Download Pintu App

Bitcoin Hits $108,000 Today (June 30) — But Is the Network Slowing Down Beneath the Hype?

Jakarta, Pintu News – Market data as of June 30, 2025 shows that the price of Bitcoin (BTC) remains stable above $108,000. This comes after a period of volatility that saw the asset hit a new record high of $111,900.

While the prices look strong on the surface, the activity behind the scenes suggests otherwise.

On-chain data indicates declining participation from retail investors as well as weak network signals, casting doubt on how long this price strength can last.

Then, how is the current Bitcoin price movement?

Bitcoin Price Up 0.65% in 24 Hours

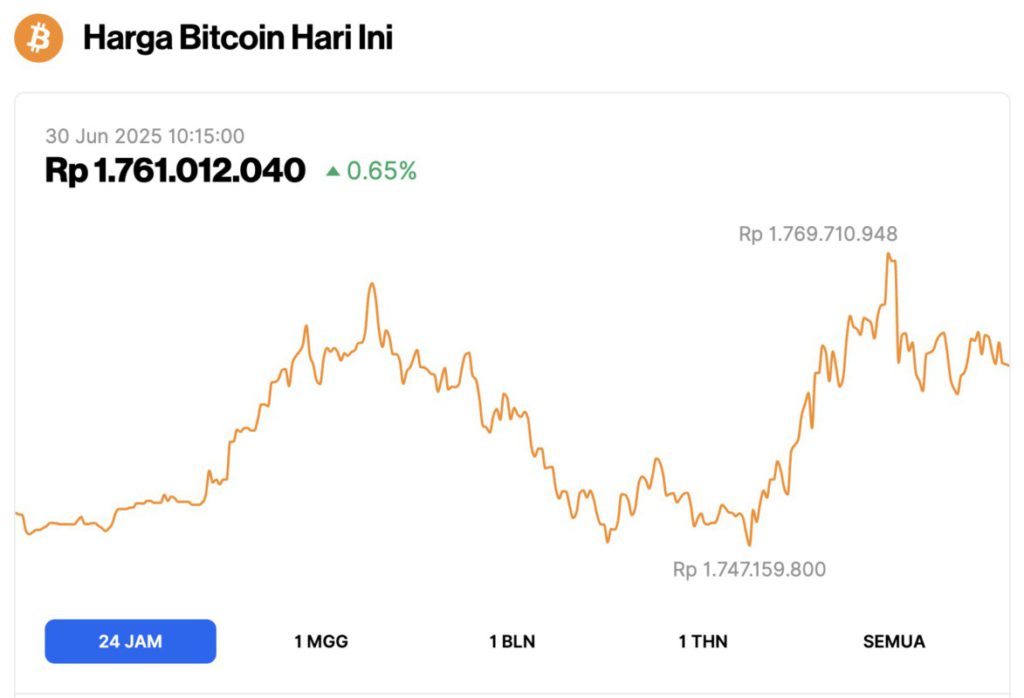

On June 30, 2025, Bitcoin was trading at $108,509, or approximately IDR 1,761,012,040 — marking a modest 0.65% increase over the past 24 hours. Throughout the day, BTC dipped to a low of around IDR 1,747,159,800 and peaked at IDR 1,769,710,948.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $2.15 trillion, with trading volume in the last 24 hours rising 23% to $36.53 billion.

Read also: These 4 Cryptos Could Explode to New All-Time Highs by July 2025 – Don’t Miss Out!

Network Activity Weakens Despite Bitcoin Price Strengthening

It is worth noting that the Bitcoin price had risen from $75,000 to $111,000 in just a few months, giving the market reason to celebrate. However, the Bitcoin blockchain tells a quieter story. The number of active addresses did not show an increase in line with the price rally.

Active addresses here refer to wallets that send or receive coins-a basic signal of user activity.

It is worth noting that after declining as the price dropped to $75,000, the BTC price against USD remained low in terms of network activity, even as the price climbed higher.

The network activity index-which combines several on-chain metrics such as total UTXOs, number of transactions, and block size-also shows a downward trend. This means the actual usage of the Bitcoin network does not reflect the enthusiasm seen on the price chart according to data from CryptoQuant.

Usually, strong price movements are accompanied by a surge in demand. Currently, such a relationship is not visible. In addition, the mempool-the placewhere transactions are pending waiting for confirmation-is almost empty.

At first glance, this may seem positive, but in this context, it signals low demand for BTC against USD. It is important to add that technologies like SegWit or batching can indeed reduce the pressure on the mempool.

However, when this happens alongside a decrease in address activity and network volume, the overall signal becomes bearish.

Retail Investors Still Pulling Out

Looking at the current market trend, the low participation of retail investors is increasingly evident. While market performance appears strong, most of the current trading activity comes from institutional channels or short-term speculation in the futures market.

On-chain flows and social sentiment suggest that the average investor is not the main driver of Bitcoin ‘s current price trend. Data from Glassnode confirms that funding rates and 3-month basis futures have decreased.

Read also: These 3 Memecoins Are Ready to Explode in July, According to Analysis!

These two indicators usually reflect how much market participants are willing to go long – a drop ineither indicates a more cautious attitude, even from normally aggressive market participants. Despite the steady flow of funds into Bitcoin ETFs, traders have adopted a defensive strategy.

According to recent reports, they are more focused on risk management and capital preservation than chasing profits. This defensive behavior is in line with the recent drop in open interest as well as the decline in BTC on-chain volume against USD.

In addition, market sentiment is currently split, reflecting doubt rather than conviction.

BTC to USD Bearish Formation Begins to Form Behind the Scenes

It should be noted that the market is also showing signs of a classic short squeeze formation. With short positions increasing and macro risks temporarily stabilizing, there is a possibility of a sudden upward movement.

However, this is still speculative. For now, a bearish tone still looms over Bitcoin price. The main concern lies in the absence of fundamental support.

If retail investors remain on the sidelines and network usage continues to decline, this rally may not last.

External factors such as interest rates or economic data can change the direction of momentum at any time. For now, caution is required as market signals are still mixed.

In related news, Bitcoin critic Peter Schiff stated that Bitcoin’s low popularity in Europe threatens its ability to reach record highs again.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinRepublic. Bitcoin Price Consolidates Above $107,000, But Bearish Twist Looms. Accessed on June 30, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.