Download Pintu App

Will Bitcoin Hit a New High This Month? These 3 Signals Say Yes!

Jakarta, Pintu News – Bitcoin (BTC) is defying predictions – jumping 6% in 3 days after a severe fall at the weekend.

With transaction volumes on exchanges slumping to a 10-year low, a historical pattern is beginning to emerge: the last time this happened, BTC shot up by 80% in just a matter of weeks.

Now, with Bitcoin at $107K, traders are wondering: will June be the month when Bitcoin finally breaks its record high?

Here are 3 explosive signals that indicate the answer is yes.

Reason 1: Volume on Exchange Drops to Lowest Point in 10 Years

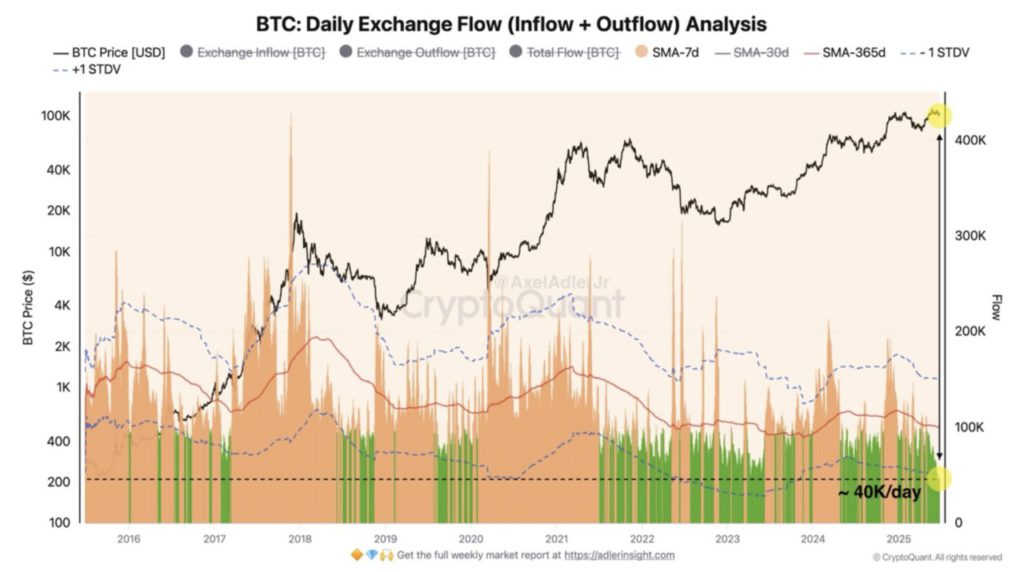

Data from CryptoQuant shows that the daily flow of Bitcoin to exchanges has now dropped to 40,000 BTC per day-a figure last seen 10 years ago.

Read also: Bitcoin Soars Past $107,000 Today (June 26) — Here Are the 4 Reasons Behind the Surge!

This decline in the amount of BTC on centralized exchanges is a clear signal of a liquidity shortage amid growing institutional interest and inflows into spot Bitcoin ETFs.

In 2016 and 2017, the decline in this indicator signaled abottom formation. The same was seen in late 2018 and early 2019. In both cases, the Bitcoin price started a massive bull run that pushed it to new record highs.

In 2022 and 2023, flows to the exchange remained low for a long time before the bull run resumed and brought the price of BTC to its highest peak again.

Currently, a similar trend is beginning to emerge, where BTC reserves on exchanges have remained low since mid-2024. Therefore, if history repeats itself, there is a high probability that Bitcoin price will restart its bull run towards new record highs.

Reason 2: Bullish Engulfing Candlestick Pattern

Bitcoin’s weekly price chart shows the formation of a bullish engulfing candlestick pattern. With four days left until the close of the week, investors are watching this pattern for further confirmation of a potential price recovery.

While Bitcoin’s daily chart appears bearish, the weekly chart paints a different picture. The price drop in mid-June has pushed BTC into the weekly Fair Value Gap (FVG) zone, which is in the range of $97,900 to $100,700, and serves as an area of support.

A bounce from this zone shows promising potential-especially if the weekly candlestick is able to close firmly above $105,633.

If this happens, then the bullish engulfing candlestick pattern will be confirmed, and could attract back thesidelined buyers.

Reason 3: Trump’s Intervention and Easing Conflict in the Middle East

The conflict between Iran and Israel rocked risk markets such as cryptocurrencies and stocks. Oil prices were hit hard after the Iranian parliament decided to close the Strait of Hormuz.

Read also: Trump Media Set to Launch Bitcoin & Ethereum ETF on NYSE – Crypto Game Changer Incoming!

However, the intervention of US President Donald Trump and the ceasefire agreement from both sides provided short-term relief for the market.

Although the ceasefire was violated by Iran, the potential for long-term peace in the Middle East region could be a catalyst for Bitcoin price gains-triggering the start of another bull run.

Overall, from its current price position, BTC only needs to rise another 5.13% to touch itsall-time high again.

Combined with the bullish Bitcoin price prediction for 2025, the potential formation of an engulfing candlestick pattern, and the decline in BTC reserves on exchanges to the lowest level in 10 years, the odds are now in favor of the bulls.

In addition, the end of the month often brings additional volatility that can trigger a Bitcoin (BTC) price rally.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. 3 Reasons Why Bitcoin (BTC) Price May Hit ATH Before June Ends. Accessed on June 26, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.