Download Pintu App

Ripple (XRP) Futures Trading Debuts on CME: Will a Spot ETF Follow?

Jakarta, Pintu News – On May 19, Ripple (XRP) futures trading on the Chicago Mercantile Exchange (CME) recorded a nominal trading volume of $19 million. This marks the first time Ripple (XRP) has traded in the form of regulated futures, joining Bitcoin (BTC), Ethereum (ETH), and Solana (SOL). The futures product is available in large-sized contracts of 50,000 XRP and micro versions of 2,500 XRP, all of which are cash-settled.

Comparison with Solana (SOL)

On the day of its launch, trading volume reached 150 contracts, which is equivalent to a nominal volume of about $19 million. However, on the second day, the volume dropped by 50% to 59 contracts. If the average reference price is $2.53, this translates to a volume of about $7.59 million.

In comparison, the Solana (SOL) futures launched on March 17 attracted only $12.1 million in volume. This shows that Ripple (XRP) surpassed Solana (SOL) by a margin of over $7 million and shows similar potential to other top crypto assets by market capitalization.

Also Read: PEPE Coin (PEPE) Shows Bullish Signal, What’s the Secret?

Spot ETF Potential in the United States

The launch of this futures product makes it easier for institutions to speculate and implement hedging strategies on Ripple (XRP), which in turn increases market liquidity. This move may be a step towards another goal – the approval of Spot ETFs in the United States. According to Nate Geraci of ETF Store, ETF approval is only a matter of time after CME futures are launched.

Previously, Spot ETFs for Bitcoin (BTC) and Ethereum (ETH) were also launched after their futures became available on CME. Since CME announced plans for Ripple (XRP) futures in April, the odds of Spot ETF approval in the US for Ripple (XRP) have increased by more than 10%, from 63% to 83%, according to data from Polymarket.

Market Dynamics and Bitcoin (BTC) Dominance

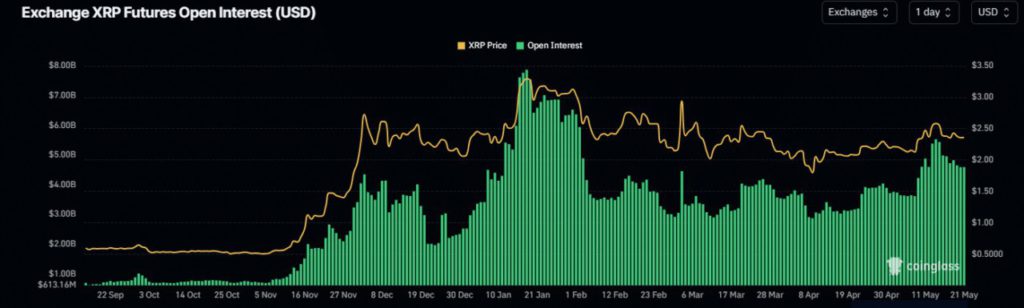

While the launch of Ripple (XRP) futures did not significantly boost speculative interest, it does reflect a broader cooling of the market after the recovery in April-May. Since mid-May, the level of Open Interest (OI) for Ripple (XRP), or money parked in the Ripple (XRP) derivatives market, has fallen from $5.5 billion to $4.5 billion. This indicates a short-term bearish sentiment.

Meanwhile, Bitcoin’s (BTC) dominance increased by 3.6% from mid-May, from 62% to over 64% after experiencing a sharp drop in early May. This recovery of Bitcoin (BTC) dominance means altcoins like Ripple (XRP) are temporarily sidelined unless capital flows from Bitcoin (BTC).

Conclusion

With support above the trendline, opportunities for Ripple (XRP) bulls are still open despite resistance at $2.6. Going forward, market dynamics and the development of derivative products such as futures may provide further indications regarding the adoption and integration of Ripple (XRP) in the mainstream financial ecosystem.

Also Read: Will Pi Token (PI) Surge Beyond $0.9? Check out the Analysis!

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. XRP Futures Debut Hits $19 Mln in Trading Volume, Is a Spot ETF Next?. Accessed on May 22, 2025

- Featured Image: Cryptoslate

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.