Download Pintu App

Will Bitcoin (BTC) Continue to Strengthen? Positive Signs from the Whales

Jakarta, Pintu News – Amid heightened geopolitical tensions between Israel and Iran, Bitcoin (BTC) price has declined from $110,530 on June 9 to just above $106,900 today. Despite concerns that Bitcoin’s (BTC) upward momentum may have stalled, on-chain data shows that whales and retail investors still expect further gains for the cryptocurrency.

Decline in Whale and Retail Inflows to Binance

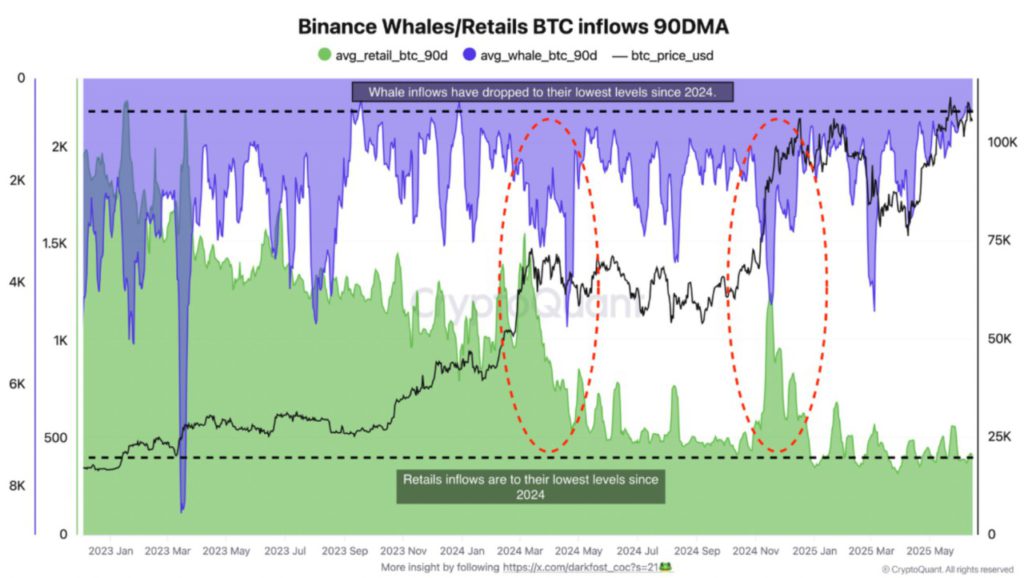

Based on a recent post on CryptoQuant by contributor Darkfost, it was noted that Bitcoin (BTC) inflows to the Binance exchange from two groups, namely whales and retail investors, have reached their lowest point in the current market cycle. Darkfost shared a chart showing that whale inflows to Binance are at their lowest point since 2024.

Similarly, inflows from retail investors also hit their lowest point since the same year, signaling a strong preference for holding over selling. This alignment of behavior between whales and retail investors is considered a very constructive signal for the market. In addition to the consistent inflows observed early in the current cycle, Darkfost identified two previous instances when both groups acted in sync.

Also Read: Bitcoin (BTC) Hits a New Low, What’s the Impact on the Market? (6/18/25)

Market Analysis and Prediction

These periods of aligned behavior usually coincide with previous market peaks. Those peaks are characterized by synchronized inflows of Bitcoin (BTC) to exchanges, resulting in increased selling pressure and, eventually, market demand exhaustion.

Darkfost suggested that market participants may be waiting for clearer macroeconomic clues or simply showing high confidence in Bitcoin’s (BTC) long-term potential. Additionally, experienced crypto analyst Ash Crypto in a post on X highlighted that a Bitcoin (BTC) whale has opened a large long position of $200 million with 20x leverage, supporting the optimistic view mentioned earlier.

Concerns and Potential Correction

While the decline in Bitcoin (BTC) inflows to major exchanges like Binance is an encouraging signal, some analysts warn that a deeper correction may be on the horizon. For example, TradingView analyst MIRZA recently predicted that Bitcoin (BTC) could drop as low as $85,000.

Furthermore, veteran trader Peter Brandt shared a cautionary note, that Bitcoin (BTC) may see a sharp decline in the coming months. Brandt stated that if Bitcoin (BTC) follows the 2021-22 market cycle, then the downside risk could reach as low as $23,600. However, Bitcoin (BTC) outflows from exchanges continue to increase, reducing available reserves, a dynamic that could result in a supply shock.

Conclusion

Currently, Bitcoin (BTC) is trading at $106,920, up 1.8% over the past 24 hours. Although there are some pessimistic voices, on-chain data and the actions of major investors show that there is still confidence in Bitcoin’s (BTC) potential future price gains.

Also Read: Global Tensions Heat Up, Crypto Takes a Hit: What Really Happened? (6/18/25)

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin Whale and Retail Inflows to Binance Fall to Cycle Lows, More Upside Ahead. Accessed on June 18, 2025

- Featured Image: Generated by AI

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.