Download Pintu App

Bitcoin Survives Global Uncertainty, What’s the Secret?

Jakarta, Pintu News – The global market is currently filled with increasing uncertainty, ranging from geopolitical tensions to economic fluctuations. However, amidst the panic engulfing traditional markets, Bitcoin (BTC) is showing impressive resilience. How are Bitcoin (BTC) investors dealing with this situation?

Bitcoin Stability Above $100,000

Despite rising tensions and potential wars in the Middle East, as well as inflation in the United States not reaching the Federal Reserve’s target, Bitcoin (BTC) has managed to keep its price above $100,000. This shows that more and more investors are looking at Bitcoin (BTC) as a safe haven asset.

Amid global economic uncertainty, gold is usually the top choice, but this time Bitcoin (BTC) also seems to be a popular choice. This price resilience shows investors’ confidence in Bitcoin (BTC) as a potential store of value. Despite the pressure on global stock markets, Bitcoin (BTC) seems to be able to maintain its position as a reliable digital asset in the face of uncertainty.

Read More: Company’s Bitcoin Accumulation Strategy Threatened, Stock Falls!

Bitcoin Investors in Wait-and-see Mode

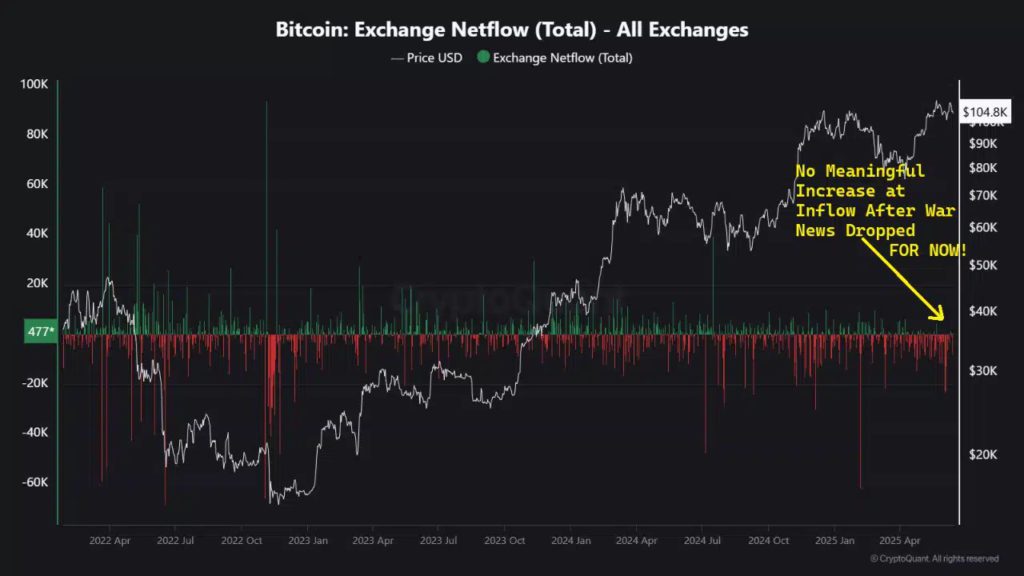

Based on analysis from CryptoQuant Insights, there is no significant selling pressure on major exchanges. This suggests that Bitcoin (BTC) holders are not in a hurry to realize profits and exit the market. This could be an indication that investors are in a wait-and-see mode, observing market developments before making further decisions.

