Download Pintu App

Bitcoin Surges to $107K Today (6/17): Is $110K Next?

Jakarta, Pintu News – The price of Bitcoin (BTC) broke through the $106,000 level again as the upward momentum continues to strengthen. Weekly inflows into ETFs exceeded $1 billion, while data from the derivatives market indicates a potential rally towards $110,000.

Starting the week on a positive note, Bitcoin price rose more than 1% in the last 24 hours and managed to reclaim the $107,000 level. Will this short-term recovery push Bitcoin all the way to the $110,000 mark? Let’s take a look at the developments.

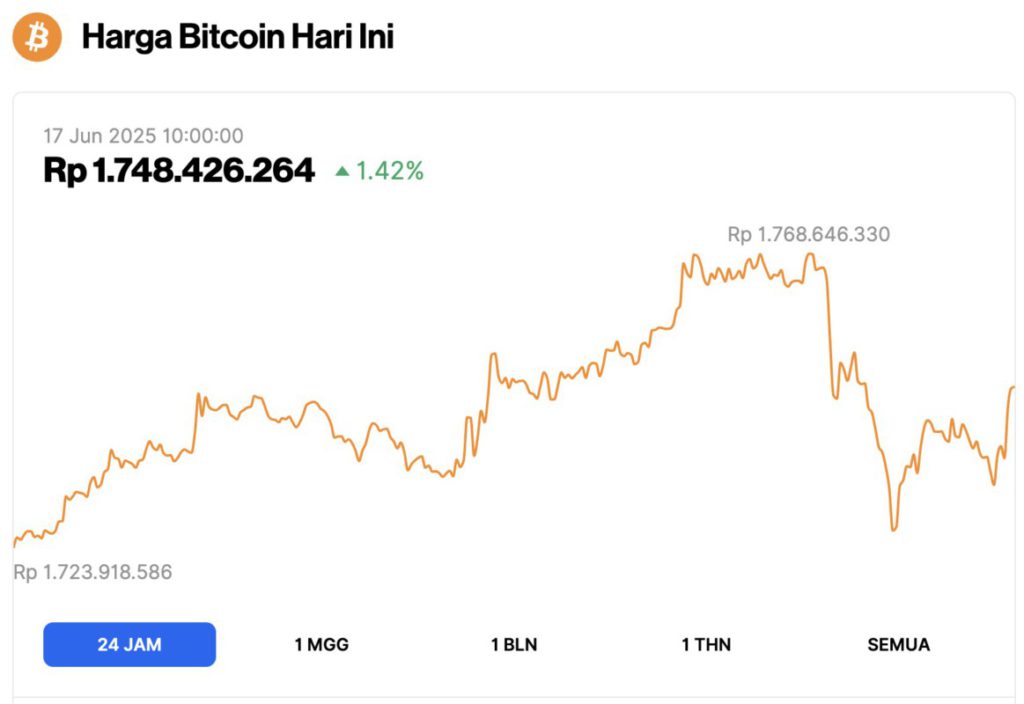

Bitcoin Price Up 1.42% in 24 Hours

On June 17, 2025, Bitcoin’s price reached $107,435 (approximately IDR 1,748,426,264), marking a 1.42% increase over the past 24 hours. During this time, BTC hit a low of IDR 1,723,918,586 and a high of IDR 1,768,646,330.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $2.13 trillion, with trading volume in the last 24 hours rising 44% to $54.14 billion.

Read also: How Will Bitcoin Price Perform Ahead of the FOMC Meeting This Week?

Bitcoin Price Analysis Leads to $110,000

On the 4-hour price chart, BTC has formed three consecutive bullish candles after bouncing off a major support line.

With momentum maintaining over the weekend through several 4-hour candles with long shadows, Bitcoin is now trading at $106,665.

This reversal rally is approaching the immediate resistance at $107.015 as the bullish momentum increases.

Technical indicators favor a potential breakout: MACD and signal lines form a positive crossover, while the RSI has crossed the midpoint, signaling stronger bullish momentum.

If the price manages to break $107,015, the next target is the resistance level at $110,266, which previously showed a double top on June 10. Conversely, in the event of a decline, Bitcoin could potentially retest the immediate support line around $105,000.

