Download Pintu App

Cryptocurrency Crisis: Dogecoin, XRP, and Shiba Inu on the Edge? Check out the Analysis Technique!

Jakarta, Pintu News – In recent weeks, the cryptocurrency market has come under significant pressure, with several popular tokens such as Dogecoin (DOGE), Ripple (XRP), and Shiba Inu (SHIB) facing severe challenges. These three currencies are showing strong indications that they may experience further declines, unless there is a dramatic change in market structure or investor sentiment.

Dogecoin (DOGE): Turning Point or Meltdown?

Dogecoin (DOGE) is currently at a critical support zone of $0.145, which may be the last chance for a technical recovery. After experiencing a decline of more than 35% from its latest local peak, Dogecoin (DOGE) appears to lack bullish momentum. Important moving averages such as the 50, 100, and 200-day lines have been continuously breached and now serve as overhead resistance.

If Dogecoin (DOGE) can’t maintain its current levels, there’s a chance that the currency will hit a low that hasn’t been seen since last year. However, $0.145 is not just an ordinary number, it is a historically significant level and could be a strong jumping-off point. Nonetheless, the declining trading volume indicates a lack of conviction and participation from the bulls.

Also Read: Robert Kiyosaki Suggests Buying Bitcoin Before the Global Monetary Collapse

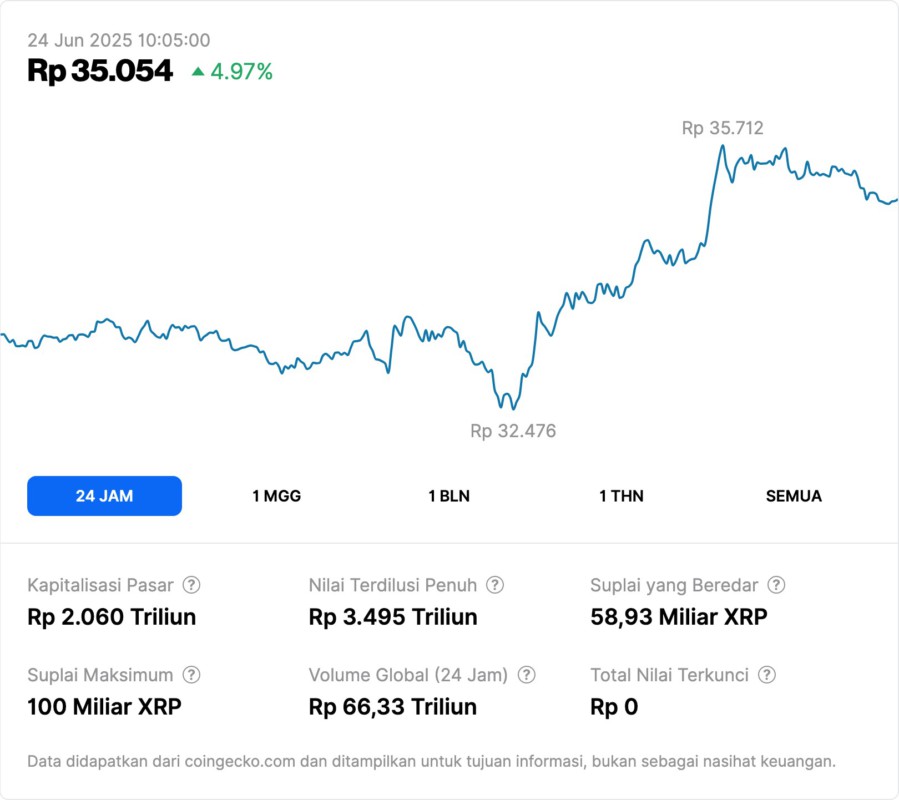

Ripple (XRP): The Decisive Failure Pattern

Ripple (XRP) recently experienced the invalidation of a symmetrical triangle pattern that had been holding investors’ hopes for a bullish breakout. Instead of moving upwards, it fell below the 200-day EMA and the lower trendline that has long been a fundamental support. This signals a change from consolidation to active selling, with Ripple (XRP) now under significant selling pressure.

