Download Pintu App

Ethereum (ETH) Approaches $2,500: Is a Price Correction Awaiting?

Jakarta, Pintu News – Ethereum (ETH), the second-largest digital currency by market capitalization, is now on the verge of market exhaustion after reaching prices close to $2,500. Various analyses suggest that Ethereum (ETH) may experience a short-term price drawdown before attempting to break through higher resistance levels. This phenomenon has caught the attention of investors and analysts around the world.

Symptoms of a Hot Market

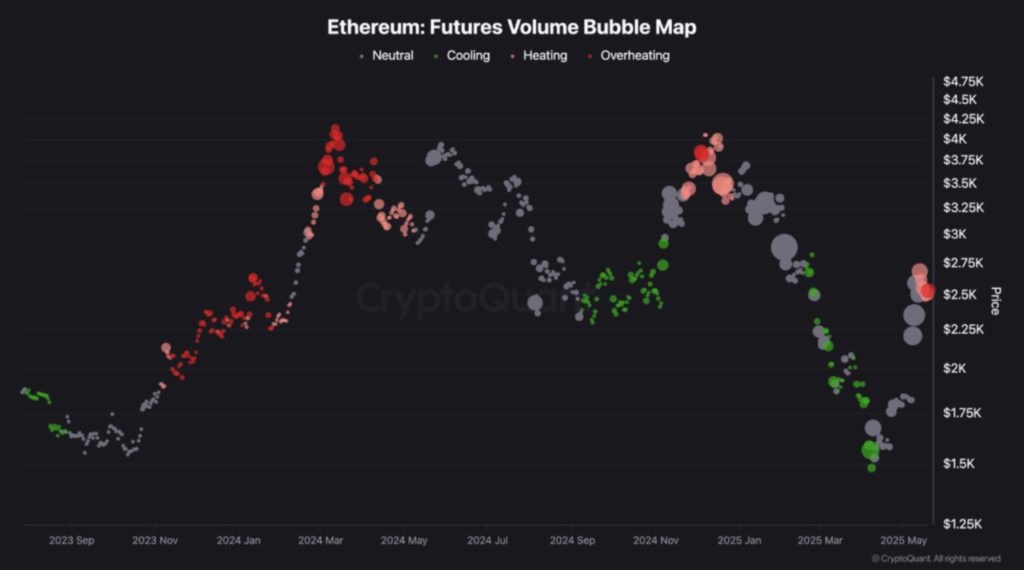

According to a recent post from CryptoQuant, Ethereum (ETH) is showing signs of its rally starting to overheat. Analysis of Ethereum (ETH) trading volume on various crypto exchanges shows a significant increase in activity. This is often an early indicator that the market may be entering a correction phase.

In the past month, Ethereum (ETH) market conditions have changed from Cooling to Overheating. This Overheating condition could trigger a short-term correction as the market cools down and enters a new accumulation phase. However, the depth and duration of the potential drawdown remains uncertain.

Read More: Bitcoin Sets New Price Records: What Are the Implications for the Crypto Market?

Ethereum Price Analysis and Predictions

Ali Martinez, a veteran crypto analyst, in a post on X, highlighted the importance of Ethereum (ETH) maintaining a price above $2,200 to keep its bullish momentum going. If this level holds, Martinez expects Ethereum (ETH) could reach its $3,000 target, possibly even $4,000 if buying pressure increases.

On the other hand, Ted Pillows, a crypto analyst, observed that Ethereum’s (ETH) 12-hour chart recently confirmed a Golden Cross, a bullish signal that usually precedes major price increases. Pillows also predicts that Ethereum (ETH) could be eyeing the $4,000 level, which is just below the upper limit of the large symmetrical triangle that has been forming since the third quarter of 2020.

Potential Downgrade Warning

Despite many bullish predictions, Gianni Pichichero, another crypto analyst, warned about a potential retracement to $2,350. His analysis shows the appearance of lower lows on the daily chart of Ethereum (ETH), which is a bearish signal. Currently, Ethereum (ETH) is trading at $2,500, up 3.6% in the last 24 hours.

Ethereum’s (ETH) impressive recent price rise has caught the attention of many crypto analysts, who are now speculating on the digital asset’s future price trajectory. This situation is indicative of the highly volatile market dynamics that are fraught with both opportunities and risks.

Conclusion

With the ever-changing market conditions and in-depth analysis from various experts, investors are expected to remain vigilant and stay abreast of the latest developments. Ethereum (ETH) is currently at a critical juncture, and investment decisions should be based on careful analysis and a well-thought-out strategy.

Read More: Bitcoin and Dogecoin Set New Price Records Amid Crypto Market Trends

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Ethereum Market Shows Signs of Overheating, Near $2500: Is a Short-Term Pullback Coming?. Accessed on May 21, 2025

- Featured Image: CNBC

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.