Download Pintu App

Crypto Market Crisis: The Impact of the US Attack on Iran on Bitcoin and Ethereum!

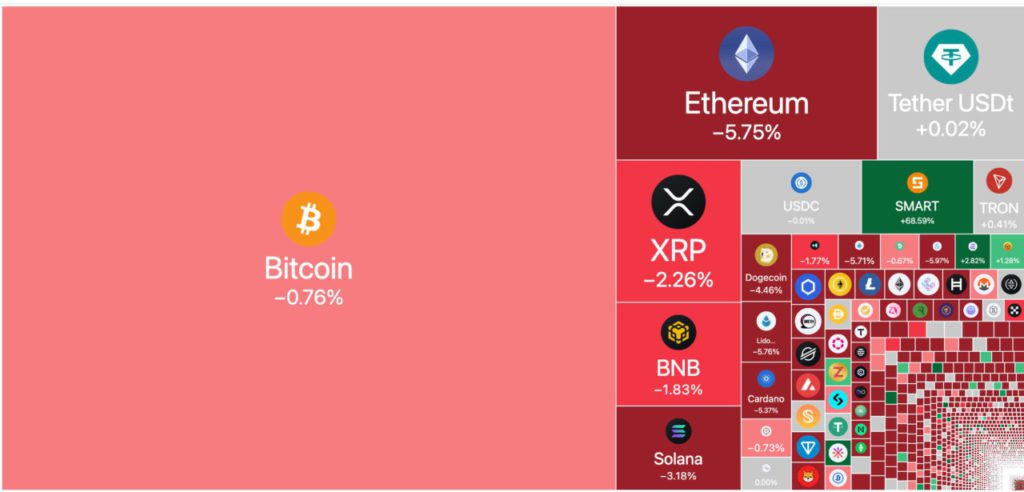

Jakarta, Pintu News – The crypto market experienced a sharp fall following the United States airstrike on Iran’s nuclear facilities. US President Donald Trump announced the attack via his X account, causing the prices of Bitcoin (BTC) and Ethereum (ETH) to plummet. This sparked investor concerns and speculation about the future of the crypto market.

Details of the Attack and Market Reaction

President Trump confirmed that three nuclear sites in Iran, namely Fardo, Natanz, and Esfahan, had been bombed by the United States. This announcement had an immediate impact on the crypto market, with Bitcoin (BTC) dropping 2% and Ethereum (ETH) dropping 7% in the last 24 hours. The price of Bitcoin (BTC) briefly plummeted to $101,000 immediately after the news broke.

This attack is part of the ongoing conflict between Israel and Iran, which is now heating up with the involvement of the United States. The crypto market, which is often considered a ‘safe haven’, is now looking shaky. Crypto investors and analysts are now paying close attention to any developments in this conflict, which could further affect crypto prices.

Also Read: Bitcoin Survives Global Uncertainty, Will it Continue to Rise?

Crypto Market Prediction and Analysis

According to a crypto trader known as Credible Crypto, Bitcoin (BTC) may experience a temporary rise before going back down. His analysis shows that Bitcoin (BTC) has reached a support zone that could provide a slight upside. However, if the price drops below $102,000, it could fall to the $98,000-$94,000 range. This situation shows how sensitive the crypto market is to geopolitical issues.

Any actions or statements from the governments involved can directly impact the value of digital currencies. Crypto investors are advised to be vigilant and watch for further developments that could affect their investments.

Broader Implications and Possible Scenarios

President Trump has warned Iran not to retaliate, but the conflict could escalate further. There are concerns that other countries such as China and Russia may get involved in this conflict, which would make the situation more complex and potentially hurt the crypto market further.

The next support for Bitcoin (BTC) is in the range of $92,000-$94,000, which suggests a potential drop of about 10% from current levels. This could mean massive selling for many altcoins. The market is currently very volatile, and any indication of peace or further escalation will greatly affect market dynamics.

Conclusion

In the face of this uncertainty, crypto market participants should consider strategies to manage risk. This incident is a reminder that crypto investments are not only affected by internal market factors, but are also highly vulnerable to unforeseen global issues.

Also Read: Is it Time to Invest in Solana (SOL)? New ETF Fuels Speculation!

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. US-Iran War: Crypto Market Crashes as U.S. Airstrikes on Iran. Accessed on June 23, 2025

- Featured Image: Generated by AI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.