Missing the 200-day EMA is particularly detrimental, as Ripple (XRP) has historically entered long consolidation or even bearish phases when trading below this EMA. A macro structure that no longer favors bullish continuation poses a big challenge for traders looking for long setups. Ripple (XRP) may attempt to retest the broken support, but if it does not immediately and strongly reclaim the level, further declines are likely.

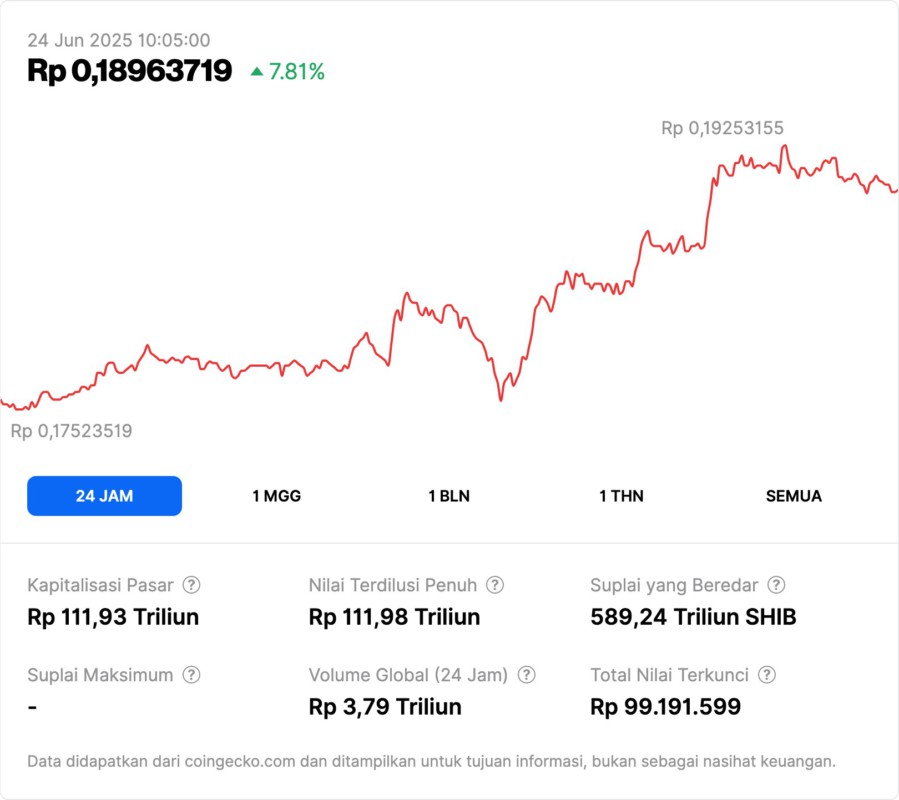

Shiba Inu (SHIB): On the Edge

Shiba Inu (SHIB) is facing a critical moment in its price trajectory. After several weeks of steady decline, SHIB is now trading just above the critical support level at $0.000010. This level could either provide much-needed relief or pave the way for further declines that would add zero to its price, a serious technical and psychological blow.

Shiba Inu’s (SHIB) RSI already falling below 26 indicates that the asset is extremely oversold. Although the $0.000010 level may act as temporary support, there is no conviction behind a potential rebound based on weak volume support. If Shiba Inu (SHIB) is unable to sustain above $0.000010, the probability of further decline is very high.

Conclusion

All three cryptocurrencies face decisive times in the coming days and weeks. Investors and traders should be extremely cautious and monitor market behavior closely to avoid any possible losses.

Also Read: Important Warning from Binance CZ: Beware of Hacker Attacks!

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- U.Today. Dogecoin (DOGE) Only Chance for Recovery, XRP Faces Major Pattern Invalidation, Shiba Inu (SHIB) Crucial. Accessed on June 24, 2025

- Featured Image: Generated by Ai

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.