Download Pintu App

Company’s Bitcoin Accumulation Strategy Threatened, Shares Fall!

Jakarta, Pintu News – VanEck’s Matthew Sigel has expressed concerns over Bitcoin (BTC) accumulation strategies by public companies. In a post on X, Sigel advised companies to stop buying Bitcoin if their stock price declines. This marks a tipping point for companies that have adopted Bitcoin as part of their financial strategy.

Warning from VanEck

Sigel emphasized that companies that integrate Bitcoin in their financial strategy need to reconsider their approach. “This may include a merger, separation, or discontinuation of the Bitcoin strategy,” Sigel said.

He also highlighted that companies that continue to issue new shares to buy Bitcoin may experience value destruction rather than value creation if their share price is at or close to net asset value (NAV).

Companies whose treasury strategy focuses on Bitcoin should tie executive compensation to growth in net asset value per share, not just to the size of Bitcoin holdings or number of shares. Sigel added, “When you trade at NAV, shareholder dilution is no longer strategic. It’s extractive.”

Also Read: Vietnam Officially Recognizes Bitcoin and Other Digital Assets!

Semler Scientific Case

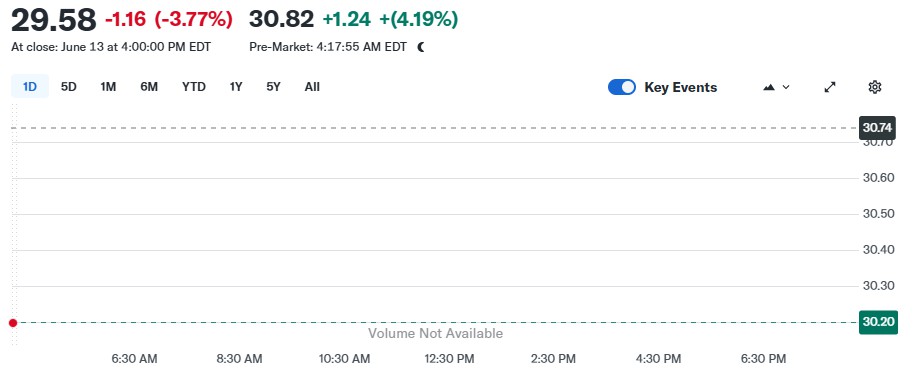

Semler Scientific, a medical technology company, is a clear example of Sigel’s warning. Since May 24, Semler has accumulated 3,808 Bitcoins worth $404.6 million. However, Semler’s stock (SMLR) has fallen about 45% this year, back to the level when they started accumulating Bitcoin. Their market capitalization is now down to about $434.7 million.

This decline puts Semler in a difficult position as their market capitalization relative to Bitcoin holdings, as measured by the multiple of net asset value (mNAV), has dropped to around 0.821x, below 1x. This suggests that the market value of their shares is almost equivalent to the value of the Bitcoin they hold.

Risks to Other Companies

Not only Semler, other large companies such as MicroStrategy and Metaplanet have also continued to increase their Bitcoin accumulation. Metaplanet recently added 1,112 Bitcoin, bringing their total holdings to 10,000 Bitcoin. However, if the downward trend in stock prices continues, these companies may also face similar risks.

Sigel suggests that these companies should reconsider their strategies, especially if they want to avoid diluting value for shareholders. Safeguards should be put in place to mitigate the risks that may arise from this Bitcoin treasury strategy.

Conclusion

With volatile market conditions, companies that have adopted Bitcoin as part of their financial strategy need to conduct an in-depth evaluation. The decision to continue accumulating Bitcoin should be carefully considered, taking into account the potential risks to share value and shareholder interests.

Also Read: Ripple (XRP) Legal Case: Strong Arguments in Joint Motion Revealed!

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. Bitcoin Accumulation Strategy Under Threat as Stock Prices Plummet, Says VanEck. Accessed on June 17, 2025

- Featured Image: Generated by AI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.