap shows a dense cluster of short position liquidation between $13.20 and $13.74. This zone is an area where over-leveraged traders could face forced position closure if the price moves up. As TRUMP steadily rises, the possibility of squeezing out short positions increases.

Volatility driven by liquidation often magnifies momentum moves, especially when resistance coincides with the use of high leverage. This liquidation may trigger sharper price movements, providing an opportunity for TRUMP to break the existing resistance and move towards higher price targets.

Market Activity: Signs of Strength or Caution?

Inflow and outflow activity on spot showed a good balance, with $47.96 million flowing into the exchange and $44.32 million flowing out. This balance suggests that traders are still hesitant, not rushing to sell or accumulate aggressively.

The balance during the technical consolidation suggests that market participants are watching price action before taking further commitments. Although inflows did not outpace outflows, it reflects enough interest to maintain price support. A strong directional move from this balance could be a confirmation of broader market conviction.

Conclusion

With multiple bullish catalysts in favor, TRUMP has a strong chance to break $13.84. If the pressure from buyers can be sustained and liquidation above $13.20 is triggered, then there is a high probability that TRUMP will break resistance and potentially reach $15.98 in the near term. The balance of spot activity and still strong market sentiment adds to this opportunity.

Read More: Bitcoin and Dogecoin Set New Price Records Amid Crypto Market Trends

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Short sellers trapped as Trump eyes $13.84, can $15.98 be next?. Accessed on May 21, 2025

- Featured Image: FastCompany

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.