Download Pintu App

3 Crypto Whale Hunted for July 2025

Jakarta, Pintu News – The crypto market experienced a slight rebound this week following President Trump’s announcement of an Israeli-Iranian ceasefire on Monday.

Some assets managed to continue their gains, while others are still struggling to maintain positive momentum.

On-chain data shows that crypto whales have been accumulating certain altcoins, including Uniswap (UNI), Worldcoin (WLD), and The Sandbox (SAND).

Check out the full analysis in this article!

Uniswap (UNI)

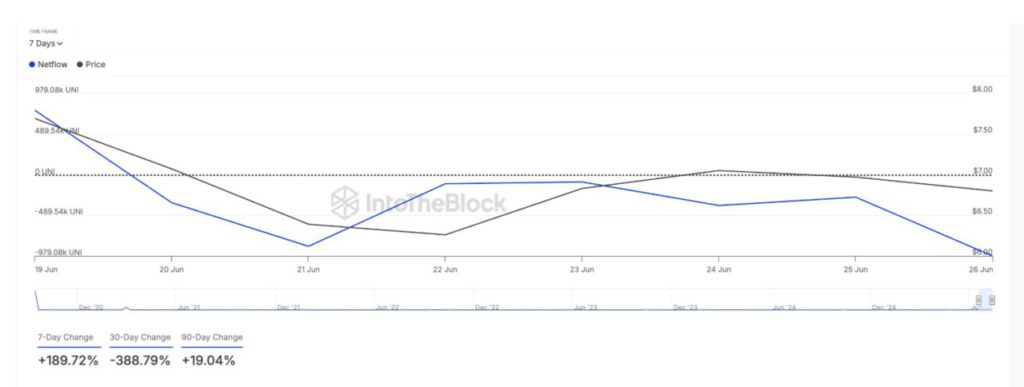

Uniswap (UNI) token, which is engaged in decentralized finance (DeFi), has attracted huge attention from whales this week. This is evident from the large holder’s netflow increase of 190% over the past seven days, according to data from IntoTheBlock.

Large holders are investors who own more than 0.1% of the total circulating supply of an asset. Their netflow measures the difference between the amount of tokens bought and sold during a given period. When netflows increase significantly like this, it signals strong accumulation by whales, indicating confidence or a bullish outlook on the asset.

Also read: 3 Figures Involved in the Biggest Crypto Scandal, Number 2 Makes You Shocked!

Moreover, this surge in large holder netflows may encourage retail traders to increase their UNI accumulation. If this buying pressure continues, the altcoin could break the $7 price zone. However, if demand declines, the token price could drop to $5.91.

Worldcoin (WLD)

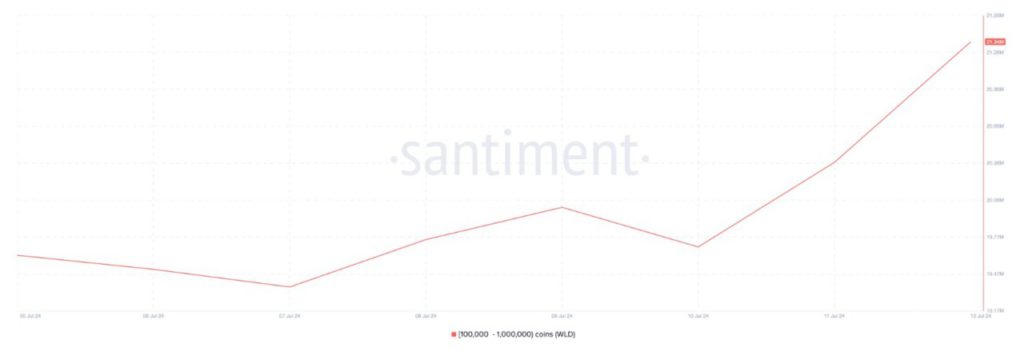

Worldcoin (WLD), the token backing Sam Altman’s project, has also been one of the altcoins bought by crypto whales this week. Data from Santiment shows a significant increase in the number of coins held by whale wallet addresses that hold between 100,000 and 1 million WLD tokens.

During the week under review, this group of WLD holders acquired 1.72 million tokens, which is currently worth over $3 million. If demand from these whales continues to increase, the price of WLD could surpass resistance at $0.97 in the near future.

However, if the sentiment turns bearish and the whales decide to sell for profit, WLD could lose some of its value and drop to $0.57.

Also read: Pi Network and Google’s Secret Cooperation: Really?

The Sandbox (SAND)

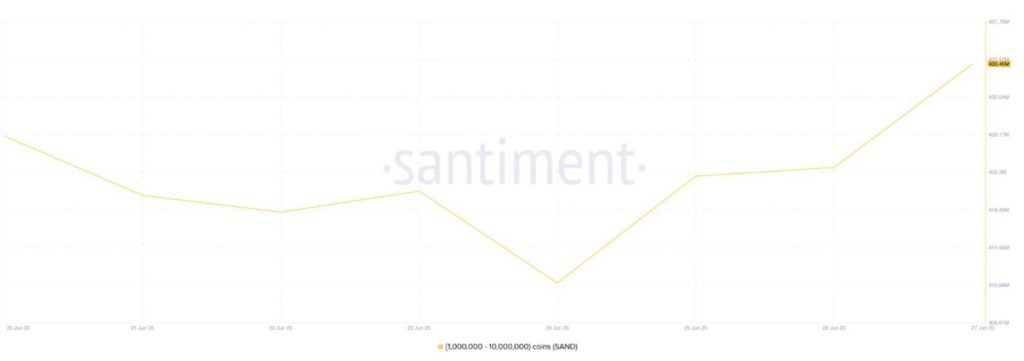

The metaverse-based token, The Sandbox (SAND), also saw increased accumulation activity by crypto whales this week. According to data from Santiment, large investors holding between 1 million and 10 million tokens have accumulated 7.45 million SAND over the past week.

This significant increase in whale accumulation indicates growing confidence in SAND’s long-term potential. If this buying trend extends to retail traders, it could strengthen the token’s bullish momentum in the coming weeks and push its price towards $0.30. Conversely, if buying activity declines, the value of SAND could drop to $0.21.

Conclusion

With market dynamics constantly changing, monitoring the activities of crypto whales can provide valuable insights for investors looking to follow trends or find investment opportunities.

These three altcoins, Uniswap (UNI), Worldcoin (WLD), and The Sandbox (SAND), show different potential based on accumulation activity by whales, which could be an important indicator for future price movements.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Crypto Whales Bought These Altcoins 4th Week June. Accessed on June 30, 2025

- Featured Image: Generated by AI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.