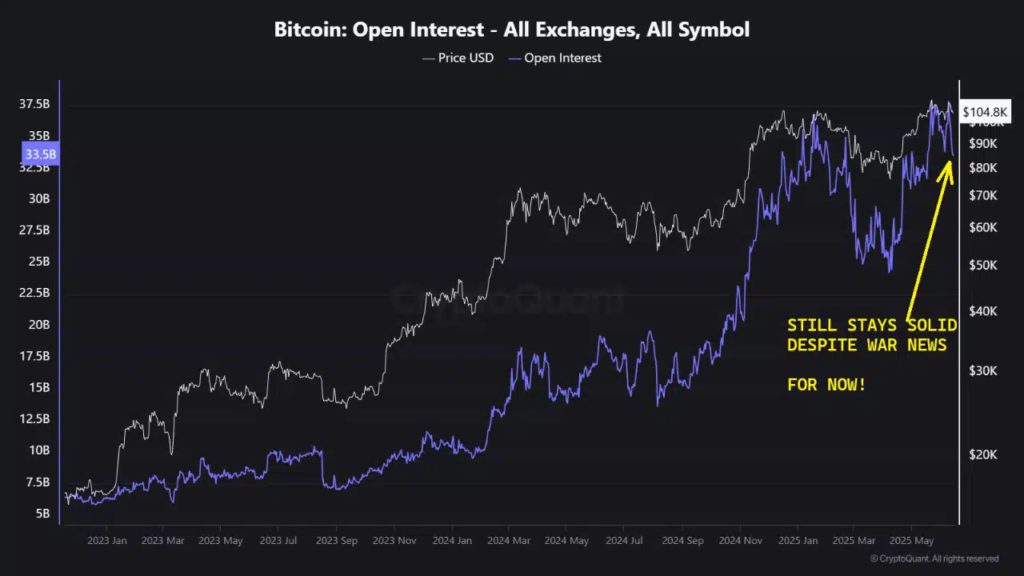

In addition, despite the correction from $110,000 to $105,000, there was no massive selling. The high level of Open Interest shows that there is still considerable speculative interest in Bitcoin (BTC), despite the fear and uncertainty in the market. This suggests that investors still have confidence in the long-term prospects of Bitcoin (BTC).

Short-Term Volatility and Future Outlook

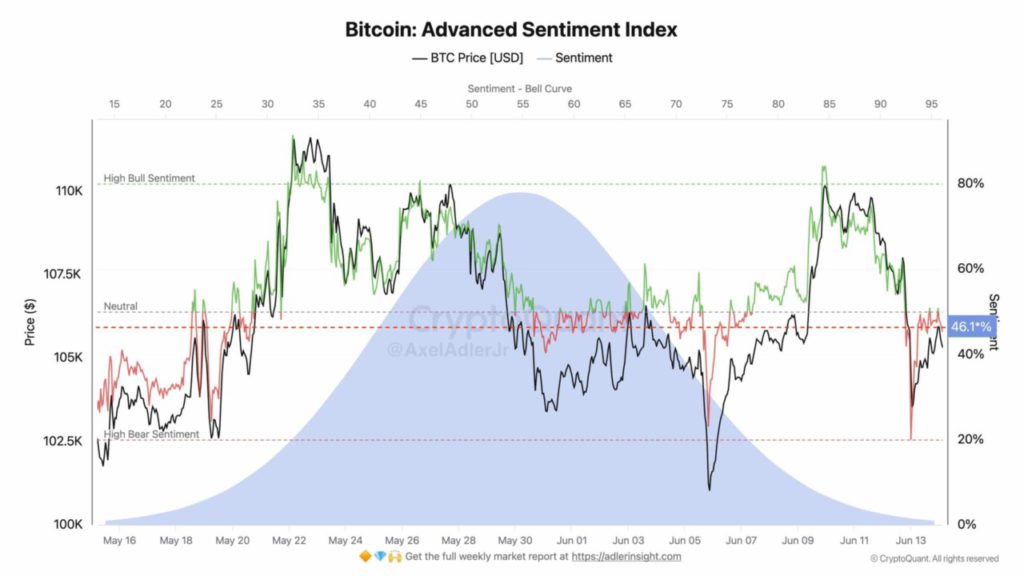

Recent analysis suggests that there could be a slight bearish bias towards Bitcoin (BTC) in the next few days. The daily chart shows that there is dominant selling pressure, with indicators such as the Chaikin Money Flow (CMF) and Awesome Oscillator showing downward momentum.

However, this does not necessarily indicate a long-term decline. Market participants are expected to brace for short-term volatility. However, the strength of Bitcoin (BTC) holders who are holding on despite the fear and panic, gives a positive signal. This suggests that it may be prudent for retail investors to adopt a wait-and-see attitude as large investors do.

Conclusion

In the face of increasing global uncertainty, Bitcoin (BTC) has shown remarkable resilience. This strength reflects not only the confidence investors have in the digital asset as a store of value, but also the potential for Bitcoin (BTC) to continue to grow in the future. By maintaining a cautious yet optimistic attitude, Bitcoin (BTC) investors may continue to see the asset as a safe harbor in the eye of the storm.

Also Read: Metaplanet Reaches 10,000 BTC Target: What Does It Mean for the Future of Cryptocurrency?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Examining how Bitcoin’s investors are holding up despite global FUD and panic. Accessed on June 17, 2025

- Featured Image: The image created by AI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.