Download Pintu App

TRON Transactions Explode by 6 Million — What This Means for the Market and What’s Coming Next!

Jakarta, Pintu News – In the past year, TRON (TRX) has seen a significant increase in daily transaction volume. With the addition of around 6 million transactions since 2021, the platform now records more than 9 million transactions per day.

This increase signals greater activity and increased interest in the development of TRON’s blockchain infrastructure.

The platform further strengthens its position as a major player in the blockchain ecosystem.

TRON Transaction Count Has Increased by 6 Million Since 2021

TRON’s daily transaction volume has seen a significant increase. The number of transactions increased by 6 million since 2021, reaching more than 9 million.

Read also: Raydium Price Prediction: Jumped 50% After Listing on Upbit, What’s Next for RAY?

This growth indicates increased activity and interest in building blockchain infrastructure on the platform.

TRON is increasingly showing itself to be a major player in the blockchain ecosystem, as it continues to grow.

The transaction success rate is also an important indicator. The transaction success rate on the platform has consistently increased to over 96%.

This high number indicates the platform’s level of reliability and its ability to handle large volumes of transactions without frequent failures.

Consistent Growth and Unparalleled Efficiency of TRON

In addition to the high success rate of transactions, block production on the TRON platform also shows stability.

Block production has increased linearly every day. This reflects the operational stability and capacity of the network to scale optimally according to demand. The platform infrastructure is designed to support increased activity without compromising performance.

Activity in TRON has not been affected by rising transaction fees in the global market. The main demand from users remains block space and high throughput. This shows that users view the platform as a favorable option in terms of fees, despite the price increase.

The efficiency of the platform allows TRON to remain competitive in the market, despite rising operational costs.

Key Support Levels and Bearish Market Trend

Data from Glassnode shows that the TRON platform has a significant level of support at a price range between 0.26 to 0.27.

The total number of TRX tokens held at this level exceeds 14 billion, making it the strongest area of support.

As supply at higher price levels decreases, upward pressure on the price may occur if demand increases. This amount of support reflects strong investor confidence in TRON’s future.

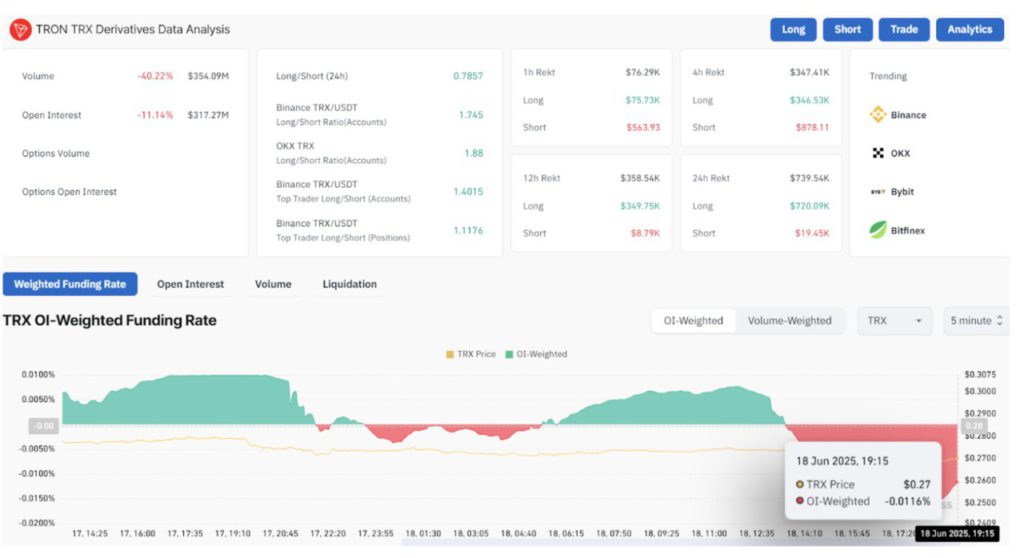

However, there was an increase in bearish sentiment in the derivatives market. Open interest decreased by 11.14%, to 317.27 million. This decline was triggered by long liquidation of 720.09k within 24 hours. Meanwhile, short liquidation amounted to only 19.45k.

In addition, the open interest-weighted funding rate is currently at a negative -0.0116%. This indicates pressure from traders who are speculating that prices will fall.

Despite the bearish sentiment in the derivatives market, the platform’s on-chain metrics are again performing strongly and growing.

The TRON platform continues to maintain solid on-chain performance. Despite bearish trends in the derivatives market, transaction success, block production rates, and user support are at high levels.

TRON’s scalability and reliability keep it one of the main actors in the blockchain market.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Tron Weekly. Tron’s 6M Transaction Surge, 96% Success Rate. Accessed on June 20, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.