Download Pintu App

Crypto Market Crisis! Bitcoin Approaches $100K, Ethereum, Ripple, and Others Plummet

Jakarta, Pintu News – The crypto market is facing the threat of a crash as Bitcoin (BTC) approaches the critical $100,000 mark, which could trigger a massive sell-off. This condition is exacerbated by global conflicts that are heating up again, including the Israel-Iran war and the India-Pakistan conflict.

Currently, Bitcoin (BTC) is trading at $102,730, down 2.58% in the past week, and market sentiment is starting to lean towards bearish after Bitcoin (BTC) broke the $104,000 support.

Check out the full analysis here!

Massive Liquidation: Ethereum Leads Losses

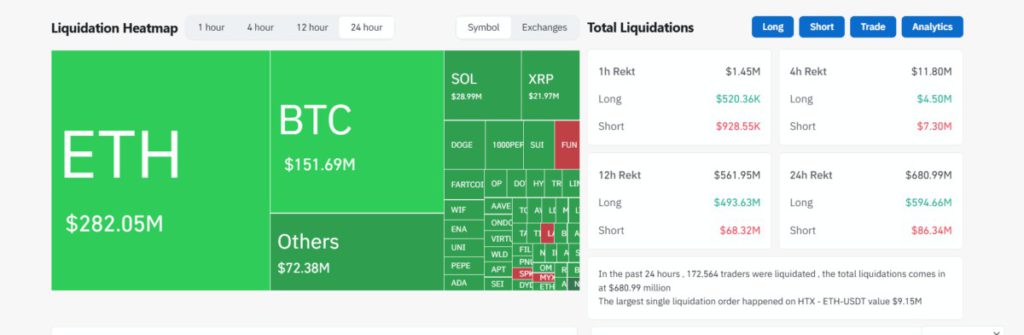

Over $680 million of long and short positions in the crypto market have been liquidated in the last 24 hours, with more than 172,000 traders incurring heavy losses. The largest liquidation order amounted to $9.15 million, recorded on the HTX platform for the Ethereum (ETH)/Tether (USDT) pair.

Ethereum (ETH) alone lost more than 5.71% of its value in the last 24 hours, to $2,268, with liquidations reaching $282 million. This figure is almost double that of Bitcoin’s (BTC) losses of $151.69 million, suggesting that Ethereum (ETH) market participants are feeling the impact of the downturn more.

Read also: Iran vs US Conflict Escalates, Gold Price Affected?

Altcoins Take a Tumble

As Bitcoin (BTC) weakens, other altcoins have also seen sharper declines. Ripple (XRP) is down 2.15% today, while Cardano (ADA) is down 4.79% to $0.55, and has dropped 12% in a week. Dogecoin (DOGE) and Solana (SOL) are also losing momentum.

Declining market volumes and deteriorating sentiment saw trending altcoins and memecoins start to reel, with Pi Coin and Pepe Coin (PEPE) down 17.5% and 17.4% respectively. Dog with Hat (WIF) and FLOKI also fell 15% each.

Also read: Gold Jewelry Price Today June 23, 2025 at The Palace

Bitcoin on the Verge of $100K: Is This the Last Support?

If Bitcoin (BTC) does break the $100,000 support, analysts warn that this could trigger more successive liquidations, potentially dragging down other major altcoins. Technical indicators including those for Ethereum (ETH) and Solana (SOL) show a bearish breakdown of support, while volatility is increasing.

James Taledano, COO of Unity Wallet, stated that the mixed views on whether Bitcoin (BTC) will rise again to above $110,000 or drop to the $90,000 area is not surprising and shows the uncertainty felt by the market.

Conclusion

Investors are expected to constantly monitor market developments. Decisions to buy or sell should be based on careful analysis and an in-depth understanding of current market dynamics. With volatile conditions, a cautious move could be the key to avoiding heavy losses.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto Times. Crypto Market Crash Incoming: Bitcoin Nears $100k, ETH, XRP, SOL, DOGE Falling. Accessed on June 23, 2025

- Featured Image: Generated by Ai

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.