Optimism Rises in Bitcoin Derivatives Market

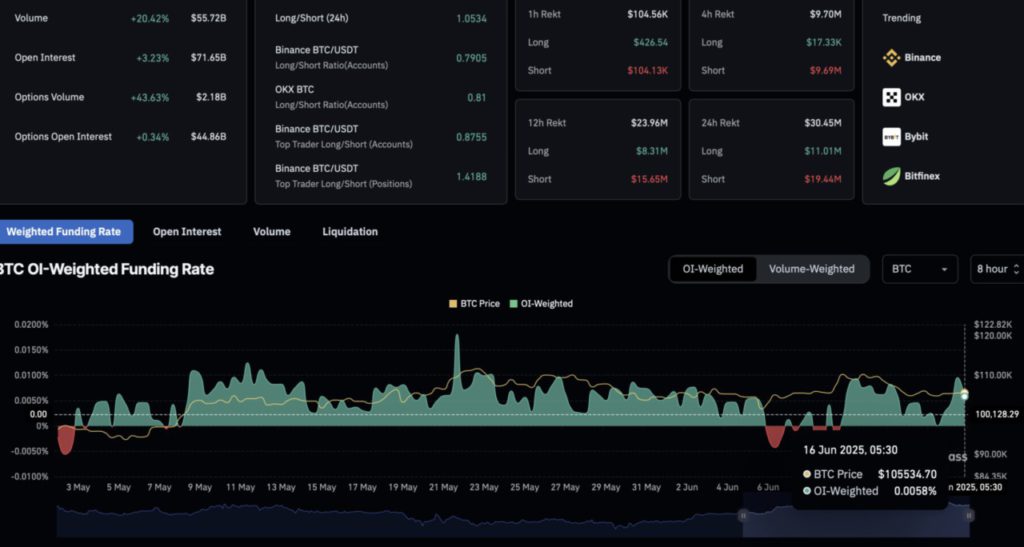

Amid the short-term recovery, optimism in the Bitcoin derivatives market has increased significantly. Greater capital flows into Bitcoin derivatives have pushed open interest (OI) up by 3.23%, reaching $71.65 billion.

With these capital flows, the funding rate calculated based on OI remained high at 0.0058%, reflecting increased bullish activity.

Read also: 5 Crypto Gains Today (6/17/25): Number 1 Altcoin Surges up to 54%!

Specifically, the liquidation of short positions in the past 24 hours has exceeded $19 million, while the liquidation of long positions was around $11 million, indicating a greater impact on bearish positions during this rally.

As the bullish dominance gets stronger, the long-to-short ratio has risen above 1, signaling a higher number of long positions. Therefore, derivative data from CoinGlass supports the possibility of a longer rally for Bitcoin.

Retail Investors Lag as Institutional Support Rises

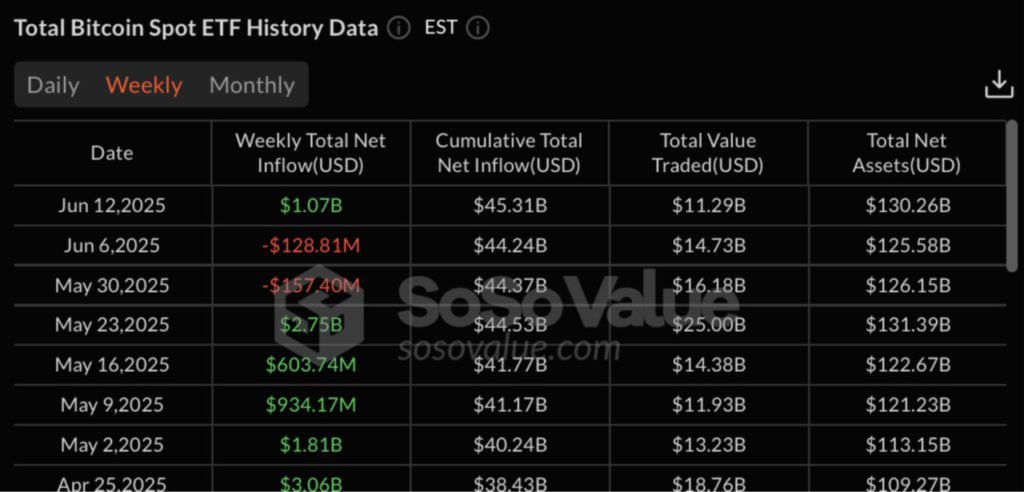

In the past week, total net inflows into US spot Bitcoin ETFs have exceeded $1 billion, reaching $1.07 billion. On June 13 alone, net inflows stood at $301.62 million, led by contributions from BlackRock of $238.99 million.

While institutional confidence continues to rise, retail investor participation remains low.

According to the latest analysis by on-chain analysts, DarkFost (CryptoQuant), BTC flows to Binance from whales and retail investors have dropped to their lowest level since the beginning of this cycle. This decline indicates a strong preference for holding over selling.

Read also: 3 US Economic Indicators This Week That Could Shake Up the Crypto Market!

Interestingly, these two groups of investors seem to have an aligned approach-a positive signal for the market as a whole.

Historically, there have only been two notable periods in this cycle where whales and retail investors acted in unison, both coinciding with major market peaks when inflows surged simultaneously.

Conversely, the current sharp decline in inflows may indicate that most market participants are either waiting for clearer macroeconomic clues or simply showing high confidence in Bitcoin’s long-term trajectory.

This alignment between investor classes could reflect rising market confidence and growing expectations of further upside potential.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Crypto Basic. Bitcoin Targets $110K Amid $1B ETF Weekly Inflows. Accessed on June 17, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.