Download Pintu App

Whale Ethereum Bets $1.6 Trillion After US Airstrikes on Iran-What Happened?

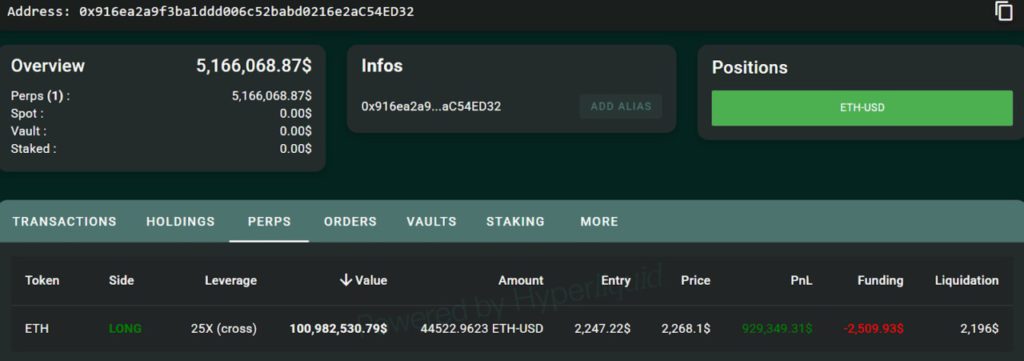

Jakarta, Pintu News – The crypto world is back in the spotlight after the massive action taken by Ethereum (ETH) whales shortly after the United States airstrikes on Iran. Based on recent reports, whales or large capital owners in the crypto market placed leveraged bets of up to USD 100 million, equivalent to around Rp1.639 trillion (exchange rate 1 USD = Rp16,390).

This event shows that geopolitical movements can instantly trigger extreme responses in the cryptocurrency market. Amidst high volatility, the whale’s decision is often an important indicator for market participants in making their next move.

Ethereum’s Whale Bet Amid Geopolitical Turmoil

This Ethereum (ETH) whale action came just after tensions between the US and Iran flared up again due to military strikes. The whales opted to use leverage instruments, borrowing additional funds to increase their exposure to crypto price movements. This strategy allows for greater profit potential, but on the other hand, it also increases the risk of loss if the market moves against the position taken.

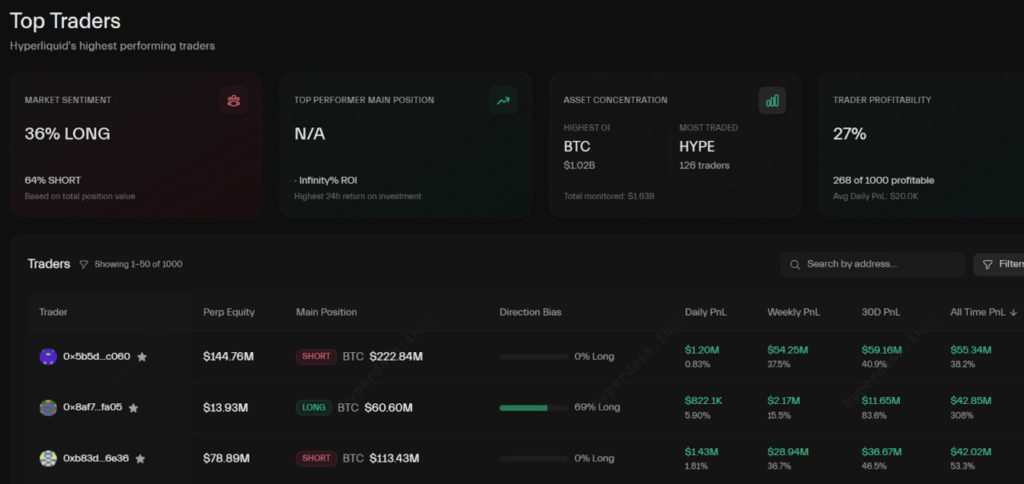

Many analysts believe that the whales’ actions are not just short-term speculation, but part of a strategy to deal with volatile markets. With the crypto market being sensitive to geopolitical news, major events such as airstrikes can trigger significant price changes in a short period of time. These big bets are of particular concern to retail and institutional traders, as they can affect overall market sentiment and liquidity.

