Download Pintu App

Global Tensions Heat Up, Crypto Takes a Hit: What’s Really Happening? (6/18/25)

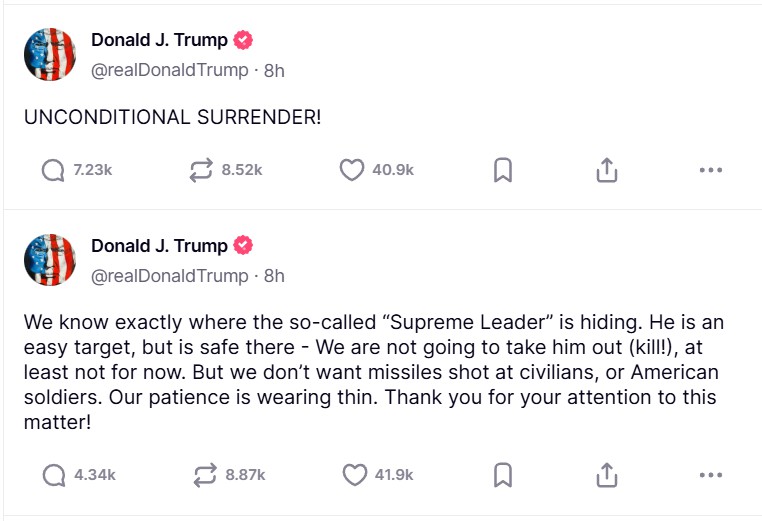

Jakarta, Pintu News – US President Donald Trump recently made a strong statement that sparked international tensions. Through the Truth.Social platform, he delivered an open threat against Iran’s Supreme Leader, Ali Khamenei. Trump claimed to know Khamenei’s location and called him an easy target, although he said he would not attack him yet. The statement sparked global fears of a potential US military escalation in the Israel-Iran conflict.

Global Financial Markets React Negatively

Following Trump’s remarks, US stock markets went into freefall, reflecting investor concerns over geopolitical tensions. The Dow Jones fell 299 points (-0.70%) to 42,215.80, while the S&P 500 lost 0.84% to 5,982.72 and the Nasdaq fell 0.91% to 19,521.09. The move to temporarily close the US Embassy in Israel until Friday reinforced concerns over a potential conflict. In a situation like this, market volatility becomes inevitable.

By law, the US President should require Congressional approval through a War Powers Resolution to initiate a large-scale armed conflict. However, in practice, presidents often use legal loopholes citing threats to national security. This adds to the uncertainty among global market participants, including cryptocurrency investors.

Read More: Company’s Bitcoin Accumulation Strategy Threatened, Stock Falls!

Crypto market corrects, US$135 billion lost

The impact of the conflict was not only felt in the stock market, but also very significantly in the cryptocurrency market. The total crypto market capitalization decreased by US$135 billion (≈ Rp2.2 quadrillion), or more than 4% in a day. This reflects the risk-off sentiment, where investors avoid high-risk assets like crypto. Volatile geopolitical tensions often trigger massive sell-offs in volatile markets.

Bitcoin (BTC) briefly hit a daily low of US$103,344 (≈ Rp1.68 billion), before stabilizing around US$104,655 (≈ Rp1.71 billion), a 2.3% decline. However, BTC wasn’t the most affected. The altcoins saw sharper declines, indicating a shift of investors to more stable crypto assets like Bitcoin. Data shows that the total market capitalization without Bitcoin (TOTAL2) fell by 4.4%, greater than the overall crypto market decline of 3.8%.

What Does It All Mean for Crypto Investors?

Current conditions show that crypto markets are highly sensitive to geopolitical dynamics, especially those involving a major country like the United States. The market reaction to Trump’s statement shows that speculation can have a big impact on the value of digital assets. In the short term, price movements may be determined more by political tensions than fundamentals.

Investors are advised to keep an eye on psychologically important levels such as US$104,000 (≈ Rp1.7 billion) on Bitcoin, as this could be a turning point or trigger a further decline. The history of Bitcoin’s price movements shows that such zones are often a tug-of-war between buyers and sellers. In uncertain global conditions, caution and risk management strategies are key when investing in cryptocurrencies.

Conclusion

The fall in crypto values in the past day proves that digital assets are not immune to global geopolitical turmoil. Tensions between the US and Iran have fueled uncertainty that spills over into crypto markets, leading to heavy losses and short-term panic. Investors need to closely follow the global situation and prioritize risk analysis before making decisions in this dynamic cryptocurrency ecosystem.

Also Read: Metaplanet Reaches 10,000 BTC Target: What Does It Mean for the Future of Cryptocurrency?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Bitcoinsensus. Why Is Crypto Down Today? $135B Wiped Amid Global Tensions. Accessed June 18, 2025.

- Featured Image: Generated by AI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.