Download Pintu App

Brad Mills Predicts BTC Could Rise 100x in 10-20 Years, What’s his Analysis?

News Highlights:

- Brad Mills predicts Bitcoin (BTC) will experience a 100x rise in the next 10-20 years, fueled by institutional adoption and scarcity-driven halving.

- The US launched the Bitcoin Reserve Strategic with 200,000 BTC, signaling a major shift in monetary policy.

- Technological advancements such as Square and CashuBTC will increase the adoption of Bitcoin in retail payments.

Jakarta, Pintu News – Brad Mills, a prominent Bitcoin (BTC) investor and thinker, recently gave a prediction that shook the crypto market. He predicted that Bitcoin could experience a 100x price spike in the next 10 to 20 years, which means the price of Bitcoin (BTC) could reach $10 million (around Rp163 billion) per coin.

This prediction is based on several important factors, including growing institutional adoption, the halving effect that reduces supply, and technological innovations that support crypto adoption by the retail sector.

In this article, we’ll dig deeper into why Mills believes Bitcoin has the potential to experience this massive growth and what factors support this prediction.

Institutional Adoption and the Effect of Halving on Bitcoin

According to Cointelegraph, one of the main reasons underlying Brad Mills’ bullish predictions is the Bitcoin halving process that occurs every four years. Each time a halving occurs, the supply of newly mined Bitcoin is reduced by 50%, creating scarcity that can affect the price.

Mills believes that this halving will continue to reduce supply and push prices up as demand increases, especially from large institutions.

Large institutions like Michael Saylor’s MicroStrategy with over 592,100 BTC in its reserves, along with countries like El Salvador with 6,209 BTC, indicate that more and more entities see Bitcoin as a must-have asset.

Also read: Franklin Templeton’s Ethereum ETF Decision Delayed by SEC, What’s the Impact?

In addition, Square, a subsidiary of Block, Inc. plans to launch Lightning Network-based payments by 2026, which will cut merchant fees by 50%, thus increasing the use of Bitcoin (BTC) in daily transactions.

Strategic Bitcoin Reserve: Changes in US Monetary Policy

One factor that has further strengthened Bitcoin’s position in the financial world is the policy measures taken by the US Government. In 2025, the United States initiated the Strategic Bitcoin Reserve, which consists of 200,000 BTC seized from criminal cases. This signaled a major shift in the way the country sees Bitcoin as part of a long-term strategic reserve.

Although the seized BTC did not immediately affect supply, the decision not to sell it and instead keep it suggests a major policy shift that will probably lead to wider recognition of Bitcoin as a reserve of value.

Some analysts argue that this move, if followed by other countries, could make Bitcoin (BTC) a global strategic asset, on par with gold and US Treasury Bills.

Read also: 3 Crypto RWAs Worth Watching in June 2025, Ready to Breach ATH?

Technological Advancements that Support the Use of Bitcoin in Retail

In addition to institutional adoption and government policies, technological innovations also play an important role in accelerating Bitcoin adoption. Mills mentioned that technologies such as Chaumian eCash and CashuBTC allow users to store Bitcoin more securely and privately.

This technology facilitates more efficient retail savings, allowing ordinary users to accumulate satoshis (the smallest unit of Bitcoin).

With more and more companies integrating Bitcoin as a means of payment and savings, especially through networks such as the Lightning Network, the demand for Bitcoin as a means of transaction is increasing.

Mills predicts that these two technologies will play a major role in introducing Bitcoin to the retail market and further steering it towards becoming a “must-have asset.”

Bitcoin Rise Prediction: 100x in 10-20 Years

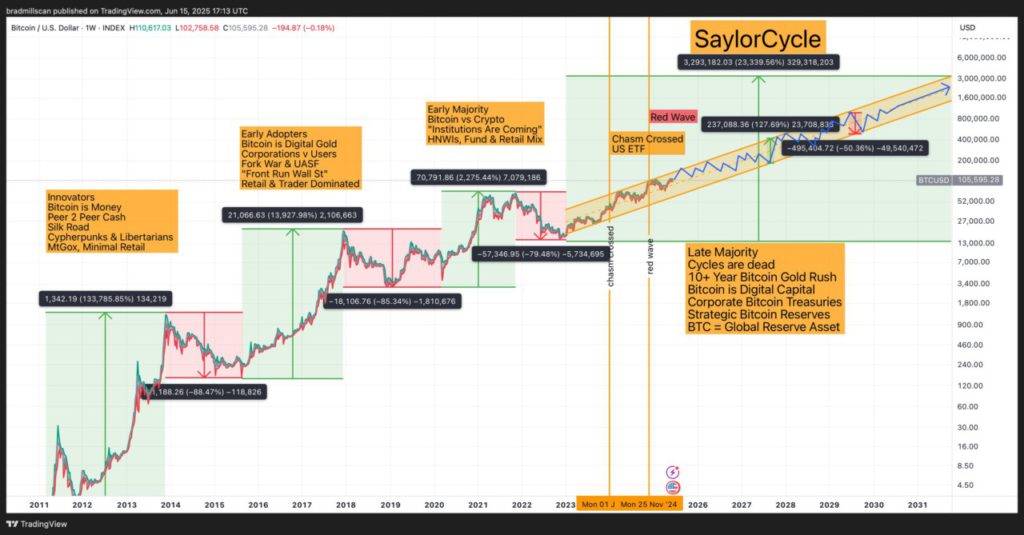

Taking all these factors into account, Mills predicts that Bitcoin could experience a price increase of up to 100x in the next 10 to 20 years. This prediction is rooted in the continuous reduction of supply through the halving process, where the supply of Bitcoin is expected to become increasingly limited over time.

ills anticipates that the price of Bitcoin could reach $10 million (Rp163 billion), with bull markets experiencing spikes of up to 200% per year, although the price could drop by 50% during bear markets.

Mills added that this movement could also buck the traditional market trend of showing a gradual decline with each price cycle. According to him, with more institutional adoption and supportive policies, Bitcoin could break out of the traditional price cycle pattern and enter a “parabolic breakout” phase, where price spikes occur faster and sharper.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Early Bitcoin Adopter Says BTC Could Have Another 100X Cycle. Accessed June 17, 2025.

- Featured Image: Bitcoinist

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.