Also Read: Robert Kiyosaki Suggests Buying Bitcoin Before the Global Monetary Collapse

Impact of Leverage Whale Betting on the Crypto Ecosystem

Leveraged inflows of up to Rp1.639 trillion in a short period of time put pressure on the price of Ethereum (ETH) and other cryptocurrencies. The volatility generated by whale action often magnifies short-term price movements, both up and down. This makes the crypto market very dynamic, so market participants need to be aware of the potential mass liquidation that could occur if the price direction reverses sharply.

Moreover, the whale’s decision to take large leverage is often followed by smaller traders who are inspired by the actions of the big players. However, not all market participants understand the risks of leverage, which is actually very high, especially in the volatile crypto market. Education is key so that investors do not get caught up in momentary euphoria and still maintain good risk management.

Crypto Market Response and Future Predictions

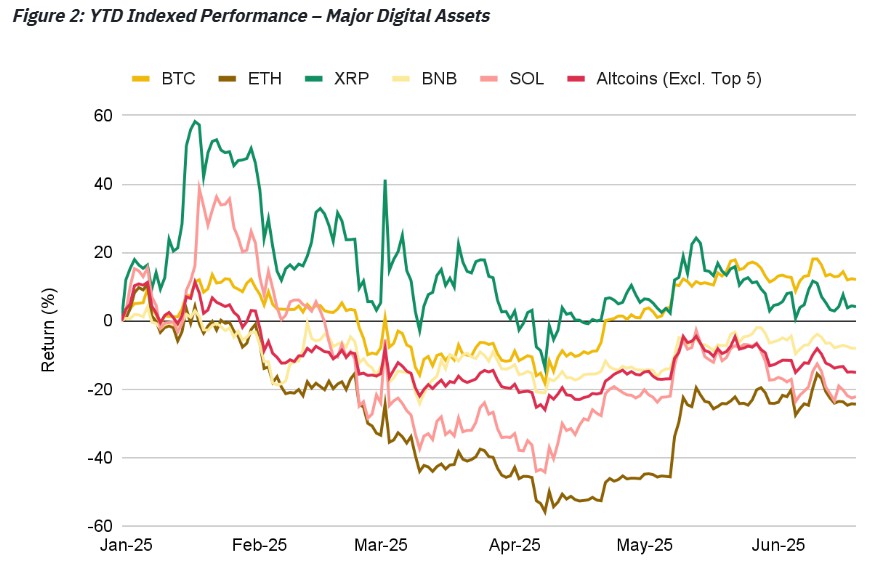

After the whale’s big bet, the price of Ethereum (ETH) experienced sharp fluctuations. Traders and analysts continue to monitor the development of the geopolitical situation, as global sentiment can trigger large-scale selling or buying in the cryptocurrency market. Nevertheless, optimism about the fundamentals of Ethereum and its blockchain technology is still high among the community.

Going forward, it is likely that similar speculative actions will continue to occur if the world situation remains uncertain. Whales and institutions will continue to seek opportunities through leverage strategies, while retail investors are expected to be wiser in making investment decisions in the fast-changing crypto market. The role of education and transparency is becoming increasingly important so that all parties can benefit from market dynamics without ignoring the risks.

Conclusion

The action of Ethereum whales placing leveraged bets of up to Rp1.6 trillion after the US airstrikes on Iran proves how closely linked geopolitics and crypto markets are. With high volatility, large capital movements like these can carry just as much risk as opportunity. In the midst of dynamic global news flow, investors should always pay attention to risk management and continue to deepen their understanding of the mechanics of leverage in the cryptocurrency world.

Also Read: Important Warning from Binance CZ: Beware of Hacker Attacks!

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Ether whales make $100M leveraged bets after US airstrike on Iran. Accessed June 23, 2025.

- Featured Image: Generated by AI

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.