Download Pintu App

Pi Network Struggles at $0.55 – What’s Behind the Continuous Drop?

Jakarta, Pintu News – Pi Network (PI) recently hit its lowest price at $0.40. Although it briefly rose to $0.58, the downward price trend continued.

With mounting selling pressure and a tight token unlock schedule, how low can PI prices go in the second quarter of 2025?

Pi Network Price Drops 4% Today

On June 18, 2025, the price of Pi Network (PI) was recorded at $0.5589, a decrease of 4% in the last 24 hours. If converted to the current rupiah ($1 = IDR 16,318), then 1 Pi Network is IDR 9,120.

Read also: Dogecoin Tumbles 2% Today – Is This the Start of a Bearish Frenzy for DOGE?

In a 24-hour time span, the PI price moved in the range of $0.5314 to $0.5825. This decline is also in line with the weakness against Bitcoin (BTC), where the value of PI against BTC fell by 1.8%.

Despite the price correction, trading activity remained high with 24-hour transaction volume reaching $111,069,581. The current market capitalization stands at $4.16 billion, while the fully diluted valuation stands at over $6.4 billion.

Token Unlock Threatens Pi Network’s Price Recovery

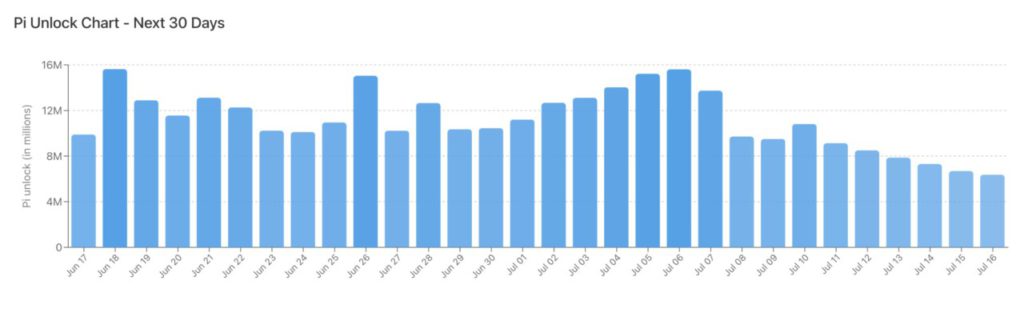

PI’s increasingly large token unlock schedule poses a major threat to any hope of a significant price recovery in the near future. In the next 30 days alone, as many as 337 million PI tokens – worth around $185 million according to data from PiScan – will be released to the market.

This increase in supply continued to weigh on market sentiment and added downward pressure to the already fragile PI price movement.

Token unlocking refers to the process of releasing previously locked or vested tokens in stages according to a predetermined schedule. This process creates a consistent stream of selling pressure for PI, which is still not listed on major exchanges such as Binance and Coinbase.

Freefalling RSI and Declining Institutional Interest Further Rocks PI Outlook

Furthermore, the sharp decline in PI’s Relative Strength Index (RSI) reflects reduced market demand, signaling the potential for further price declines. As of June 17, 2025, the RSI stood at 33.54 – indicating low buying interest.

RSI itself is a technical indicator used to measure the market condition of an asset, whether it is overbought (too much bought) or oversold (too much sold). Its value ranges from 0 to 100.

Values above 70 indicate that the asset is overbought and has the potential to decline in price, while values below 30 indicate oversold conditions and a possible price bounce.

With PI’s RSI at 33.54 and still declining, this indicates a weakening market momentum, reinforcing the negative view on the token’s price movement.

Read also: 3 Best Crypto Airdrops in the Third Week of June that You Must Watch!

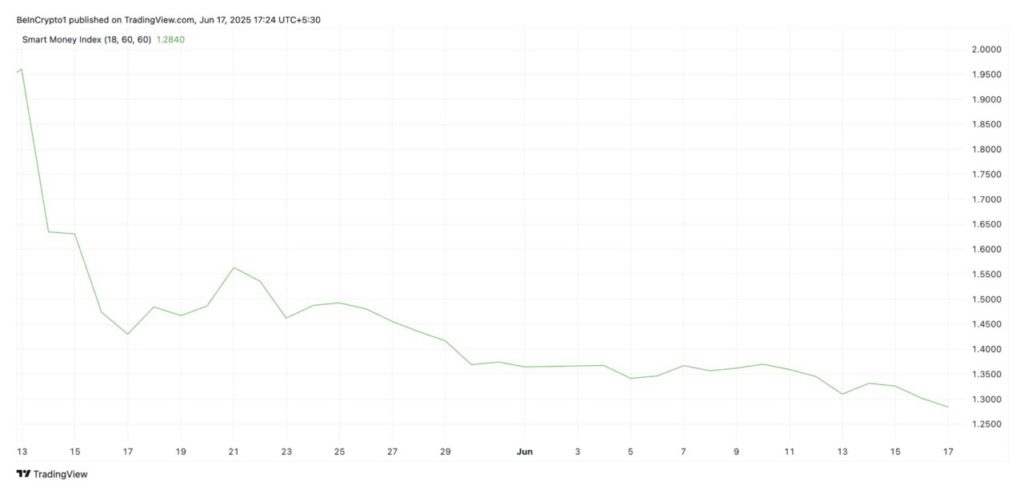

Furthermore, the continued decline in the PI Smart Money Index (SMI) suggests that institutional capital is starting to move away from this asset. Currently, the SMI stands at 1.28 – down about 10% in the last 30 days.

SMI is an indicator that tracks the activity of institutional investors or seasoned investors by analyzing market behavior in the first and last hours of trading each day.

If the SMI value increases, it means there is increased buying activity by institutional investors, signaling increased confidence in the asset.

Conversely, if this indicator declines, it indicates selling activity or reduced confidence from large investors, which is generally a sign of expectations of further price declines.

Pressure Mounts for PIs

Since May 21, PI prices have continued to trade below the downtrend line – a pattern that indicates continued bearish momentum (downtrend).

This pattern forms when selling pressure dominates the market, creating lower and lower highs over time and thwarting any meaningful price recovery attempts.

The fact that PI prices continue to remain below the trend line reflects high investor hesitation and weak demand.

If this trend continues, the PI price is at risk of retesting its all-time low of $0.40, and could even drop to even lower levels.

On the other hand, if demand picks up again, the PI token price could potentially rise towards the $0.65 range.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Pi Token Hints at Q2 Decline. Accessed on June 18, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.