Download Pintu App

VanEck’s Solana ETF Just Hit the DTCC List — Is a 91% SEC Approval Imminent?

Jakarta, Pintu News – VanEck’s proposal for a Solana spot exchange-traded fund (ETF) has been listed on the Depository Trust and Clearing Corporation (DTCC) website. This development is considered a strong signal that the US Securities and Exchange Commission (SEC) may soon grant approval to the fund.

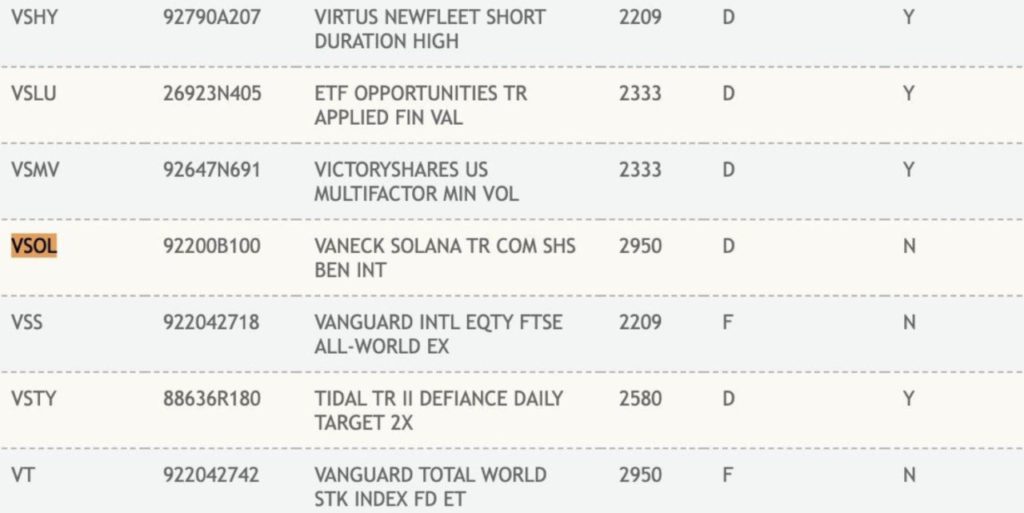

The ETF is listed under the ticker code VSOL and is included in the “active and pre-launch” section of the DTCC website. However, DTCC states that the fund cannot yet be created or redeemed as it is still awaiting approval from regulatory authorities.

VanEck’s Solana ETF Ready for Approval

According to DTCC, these ETFs cannot be processed until they receive approval from the SEC. However, the presence of VanEck’s Solana spot ETF (SOL) on the list is considered a positive indicator that approval may be forthcoming in the future.

Read also: Solana’s Rise: Could SOL Surpass Bitcoin and Ethereum in 2025?

The inclusion indicates that the regulatory oversight process is still ongoing, but the fund’s presence on the list hints that a decision from the SEC could be imminent.

So far, the SEC has been known to be quite cautious in approving spot crypto asset-based ETFs. While spot Bitcoin (BTC) and Ethereum (ETH) ETFs have been approved, other crypto assets such as Solana have not received similar treatment.

Therefore, the inclusion of VanEck ETFs on the DTCC website could be an important milestone in the process of wider acceptance of crypto ETFs in the United States.

Meaning of Inclusion in DTCC

VanEck reports that the listing of the Solana ETF on the DTCC website is a sign that the fund is nearing the launch stage. However, it is important to understand that the presence of an ETF on the DTCC website does not automatically mean that the SEC will approve it.

This inclusion only indicates that the ETF is in the process of legislation and is not yet fully active. DTCC’s inability to process the fund at this stage indicates that the ETF is still in the pre-launch review stage.

Nonetheless, this inclusion is significant, as it is usually the first step before the final approval process. The SEC’s next steps will largely determine whether Solana ETFs will become popular investment products in the future.

Potential SEC Approval of Solana ETF

According to Bloomberg analysts James Seyffart and Eric Balchunas, the SEC is likely to give the green light to the Solana ETF in the coming months.

This prediction is based on Solana’s good market performance as well as the announcement from the CME (Chicago Mercantile Exchange) regarding the planned launch of Solana futures contracts.

The SEC is known to have been in discussions with ETF issuers to revise their S-1 filings, which is a key requirement in the regulatory approval process.

Read also: Top 3 Crypto Must Buy Before Market Rebound: Pi Network, Solana, Neo Pepe Protocol!

James Seyffart stated that while there is no certainty regarding the exact timing, he would not be surprised if the approval of the Solana ETF happens in the next month or so.

This suggests that the SEC is actively assessing Solana-based ETF products. Meanwhile, according to predictions from Polymarket, the chances of a Solana ETF being approved have risen to 91%.

Bloomberg analysts expressed a similar view, putting the likelihood of approval from the SEC at around 90%.

Growing Industry Interest in Solana ETFs

As the crypto ETF market continues to grow, more and more companies are vying for Solana-based funds.

Besides VanEck, several other asset managers such as CoinShares and Bitwise have also submitted their Solana ETF proposals. However, some of them have experienced delays, such as the recently delayed Franklin Templeton SOL ETF.

Interestingly, some companies have also started amending their filing documents to include staking options, indicating a growing desire to offer more diverse products within the crypto ETF market.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. VanEck’s Solana ETF Listed on DTCC as US SEC Approval Odds Hits 91%. Accessed on June 19, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.