Download Pintu App

Fartcoin Whale Drops $2 Million Right Before $6 Million Crash – Is a Major Dump Incoming?

Jakarta, Pintu News – Awallet linked to “wiftardio.sol” withdrew $2 million in USDC from Bybit and immediately bought 2.125 million Fartcoins (FARTCOIN) at $0.94, just before a massive liquidation event.

As of June 20, long positions worth over $5.99 million were erased, compared to only $921K worth of short positions being liquidated.

As of June 21, FARTCOIN was trading at $0.9359 after a 9.49% decline in the last 24 hours. The timing of this transaction raised concerns that the purchase was not a signal of bullish conviction, but rather a strategy to create exit liquidity.

Is the Continuous Fartcoin Outflow a Warning Sign?

FARTCOIN recorded a net outflow of $79.3K on June 21, continuing the trend of negative flows that occurred throughout the previous week.

Read also: Shiba Inu Price Forecast: From $0.01 to $1, When will SHIB soar?

Outflows from the spot market indicate that more tokens are being moved out of the exchange than are coming in-usually related to profit-taking or loss-cutting.

In this context-combined with the liquidation of long positions and a decline in Open Interest(OI)-the ongoing outflow most likely reflectssell-side pressure rather than long-term accumulation.

Open Interest has decreased by 9.74% and now stands at $557.44 million. This significant drop occurred immediately after a wave of liquidations, indicating that traders were quickly exiting the market.

As such, bearish market sentiment seems to be widespread in both the spot and derivatives markets.

Is the Big Liquidation Zone Now Turning into Short-Term Resistance?

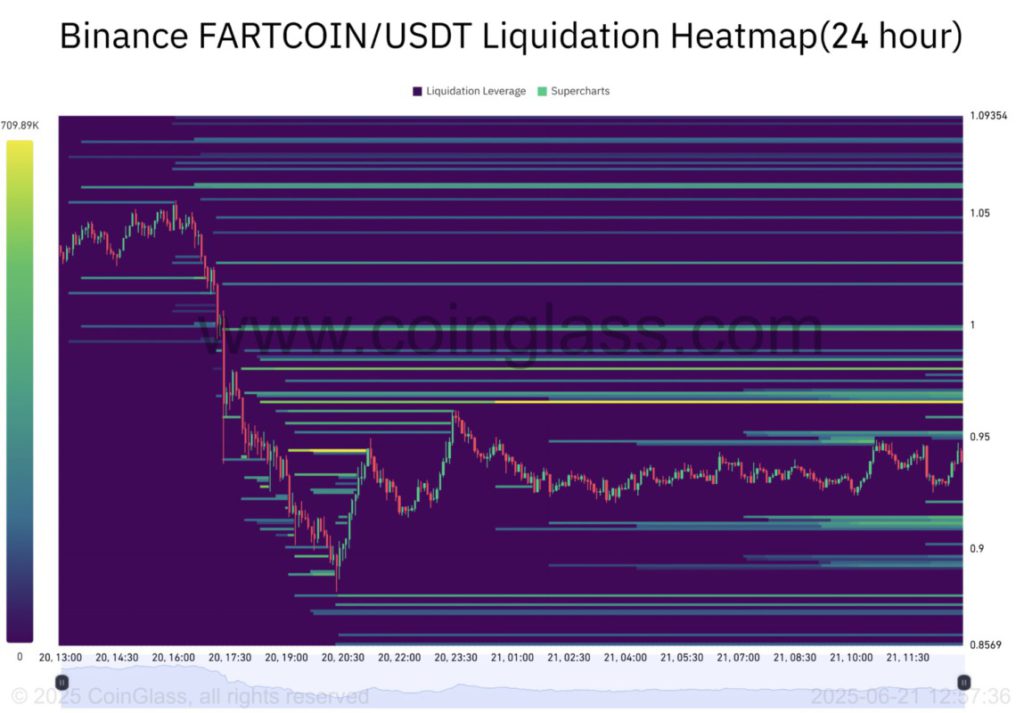

Binance ‘s liquidation heatmap shows a heavy concentration between the $0.95 to $1.00 price level, an area where many traders have previously experienced liquidation.

These zones now serve as short-term resistance as they represent points where traders’ positions are erased.

If the price tries to rise past this zone, surviving or near-loss traders will likely close their positions atbreakeven, adding to theselling pressure.

Therefore, even a small price increase could immediately encounter resistance from the previous liquidation zone, increasing the probability ofprice rejection before reaching the $1.00 psychological barrier.

What Do Neutral Funding Rates Say About Trader Bias?

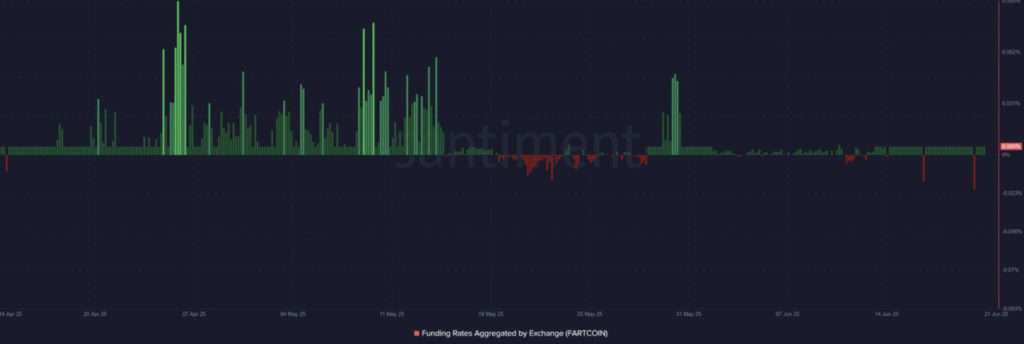

FARTCOIN Funding Rates remained flat, with a slight dip into negative territory on some exchanges.

This neutral funding level indicates that traders are not paying a premium to aggressively open long or short positions.

Normally, a strong bullish sentiment would push funding rates into positive territory. However, the absence of this conviction confirms that most market participants prefer to wait rather than speculate.

Read also: What is Pi2Day? Pi Network’s Big Day that Could Change the Fate of the Pioneers!

These doubts further reinforce the notion that the recent whale-driven price movements are not enough to generate widespread confidence among traders.

Can Fartcoin’s Demand Zone Survive Without Further Support?

FARTCOIN briefly bounced off the demand zone near the $0.915 level, which coincided with the 0.786 Fibonacci retracement level.

However, the price is still below theascending trendline and well below the $1.05 resistance zone.

This structure reflects weakness more than strength. For a solid recovery, the bulls need to reclaim the trendline and reverse the key Fibonacci levels intosupport.

Without such confirmation, the price action currently moving in a narrow range risks turning into a further decline towards the lower support zone around $0.86.

Overall, the $2 million purchase of FARTCOIN looks more like aliquidity trap than genuine accumulation.

The buying that took place just before the big liquidation wave, followed by a sharp drop in Open Interest, neutral Funding Rates, and sustained negative net outflows-all point to an exit strategy, not long-term conviction.

The lack of response from other market participants further strengthens this narrative. Unless the bulls manage to reclaim the $1.05 level with strength, this action reflects more profit-taking than a commitment to the long-term uptrend.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Fartcoin whale makes $2M move just before $6M liquidation – Warning sign? Accessed on June 23, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.