Download Pintu App

Bitcoin Slips to $109,300 on May 26 — Is the Bull Run Over as Traders Turn Bearish?

Jakarta, Pintu News – Bitcoin (BTC) recently crossed the $111,000 mark and set an all-time record high.

However, data from major exchanges shows that traders are increasingly cautious about the continuation of this price rally.

According to data from CoinGlass, more than 53% of Bitcoin’s current trading positions are short positions, meaning the majority of traders predict the price will fall. In contrast, only about 47.43% of positions are long or expecting a price increase.

Then, how will the Bitcoin price move today?

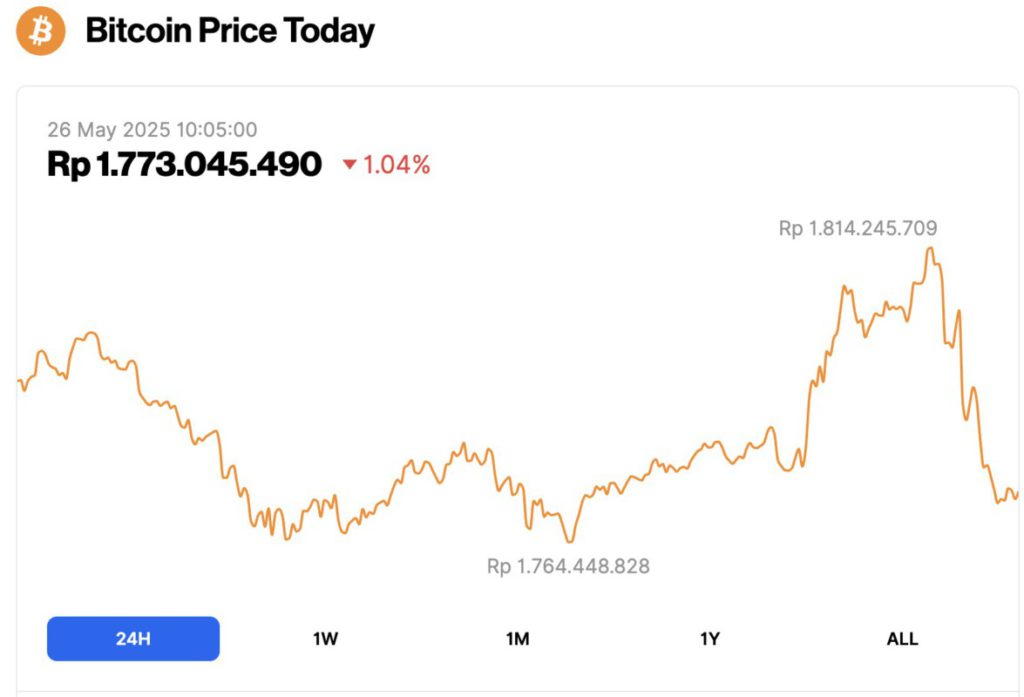

Bitcoin Price Drops 1.04% in 24 Hours

As of May 26, 2025, Bitcoin was trading at $109,373, equivalent to approximately IDR 1,773,045,490. The price reflected a 1.04% decline over the past 24 hours. During that period, BTC dipped to a low of IDR 1,764,448,828 and climbed as high as IDR 1,814,245,709.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $2.17 trillion, with trading volume in the last 24 hours falling 0.75% to $46.18 billion.

Read also: Dogecoin Holds Steady at $0.2254 — Is the Road to $1 Finally in Sight?

Most Traders Begin to Be Bearish Despite Bitcoin’s Record Highs

Reporting from BeInCrypto (5/25), this pattern is also seen on Binance, where short positions account for 54.05% of the total open interest, while long positions are only 45.95%.

This trend of increasing short positions reflects the growing skepticism in the market, despite Bitcoin having just reached a record high price.

This change in sentiment was also reinforced by the latest move from one of the famous crypto “whales”, James Wynn, who changed his optimistic outlook after suffering millions of dollars in losses.

Wynn previously held a highly leveraged long position of up to 40x worth about $1.25 billion. However, he exited the position after Bitcoin’s price dropped from $109,000 to around $107,107.

He closed his long position at a loss of $13.39 million, with the liquidation process taking place in less than an hour on May 25.

Currently, Wynn has opened a short position of 3,523 BTC – worth approximately $377 million – with an entry price of $107,128. This new position has a liquidation threshold of $118,380.

Market Analysts Assess Wynn’s Strategy Change as a Sign of Bullish Cycle Saturation

Market analysts think that James Wynn’s change in strategy reflects broader signs of saturation in the current Bitcoin bull cycle.

Read also: These 4 Memecoins Could Outrun Bitcoin’s Bull Run – Don’t Miss the Next Crypto Explosion!

According to blockchain analytics firm Alphractal,short-term holders ( STHs) have started distributing their coins. Historically, a decrease in supply from STH groups is often an indication that Bitcoin is nearing a local price peak.

The company noted that the Realized Price for short-term holders is currently at $94,500, which is considered the last strong support level before potential losses.

In contrast,Long-Term Holders ( LTH) still showed conviction, with their realized price rising to $33,000-illustrating the widening behavioral gap between the two groups.

Alphractal states that although Bitcoin also previously hit record highs under similar conditions in 2021, the current cycle is showing signs of approaching saturation point.

They added that a number of macro indicators as well as historical post-halving patterns point to the possibility of a market correction after October 2025.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Short Positions Increase as Market Sentiment Shifts to Fear. Accessed on May 26, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.