Download Pintu App

Dogecoin Dives Today – Can Fresh Technical Signals Turn the Tide or Push DOGE Even Lower?

Jakarta, Pintu News – Dogecoin (DOGE) is still struggling to regain momentum. In the last seven days, its value has dropped by more than 5% and has been trading below $0.25 since late February.

Despite showing signs of recovery, technical indicators still point to bearish tendencies, with key resistance levels limiting any attempts at price gains.

Reporting from BeInCrypto (6/15), the ichimoku cloud remains red, the EMA line still shows a downtrend, and the price movement continues to be below the important trend confirmation zone.

However, a sharp change in the BBTrend indicator and an increase in the momentum metric indicate that traders are starting to look closely at the potential for a breakout.

Then, how is the current Dogecoin price movement?

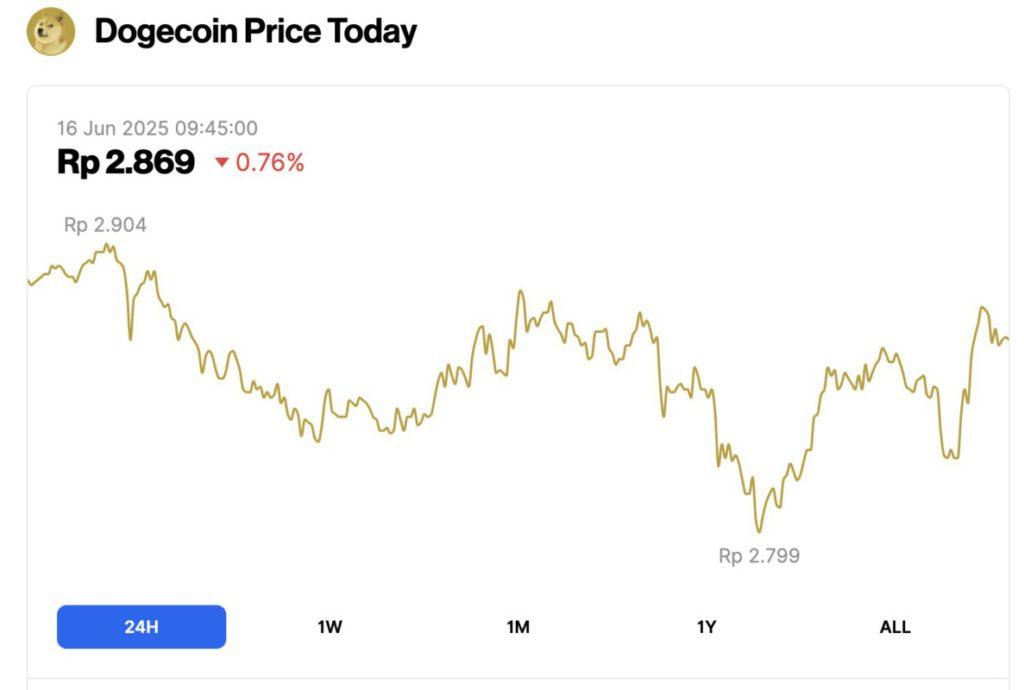

Dogecoin Price Drops 0.76% within 24 Hours

Read also: Ethereum Hits $2,500 as Whale Snaps Up 1.29M ETH – Is a Surge to $4,000 Coming?

On June 16, 2025, Dogecoin saw a slight pullback, dipping by 0.76% over the past 24 hours to trade at $0.1760, or around IDR 2,869. During the day, DOGE reached a high of IDR 2,904 and slipped to a low of IDR 2,799.

At the time of writing, Dogecoin’s market cap stands at around $26.36 billion, with trading volume rising 29% to $885.4 million within 24 hours.

Dogecoin faces resistance as Ichimoku Structure remains bearish

Dogecoin’s Ichimoku Cloud chart as of June 15 shows a clear bearish structure, where the price movement is still below the red Kumo (cloud) in the short term.

