Download Pintu App

US Airstrikes Trigger Crypto Market Crash, $595 Million Liquidated!

Jakarta, Pintu News – Heightened geopolitical tensions due to US airstrikes on Iran’s nuclear facilities have caused panic in the cryptocurrency market. On Friday, these unexpected strikes hit Iran’s key uranium enrichment sites at Fordow, Natanz, and Isfahan.

This was announced by former President Donald Trump and immediately triggered a massive sell-off in the crypto market. In the last 24 hours, the resulting losses amounted to $681.8 million, with $595 million of that being the liquidation of long positions.

Direct Impact on Crypto Market

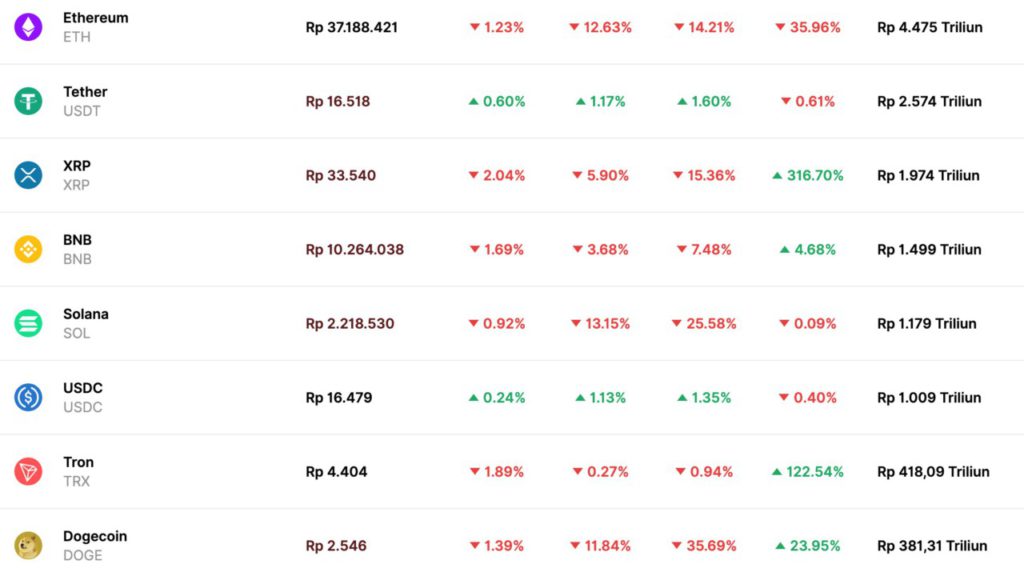

The attack resulted in massive liquidation in the cryptocurrency market. Ethereum (ETH) was the hardest hit with liquidations reaching $282 million, followed by Bitcoin (BTC) which recorded a loss of $151 million. Other cryptocurrencies such as Solana (SOL), Ripple (XRP) and Dogecoin (DOGE) also suffered significant losses, totaling more than $22 million.

Liquidation occurs when an exchange forcibly closes a trader’s leveraged position due to losing some or all of their initial margin. This happens when a trader’s account balance is insufficient to maintain a position opened with leverage. This phenomenon often signals market extremes, which could be a sign of a price reversal due to excessive market sentiment.

Read More: Crypto Market Crisis: The Impact of US Attack on Iran on Bitcoin and Ethereum!

Price Stability After the Shock

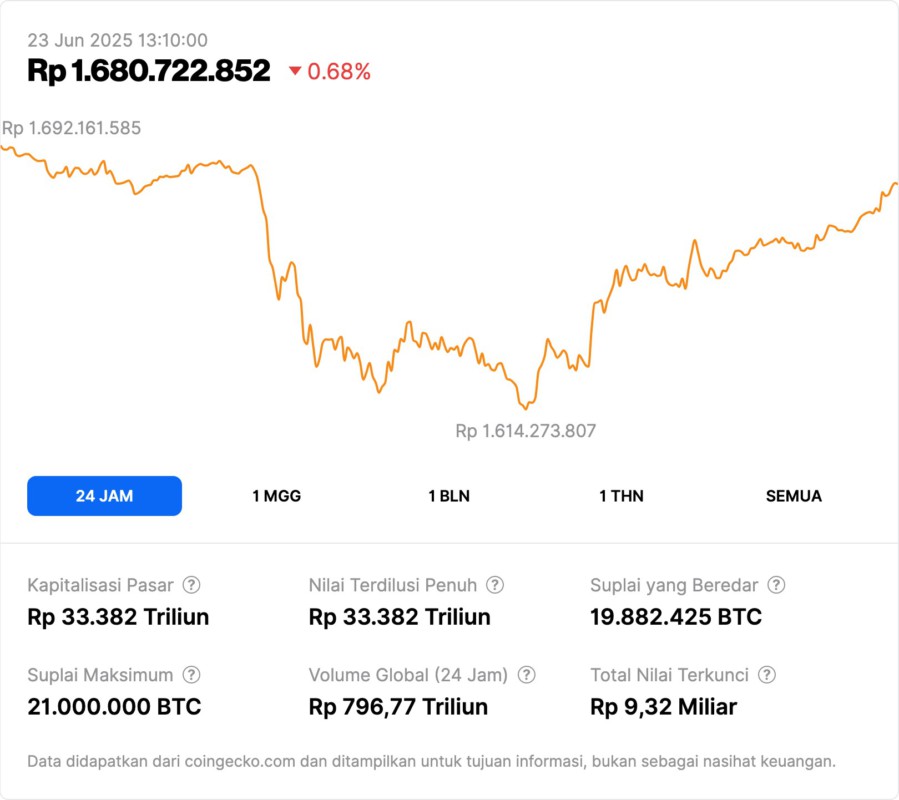

Despite the market crash, the prices of major cryptocurrencies managed to find a stable point afterwards. Bitcoin (BTC) is holding at around $102,000, while Ethereum (ETH) is trading above $2,280. Both cryptocurrencies experienced a drop on the day, but managed to avoid further declines.

Crypto exchanges such as Bybit and Binance were the main locations for liquidations, with both accounting for two-thirds of the total liquidations. With the threat of more attacks from the US, the market may still face high volatility in the near future.

Market Outlook and Preparedness

Traders may now have to prepare themselves for more turmoil in the markets. The threat of further attacks from the United States against Iran could trigger further instability, both in the global market and specifically in the crypto market. This shows the importance of risk management and a deep understanding of the influence geopolitics can have on crypto investments. Furthermore, this incident also highlights the importance of liquidity and speed of reaction in crypto trading. Traders need to be vigilant and prepared for rapid market changes to avoid huge losses or even bankruptcy.

Reflection and Anticipation of the Future

This incident is a harsh reminder to market participants of how quickly things can change in the crypto world. Geopolitical events such as military attacks can have a huge and sudden impact, forcing traders and investors to always be on their toes. Going forward, it is important for every market participant to pay more attention to global news and integrate it into their trading strategies.

Also Read: Sharp ADA Decline Amid Geopolitical Tensions, What’s the Impact? (23/6/25)

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coindesk. Bullish Crypto Bets Liquidated for $595M as US Bombs Iran Nuclear Sites. Accessed on June 23, 2025

- Featured Image: Generated by AI

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.