Download Pintu App

3 Cryptos to Focus on at the End of June 2025

Jakarta, Pintu News – As the end of June 2025 approaches, the cryptocurrency market is again showing dynamic movements that attract the attention of global investors.

Amidst price fluctuations and ever-changing market sentiment, some cryptocurrencies have stolen the spotlight due to strong performance, adoption, or community sentiment.

Three cryptos stood out in this period, both in terms of trading volume, whale activity, and expectations for ecosystem updates.

This article will take a concise and educational look at three cryptos that took center stage for investors and traders at the end of this month!

1. Bitcoin (BTC)

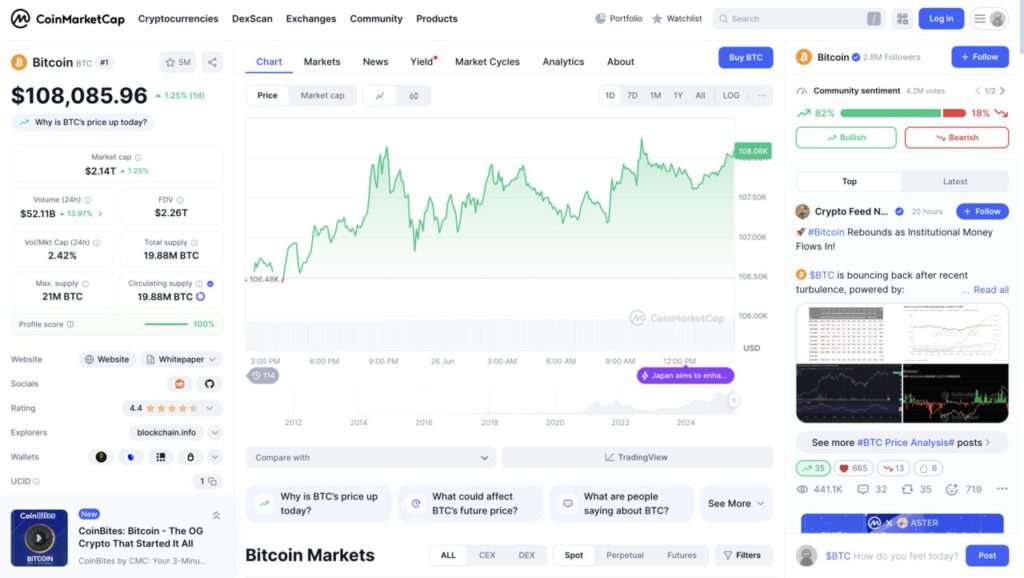

Bitcoin’s (BTC) daily price movement chart shows a steady upward trend in the last 24 hours. The price of BTC opened at around US$106,484 and increased gradually, until it reached a daily high of US$108,085 (around Rp1.84 billion at an exchange rate of Rp17,000). This increase reflects price recovery after several days of consolidation or sideways movement.

Bitcoin’s trading volume over the past 24 hours stood at US$52.11 billion (up 13.97%), signaling increased buying activity in the market. Technically, the price movement pattern shows several phases of mild corrections followed by price spikes – a common signal in an uptrend (bullish). Currently, Bitcoin has a market capitalization of US$2.14 trillion, accounting for more than half of the total global cryptocurrency market value.

Market sentiment towards BTC is also trending positive, with 82% of the community expressing a bullish view. The combination of institutional fund inflows and retail investor confidence is the main factor driving prices upwards. If this trend continues, then BTC has the potential to retest resistance at higher levels, while strengthening its status as a long-term digital hedge asset.

2. Onyxcoin (XCN)

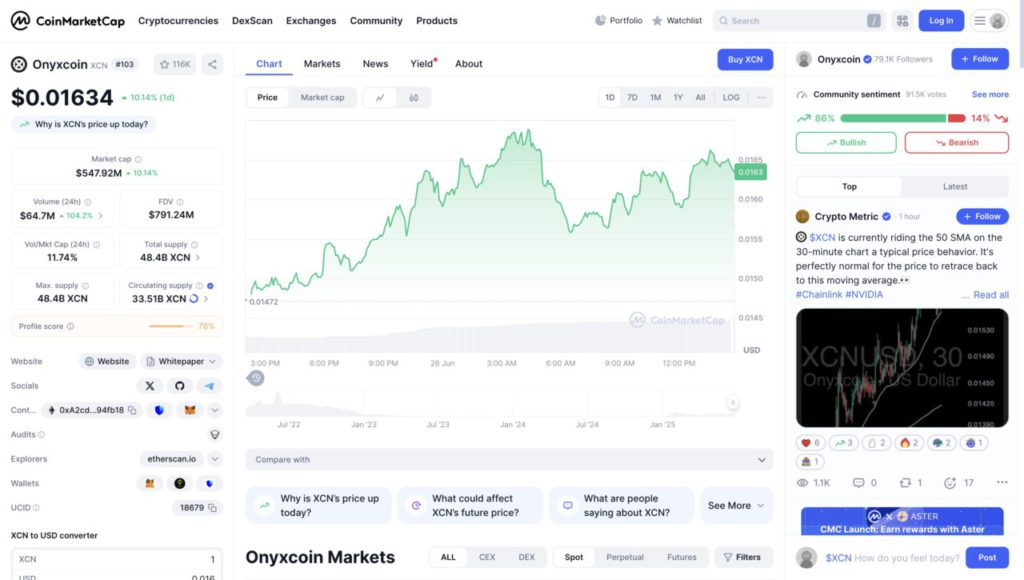

The daily chart of the Onyxcoin (XCN) price shows a positive movement with an upward trend over the past 24 hours. The XCN price increased by 10.14% and is now trading at US$0.01634 (around Rp278 at an exchange rate of Rp17,000). This increase was also supported by a 104.2% surge in daily trading volume, reaching US$64.7 million (around Rp1.1 trillion), signaling significantly increased buying interest from market participants.