The blue Tenkan-sen line (conversion line) is below the red Kijun-sen line (base line), which reinforces the bearish view in the short term.

In addition, the price candles appear to be struggling to break the Tenkan-sen line, which acts as a dynamic resistance and inhibits upward momentum. This usually signals weak buying pressure in the current market phase.

Looking ahead, the Kumo cloud is starting to transition from red to green, which could signal a change in sentiment if the price manages to approach and break the cloud.

However, this fairly thick cloud indicates a strong resistance zone and requires a significant bullish push to break through. As long as the price has not entered or broken through the cloud, the market bias remains bearish.

Kumo’s current flat bottom could also act as a “magnet” that pulls the price towards it, but continued price gains will depend heavily on Dogecoin’s ability to turn the cloud into an area of support.

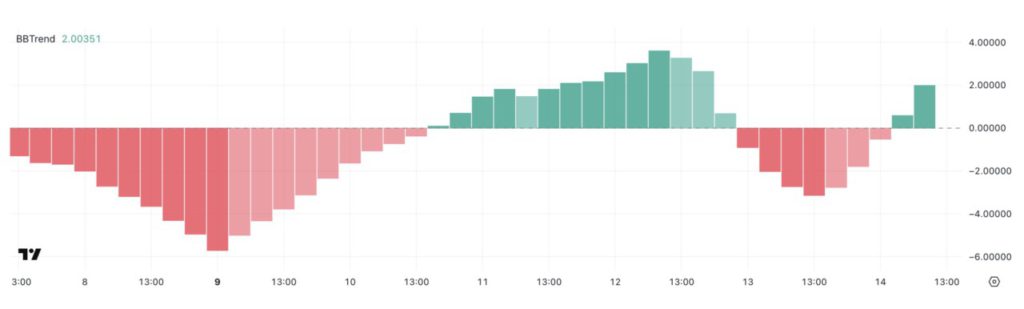

DOGE Experiences Sharp Reversal as BBTrend Indicator Turns Positive

Dogecoin’s BBTrend indicator showed a drastic change in the bullish direction, jumping from -3.14 to 2 in just one day.

BBTrend (Bollinger Band Trend) is a momentum indicator that measures the strength and direction of price movement relative to the Bollinger Bands.

Values above zero indicate bullish (upward) momentum, while values below zero indicate bearish (downward) pressure. The higher the positive value, the stronger the upward push; conversely, the deeper the negative value, the stronger the downward pressure.

Read also: Bitcoin Holds Strong at $105K — But Is a Drop Below $103K Coming Soon?

With DOGE’s BBTrend currently at 2, this signals a potential change in market sentiment and an increase in bullish momentum. This sharp reversal suggests that buying pressure is building up and the asset may be entering a recovery phase.

While not a definitive confirmation of a sustained uptrend, BBTrend entering positive territory is often an early signal of further upside – especially if supported by increased trading volumes and price action following suit.

Traders can see this as an early signal to start monitoring for a possible continuation of the uptrend.

DOGE Must Break $0.206 to Reverse Trend-or Risk Dropping to $0.168

Dogecoin’s EMA line still shows a bearish setup, where the short-term average is below the long-term average, reflecting the ongoing downward pressure.

If the current price bounce fails to strengthen, DOGE will most likely retest the support level at $0.168-which has previously managed to hold the decline in recent sessions. Without a clear change in momentum, this level could become a “magnet” that attracts prices in the near term.

The absence of crossover on the EMA lines keeps the overall trend bearish for now.

On the contrary, if the momentum strengthens and DOGE manages to break the resistance level at $0.206, it could trigger a broader trend reversal.

In that scenario, the next upside target is $0.232 and could potentially reach $0.254 – provided there is a continuation of strong and consistent price movement.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Dogecoin (DOGE) Struggles to Break Out-Can Rising Indicators Shift the Trend? Accessed on June 16, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.