Download Pintu App

XRP Crisis: Plummets Below $2.30 Amid Heavy Selling Pressure

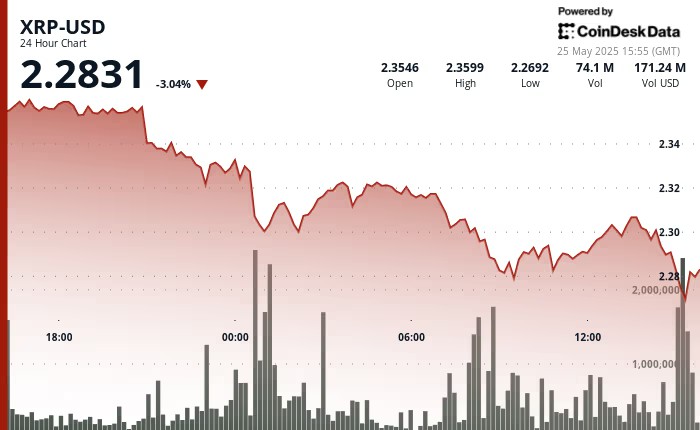

Jakarta, Pintu News – In recent days, the global cryptocurrency market has experienced significant turmoil, with Ripple (XRP) experiencing a sharp drop below $2.30. This drop comes amid market uncertainty triggered by the United States government’s announcement of new tariffs on imports from the European Union. Despite Bitcoin (BTC) hitting record highs recently, Ripple (XRP) and other major cryptocurrencies continue to slide.

Global Economic Conditions Weigh on the Market

Heightened global economic tensions have had a significant impact on the cryptocurrency market. The announcement of potential tariffs of 50% on imports from the European Union by the US government has created widespread market uncertainty. Ripple (XRP) experienced a sharp drop in value, falling alongside the majority of other major cryptocurrencies.

This situation shows how sensitive the crypto market is to changes in global economic policy. This also affected trading patterns, with high trading volumes creating a double-bottom pattern on the Ripple (XRP) price chart. Despite the correction, technical analysts point out that critical support is in the range of $2.25-$2.26. If the price falls below this level, it could trigger a deeper drop towards the $1.55-$1.90 zone.

Also Read: Astonishing Prediction: Bitcoin Will Break $250,000, Really?

Institutional Interest Remains Strong

Despite the price drop, interest from financial institutions in Ripple (XRP) remains strong. Volatility Shares recently launched a Ripple (XRP) futures ETF which shows that there is optimism among institutional investors towards the future of this cryptocurrency.

In addition, leveraged ETF inflows increased, signaling that Wall Street continues to accumulate positions despite market weakness. This strength of institutional interest indicates a belief that Ripple (XRP) has recovery potential. Institutional investors often have access to more in-depth analysis and data, which may help them in making investment decisions amid market volatility.

Ripple (XRP) Market Outlook

The future of Ripple (XRP) in the cryptocurrency market is still full of uncertainty, but several factors could provide clues about the next direction. Market analysts will continue to monitor critical support levels and market reactions to changing global economic policies.

In addition, investment decisions by large institutions will greatly influence price dynamics. Monitoring technical and fundamental indicators will be crucial in determining whether Ripple (XRP) will experience a recovery or continue to face selling pressure. Investors and analysts alike should be wary of rapid changes in market sentiment that could drastically affect the price.

Conclusion

With constantly changing market conditions and global economic uncertainty, the future of Ripple (XRP) in the cryptocurrency market will continue to be an interesting topic to follow. Despite the challenges, strong interest from institutional investors could be key to Ripple (XRP)’s future recovery.

Also Read: XRP Ledger Activity Decline Reaches 90%: What’s the Impact?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coindesk. XRP Plunges Below $2.30 Amid Heavy Selling Pressure. Accessed on May 26, 2025

- Featured Image: Coinpedia

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.