Download Pintu App

Pi Network in Trouble? Massive Sell-Off Sends PI Price Crashing to New Weekly Low!

Jakarta, Pintu News – Pi Network’s native token, PI, experienced a 22% price drop in the past week. This decline extended its negative trend to a seven-day low of $0.61 at the time of writing.

This double-digit drop reflects the increasingly pessimistic market sentiment towards the token, which also comes along with a broader shrinkage in the crypto market as a whole.

PI Outlook Worsens as Downward Trend Strengthens

The global crypto market capitalization has dropped by more than 5% in the past seven days, shrinking by more than $170 billion. This massive correction shook investor confidence, which triggered a fresh sell-off against PI tokens in recent days.

Read also: Hyperliquid trader turns $3 million into $27.5 million in a flash as crypto market explodes!

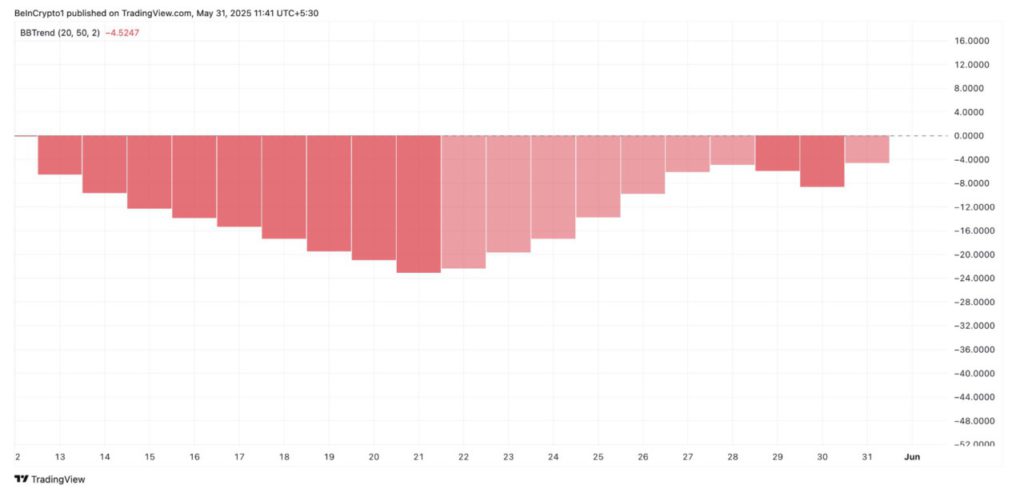

The growing selling pressure is evident through PI’s BBTrend indicator, which continues to print red histogram bars-a clear sign of increasing bearish momentum. At the time of writing, the indicator’s value stands at -4.52.

BBTrend is an indicator that measures the strength and direction of a trend based on the widening and narrowing of the Bollinger Bands. When the value is positive, it usually signals a strong uptrend, while negative values indicate increasing downward pressure or bearish momentum.

PI’s consistently negative BBTrend values indicate that PI prices often close near the lower boundary of the Bollinger Band. This pattern reflects continuous selling activity and signals a potential prolonged price decline.

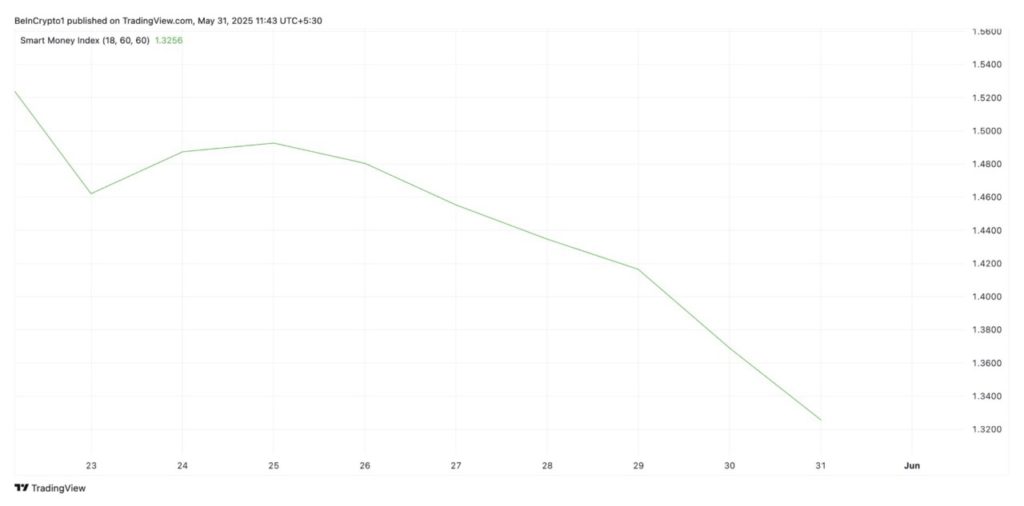

In addition, the PI Smart Money Index (SMI) has also declined in recent days, indicating the exit of “smart money” or institutional investors from the market. This is often considered an early indicator of a potential deeper price drop, as it reflects the diminishing confidence of these key investors.

An asset’s SMI tracks institutional investor activity by analyzing market behavior in the first and last hours of trading.

If the SMI rises, it means that institutional investors are increasing their buying activity, which hints at a potential prolonged rally.

Conversely, as is the case with PI, when SMI falls, it indicates that institutional demand for the asset is weakening-a signal of potential further price declines.

Read also: Tether Now Holds Over 100,000 Bitcoins and 50 Tons of Gold!

PI is on the Threshold of Key Support – Can the Bulls Hold at $0.55?

The increased selling activity on PI tokens suggests that in the short term, these tokens are at risk of further decline.

If the sell-off continues, the altcoin could break the crucial support level formed at $0.55.

If the bulls fail to defend this support level, the PI price could potentially drop back to an all-time low of $0.40.

However, a new surge in demand for these tokens could prevent this scenario. If buying pressure on PI Network tokens increases sharply, the PI price could be pushed up to reach $0.86.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Pi Network Sell-Off Continues as PI Hits 7-Day Low. Accessed on June 1, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.