Download Pintu App

Avalanche (AVAX) on the Rise: What Happens Next After the Big Sale?

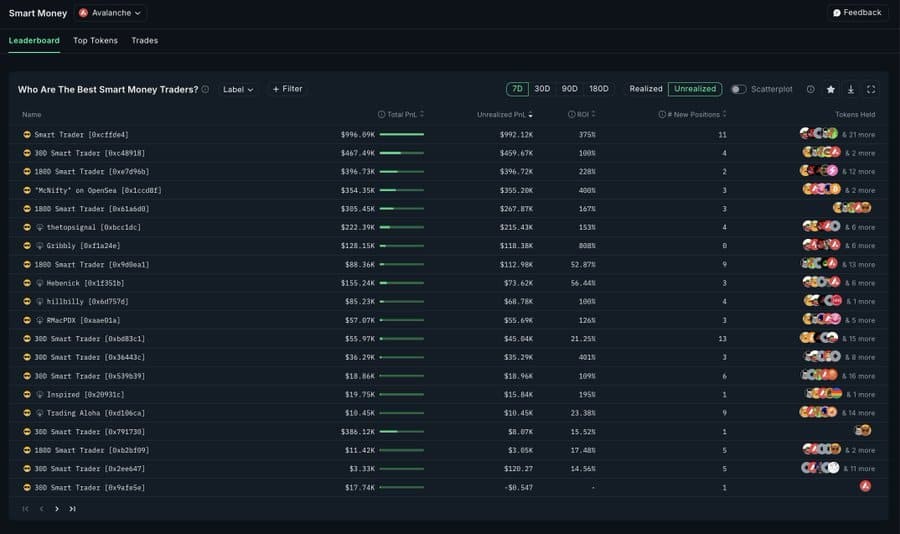

Jakarta, Pintu News – Avalanche (AVAX) recently recorded a gain of 2.62% after a month-long decline, attracting attention from a wide range of investors. Despite the overall price drop of 13%, large investors or ‘smart money’ continued to hold AVAX, while retail investors started selling their assets.

Smart Money: Big Profits, Staying Afloat

According to data from Nansen, large investors in Avalanche (AVAX) managed to make significant profits. Despite the general decline in prices, they are in no hurry to sell their assets. This shows confidence in the long-term potential of Avalanche (AVAX).

These investors tend to have access to better information and analysis, which allows them to make more informed investment decisions. On the other hand, the courage of these large investors to maintain their positions despite market volatility, provides a possibly positive signal to other investors. This decision could be based on an in-depth analysis of technological developments or the increasing adoption of the Avalanche platform.

Read More: Israeli Spy Arrested in Iran: Crypto Motives Behind Digital Espionage?

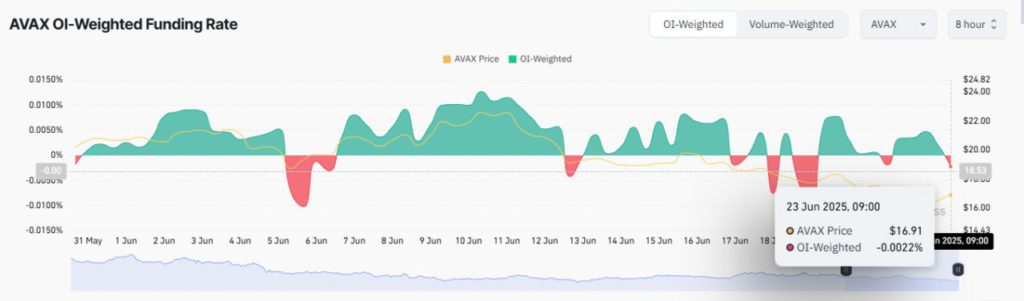

Retail: Selling on the Rise

Based on a report from CoinGlass, retail investors seem to be less optimistic compared to large investors. They have started selling their Avalanche (AVAX) assets, taking advantage of the recent price increase. This may indicate a lack of confidence in the price stability of AVAX or the need to secure profits amid market uncertainty.

This selling by retail investors can also affect market dynamics. When retail investors sell their assets, it can lead to price declines if not offset by sufficient purchases from other investors. This is a dynamic that investors considering entering or adding to a position in Avalanche (AVAX) should be aware of.

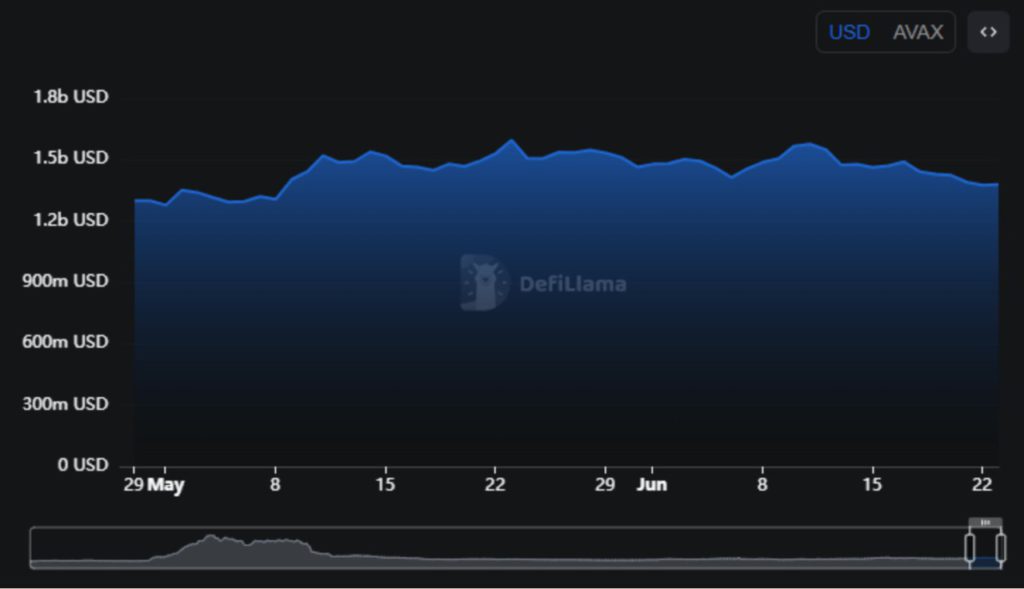

Technical Analysis: Showing Potential, But Obstacles Remain

From a technical analysis perspective, Avalanche (AVAX) is showing signs of a breakout from the descending channel pattern it has formed. This is a bullish indicator that suggests the potential for further price gains. However, there are still some resistance levels to watch out for, which could hinder the price increase.

Monitoring these resistance levels is important as it can give clues about market strength. If AVAX manages to break this resistance, it could trigger a new wave of buying that would push the price higher. However, failure to break could lead to a price drop.

Conclusion

With mixed dynamics between large and retail investors, and technical signals showing potential but with obstacles, the Avalanche (AVAX) market is currently at a crucial juncture. Investors are advised to closely monitor price movements and trading volumes, as well as the latest news surrounding the adoption and development of Avalanche technology.

Also Read: Dogecoin Continues to Slump: Is this $480 Utility Coin the Wiser Choice in the Crypto World?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Avalanche retail sells $821k of AVAX, smart money holds on; what next?. Accessed on June 25, 2025

- Featured Image: The Cryptonomist

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.