Download Pintu App

BlackRock’s Bitcoin ETF to Surpass Satoshi’s Wallet in 2025? Analysts Weigh In!

Jakarta, Pintu News – The ETF market has witnessed tremendous dominance from the BlackRock Bitcoin ETF, with inflows reaching $287.5 million just on Tuesday. Since its launch in January 2024, the ETF has raised more than $46 billion.

Bloomberg Senior ETF Analyst Eric Balchunas predicts that the asset manager will surpass the amount of Bitcoin (BTC) owned by Bitcoin (BTC) creator Satoshi Nakamoto by the summer of next year. If the price of Bitcoin (BTC) rises to $150,000, this milestone could happen even sooner.

Check out the full analysis below!

BlackRock Approaches Satoshi Nakamoto’s Position

Eric Balchunas highlights that BlackRock is currently the second-largest Bitcoin (BTC) holder in the world, trailing only the mysterious Satoshi Nakamoto. If the BlackRock Bitcoin ETF continues to accumulate Bitcoin (BTC) at this pace, they could become the largest Bitcoin (BTC) holder by the summer of next year.

Balchunas suggests that if the price of Bitcoin (BTC) reaches $150,000 in the coming months, it could trigger a “feeding frenzy” among financial advisors. With the recent large inflow of Bitcoin ETFs, BlackRock managed to unseat Binance from the second spot.

Balchunas added, “And yes, this list is debatable given the role of depositories like Coinbase, we get it, the bigger point to be made here is HOW FAST BLACKROCK USES BTC, or rather their investors as their holdings represent millions of people”.

Read also: Metaplanet: A New Short Squeeze Phenomenon in Japan, Similar to Gamestop?

BlackRock’s Bitcoin ETF is Unstoppable

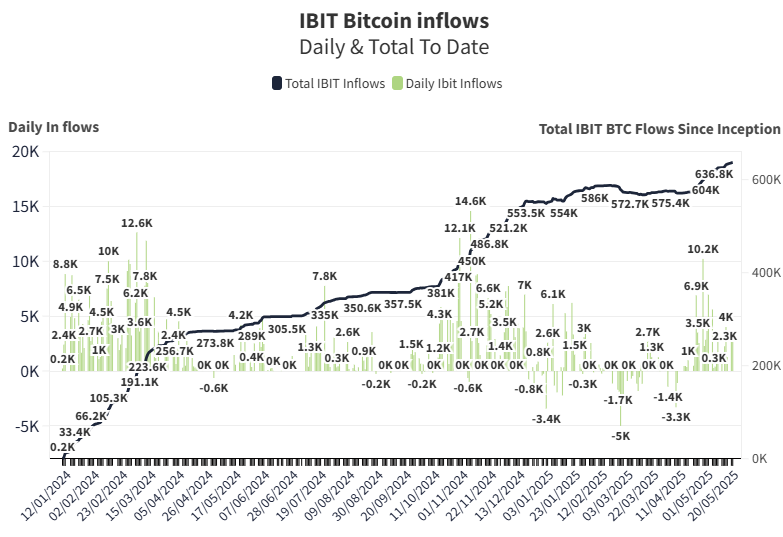

With record fund inflows over 24 of the last 25 trading sessions, the BlackRock Bitcoin ETF (IBIT) has independently increased the ETF’s fund inflows over the last month.

Data from Thomas Fahrer shows that IBIT raised a total of 2,705 BTC worth $287.5 million, which is ten times that of its closest competitor, the Fidelity FBTC ETF, which only saw an inflow of $23 million.

With this, BlackRock’s IBIT has reached another milestone by crossing $46 billion in fund inflows since its inception. As a result, iShares Bitcoin Trust’s total holdings have now jumped to 639,000 BTC.

Read also: Arthur Hayes’ Shocking Prediction: Ethereum (ETH) Headed for $10,000!

Bitcoin Price Strengthening

Bitcoin (BTC) price is also showing strength, with another 1.2% gain today and surging past $107,000. Market experts believe that if this momentum continues, we could see new record highs by the end of this week.

Some of the largest IBIT shareholders in the market include financial giants such as Goldman Sachs. In a recent development, $1 trillion asset manager Blackstone declared a stake of 23,094 shares in the BlackRock Bitcoin ETF as of March 31, according to the latest disclosure.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. BlackRock Bitcoin ETF to Overtake Satoshi Nakamoto BTC Holdings Next Summer. Accessed on May 22, 2025

- Featured Image: Viska Digital

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.