Download Pintu App

Bitcoin (BTC) ready to face turmoil, on-chain data gives strong signals!

Jakarta, Pintu News – Although Bitcoin (BTC) options traders have indicated low volatility expectations, on-chain data indicates the potential for high volatility in the near future.

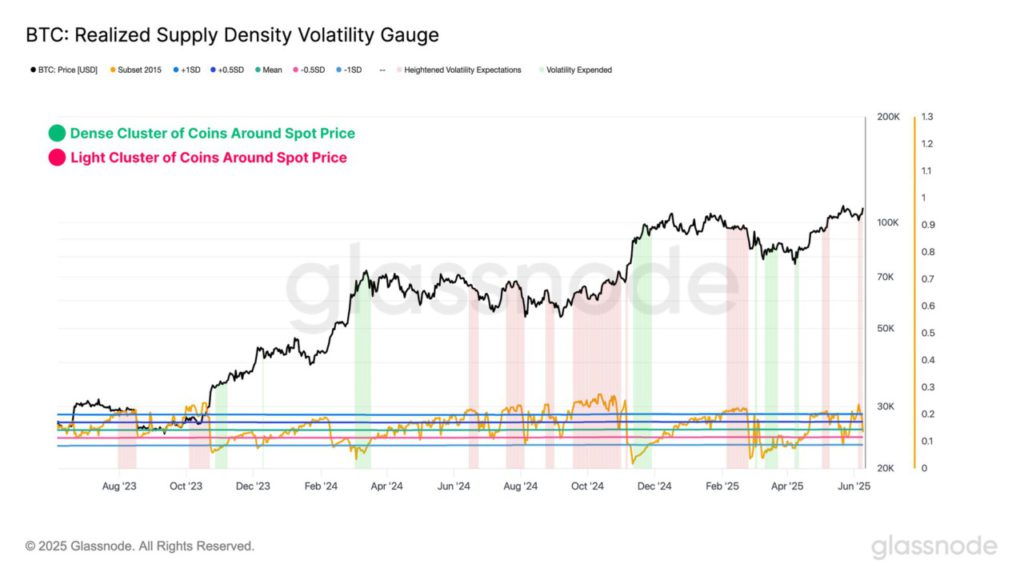

A recent report from analytics firm Glassnode revealed that there is a mismatch between options market expectations and the reality of on-chain data. The high Realized Supply Density indicator suggests that many investors have bought Bitcoin (BTC) at prices close to the current spot price, increasing the risk of volatility.

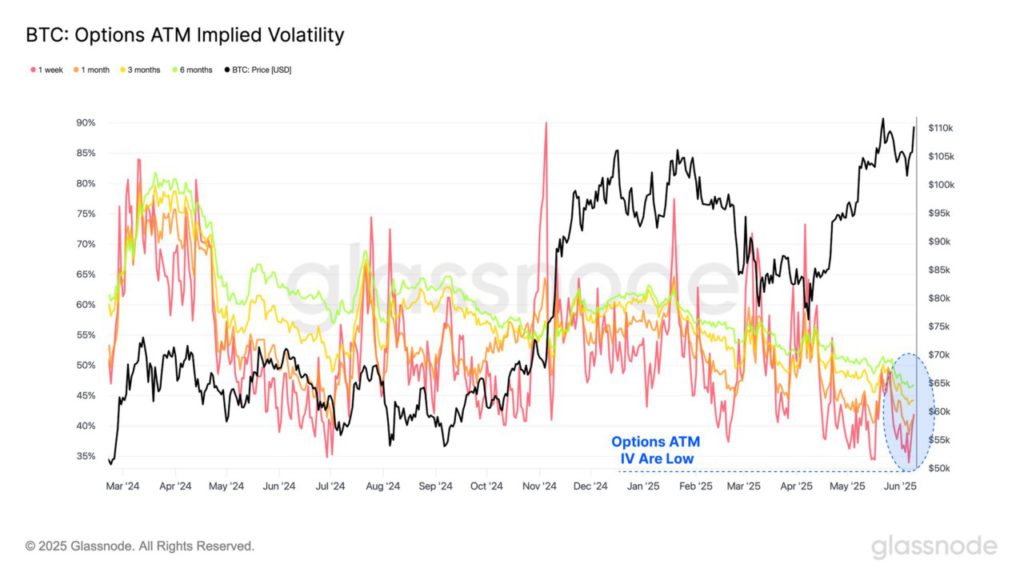

Implicit Volatility in the Options Market

The At-the-Money Implicit Volatility (ATM IV) for Bitcoin (BTC) has shown a consistent decline across various tenors. This indicates that options traders are not anticipating significant price fluctuations in the near future. ATM IV is a metric that describes the expected volatility of Bitcoin (BTC) based on the option contract price that is closest to the current spot price.

Nonetheless, this downward trend is often considered a counter-trend signal that precedes a period of increased volatility. The analytics firm suggests that the calm in options prices could be the calm before the storm, given the on-chain data that suggests otherwise.

Read More: Algorand Transaction Surge: A Sign of ALGO Price Rise in June 2025?

On-Chain Data Shows Accumulation

The Realized Supply Density indicator provided by Glassnode shows that there has been an accumulation of Bitcoin (BTC) around the current spot price. The increase in the value of this metric signifies that a large number of investors have engaged in purchases at prices close to the current price.

This creates the potential for overreaction to small price changes, which can increase market volatility. The high concentration of Bitcoin (BTC) holdings at any given price makes the market more sensitive to price changes. Any significant price movement can trigger a large reaction from holders, which in turn, can accelerate further price movements.

Bitcoin (BTC) Price Outlook

Currently, the price of Bitcoin (BTC) hovers around $108,800, having risen more than 3.5% in the past week. Although the options market shows low volatility expectations, investors and traders should be aware of the potential for increased volatility indicated by on-chain data.

A mismatch between market expectations and on-chain indicators is often an early signal of a sudden change in market dynamics. Therefore, it is important for market participants to consider both sides of this information when making investment decisions.

Conclusion

With strong indications of on-chain data going against options market expectations, Bitcoin (BTC) market participants may need to prepare themselves for a possible increase in volatility. Monitoring these two aspects will be crucial in navigating this uncertain market.

Also Read: Crypto Market Optimism: Can Optimism (OP) Break $0.72?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin Options Traders Expect On-Chain Chaos. Accessed on June 12, 2025

- Featured Image: Generated by AI

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.