Download Pintu App

Ripple’s Big $438 Million Transaction: Danger Sign or New Opportunity?

Jakarta, Pintu News – Recently, Ripple (XRP) made a massive transfer of $438 million that sparked panic among investors. However, on-chain data shows mixed signals about what might happen next. Despite concerns about the massive sell-off by Ripple, some on-chain indicators point to a different potential.

High MVRV Ratio: Potential Profit Taking?

The Market Value to Realized Value (MVRV) ratio for Ripple (XRP) is still at a high, around 195%. This suggests that many holders currently have considerable unrealized gains. If holders decide to take profits, this could trigger a significant price drop.

However, the high MVRV ratio can also be interpreted as a sign of investor confidence in the long-term value of Ripple (XRP). This suggests that despite the potential for profit-taking, many are still optimistic about the future prospects of Ripple (XRP).

Also Read: Bitcoin Survives Global Uncertainty, Will it Continue to Rise?

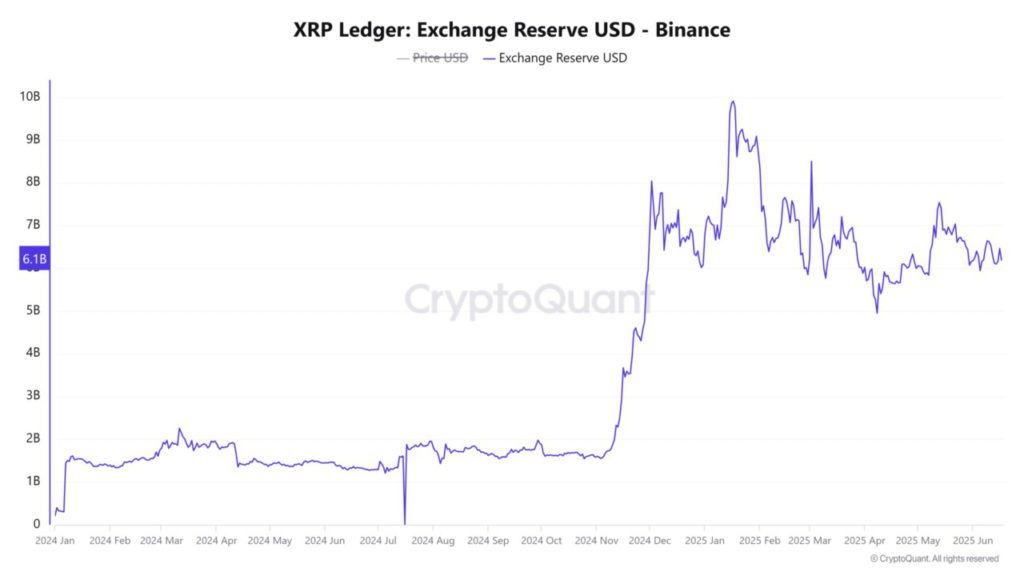

Reserve Contradictions on the Exchange

Despite initial concerns about a potential massive sale by Ripple, Ripple (XRP) reserves on exchanges have actually shown a decline. This could signal that there isn’t much Ripple (XRP) ready to be sold, which reduces the risk of a price drop due to heavy selling.

This decrease in reserves on exchanges could also indicate that investors prefer to keep their Ripple (XRP) in the long term, instead of selling it on the market. This is a positive indicator that shows investor confidence in the stability and growth potential of Ripple (XRP).

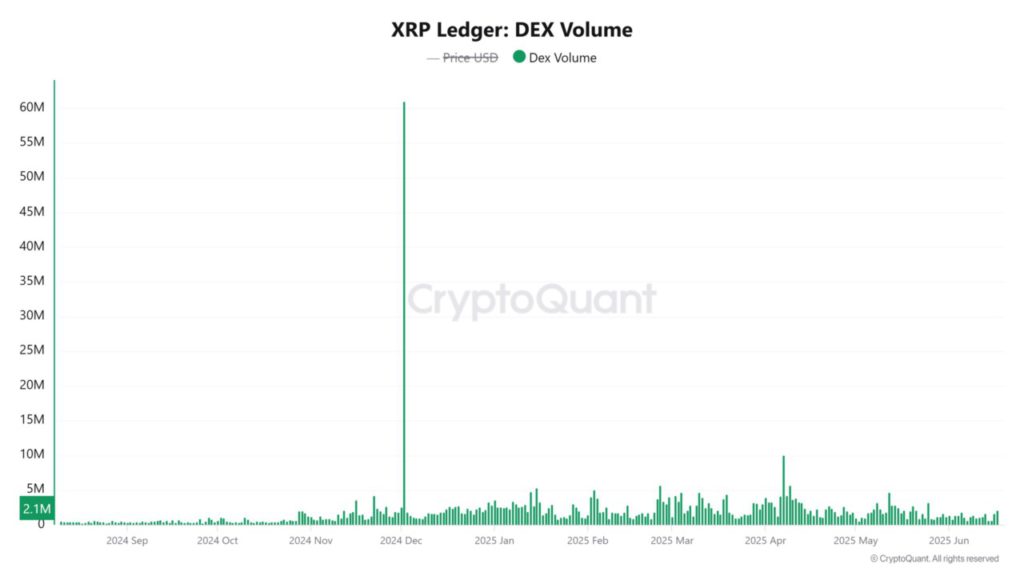

DEX Volume Surge and Weak Network Growth

The trading volume of Ripple (XRP) on decentralized exchanges (DEX) increased sharply, by more than 770% in the last 24 hours. This indicates a significant increase in trading activity, which could be a good sign for Ripple (XRP) market dynamics. However, the growth of the Ripple (XRP) network showed a decline, with only 807 new addresses recorded. This could be a warning signal that renewed interest in Ripple (XRP) is starting to wane, which might affect future price momentum.

Closure

While Ripple’s (XRP) large transfer initially raised concerns, on-chain data paints a more complex and not entirely negative picture. With declining exchange reserves and increasing trading volumes on the DEX, as well as market sentiment remaining bullish, Ripple (XRP) still has potential for growth. However, investors should remain wary of the high MVRV ratio and weak network growth.

Also Read: Is it Time to Invest in Solana (SOL)? New ETF Fuels Speculation!

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. 438M XRP transfer sparks panic, is Ripple about to dump?. Accessed on June 20, 2025

- Featured Image: The Currency Analytics

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.