In terms of charts, XCN experienced a consolidation phase at the beginning of the trading session before finally jumping sharply towards midnight. The price peaked in the early morning before undergoing a reasonable correction and rallied again towards noon. This pattern shows fairly active volatility, but remains on an uptrend path, showing short-term bullish potential.

XCN’s market cap now stands at US$547.92 million with a volume to market cap ratio of 11.74%, which is high. This means that XCN’s liquidity is healthy enough to support significant price movements. In addition, community sentiment also looks optimistic, with 86% of votes showing a bullish view on XCN’s movement.

Also read: Top 5 Altcoins that Surged Silently This Month

Technically, Onyxcoin is currently moving along the 50 SMA average line on the 30-minute chart-a common pattern in technical analysis that shows the tendency for prices to move around this average line. As long as the price remains above or close to this line, the short-term uptrend is likely to persist. However, investors are still advised to pay attention to potential corrections and use other technical indicators for decision-making.

3. Gains Network (GNS)

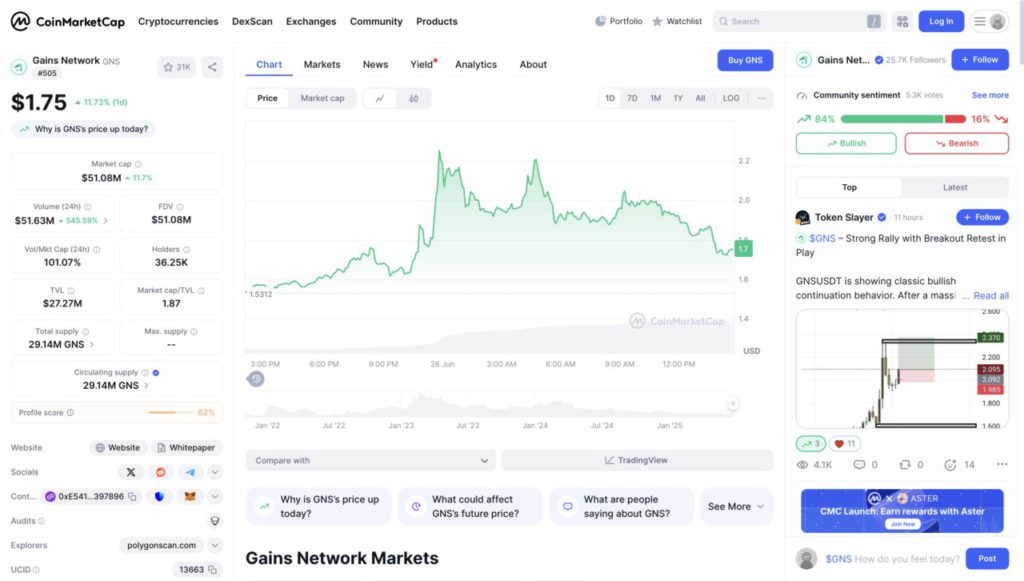

The daily chart of Gains Network (GNS) prices shows a significant upward trend in the last 24 hours. The price of GNS increased by 11.73% and is currently trading at US$1.75. This movement was supported by a very drastic surge in trading volume, which rose 545.59%, reaching US$51.63 million. This increase in volume is a strong signal that there is a large accumulation by investors or increased market interest in GNS tokens.

Technically, the chart shows a sharp rally since the evening, where the price jumped from around US$1.53 to above US$2.20 before experiencing a healthy correction. This pattern is a form of bullish breakout, where the price broke through the previous resistance level and then returned to test that point as support. After the correction, the price remained above US$1.70, indicating that the upward trend is still maintained and the potential for a continued rally is still open.

Another indicator to note is the volume to market cap ratio (Vol/Mkt Cap) of 101.07%, reflecting high liquidity and very active market activity. In addition, community sentiment towards GNS is also very positive, with 84% of users giving a bullish view, signaling market confidence in the continuation of the uptrend. With a total supply of 29.14 million GNS already in circulation, the token exhibits limited supply characteristics that often attract investors.

Read also: 3 Altcoins that Will Dominate the Market in 2025

With a total locked value (TVL) of US$27.27 million, Gains Network is also showing strong ecosystem activity. If the current momentum holds, GNS could potentially retest resistance in the US$2.00 to US$2.30 area in the near term. However, investors are advised to keep an eye on the support level around US$1.60 as an important lower boundary in short-term technical analysis.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinmarketcap

- Featured Image: Generated by Ai

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.