Download Pintu App

Investors Start Buying Solana, Is SOL Ready to Surge?

Jakarta, Pintu News – Solana (SOL) has shown limited price movement lately despite massive accumulation of the token. Throughout the month of May, the price remained relatively stable, likely due to the overheated altcoin market conditions.

While this stagnation is a signal of caution, the market continues to show optimism, which could open up opportunities for Solana price increases in the near future.

Solana Investors Continue to Accumulate

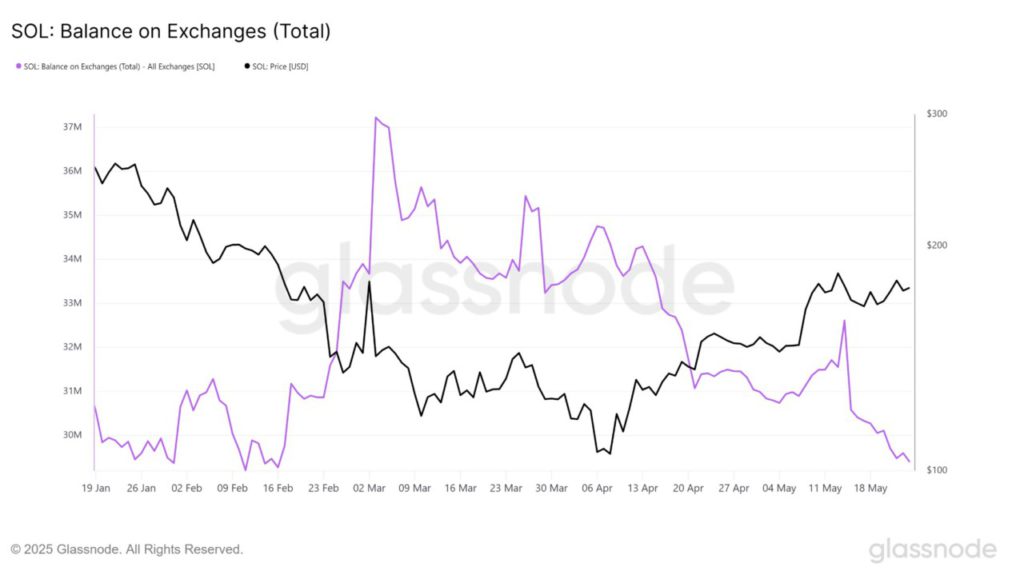

In the last 10 days, the amount of Solana (SOL) held on exchanges has decreased by 2.2 million SOL, worth approximately $381 million. This decrease in supply indicates that investors continued to accumulate Solana during the period.

Read also: Swiss Luxury Watchmaker Releases Limited Edition Solana Watch!

The accumulation may be driven by various factors, such as bullish market sentiment, fear of missing out (FOMO), and expectations of future price increases.

This decrease in supply reflects the increasing confidence of investors, with many of them choosing to hold rather than sell their SOL.

As more investors accumulate these tokens, the supply on exchanges decreases, potentially creating upward pressure on prices in the long run.

Solana Potentially Surges

Furthermore, as reported by BeInCrypto (5/25) Solana’s overall market momentum is showing signs of potential volatility. Technical indicators such as Bollinger Bands reveal that the bands are beginning to narrow.

This narrowing is a classic signal of a potential squeeze, which is often the harbinger of a spike in price volatility.

If this squeeze results in a bullish breakout, Solana’s price could increase, especially since the general market sentiment is also positive.

However, the narrowing of the Bollinger Bands also indicates a possible consolidation phase before the next significant move.

SOL Price Needs to Breakout

The price of Solana (SOL) has been moving sideways throughout May, possibly due to the token overheating in the previous weeks. However, this cooling period could be an opportunity for a bullish move.

Read also: Dogecoin Runs the Indy 500 Circuit, Donates $26,000 to Children’s Hospitals!

With market sentiment continuing to show positive signals and the ongoing accumulation trend, Solana could potentially break out of its current consolidation phase.

At $173, Solana is testing a crucial support point. To start the rally, SOL needs to break and maintain the $178 level as support.

If it manages to cross $180 and then breaks $188, this could be the first sign of an upward trend.

A successful breakout above these levels would signal further upside potential.

On the contrary, if Solana fails to maintain support at $178, the price risks dropping below $168, and could even touch $161. Such a drop would invalidate the bullish scenario and indicate a potential risk of a deeper price drop.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Traders Accumulate $381 Million SOL – Is Solana Preparing for a Breakout? Accessed on May 26, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.