Download Pintu App

The Mystery of Bitcoin’s Drastic Hashrate Drop: Is Iran or the US Responsible?

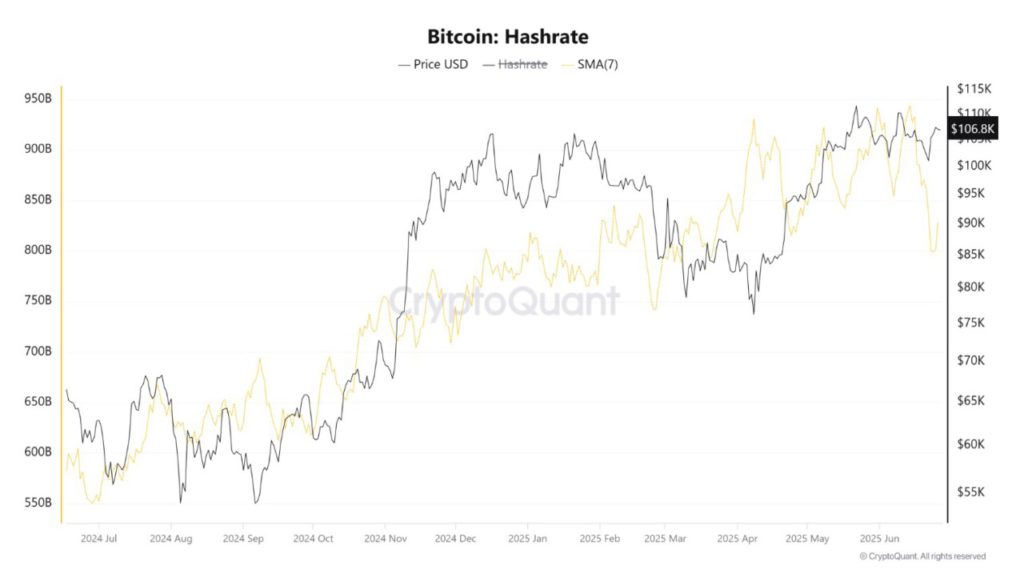

Jakarta, Pintu News – The sharp drop in Bitcoin’s (BTC) hashrate last June has sparked various speculations and theories.

Hashrate, an important indicator of the computational power securing the Bitcoin (BTC) network, experienced a significant drop to its lowest level since March 2025, at 800 EH/s.

Various factors, ranging from geopolitical conflicts to climatic conditions, have been proposed as causes for this phenomenon.

Check out the full news here!

Geopolitical Conflict Theory: Iran’s Role in Hashrate Decline

Nic, founder of CoinBureau, put forward the theory that Iran may be using Bitcoin (BTC) mining to circumvent sanctions and fund state spending. It is estimated that about 3.1% of Bitcoin’s (BTC) global hashrate originates from Iran. According to Nic, the decline in hashrate that occurred alongside the US airstrikes may not be a coincidence.

Mining facilities operated by Iran’s Islamic Revolutionary Guard Corps (IRGC) may have been targeted. Elliptic, a blockchain analytics firm, also supports this theory with reports that Iran is using Bitcoin (BTC) mining as a financial tool to survive international sanctions.

Mike Alfred, another analyst, added that Iran not only evades sanctions with Bitcoin (BTC) but also sells BTC obtained through cyberattacks to buy missiles and upgrade uranium enrichment infrastructure.

Also read: 3 US Crypto Stocks That Have Been the Talk of the Town Lately

US Domestic Conditions Theory: Extreme Weather as the Main Cause

On the other hand, Rob Warren, author of The Bitcoin Miner’s Almanac, offers a different perspective. He suggests that the decline in hashrate may be more due to domestic conditions in the US, rather than geopolitical conflicts. Warren points to extreme temperatures in the US as a more likely factor.

Daniel Batten, a tech investor, supports this view by applying Occam’s Razor Principle, which states that the simplest explanation is usually the most correct. He notes that record-high temperatures in Texas have increased electricity demand on the ERCOT power grid, forcing miners to reduce their operations to prevent overloading.

Data from the US Energy Information Administration (EIA) shows a surge in electricity use in Texas, largely due to the growth of data centers and mining facilities.

Also read: 3 Crypto Whale Hunted for July 2025

Regardless of the exact cause, this drop in hashrate will likely have long-term implications for Bitcoin (BTC) price and mining strategies. The crypto community continues to watch closely for a definitive answer.

Geopolitical instability and increasing climate-related disruptions are major concerns in determining the future of Bitcoin (BTC) mining.

Conclusion

With various theories floating around, it is important for stakeholders in the crypto industry to understand the various factors that can affect the hashrate and, in turn, the security and value of Bitcoin (BTC).

In-depth analysis and constant monitoring of global and domestic conditions will be key in overcoming the challenges faced by the industry.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Why Bitcoin Hashrate Plummeted in June. Accessed on June 30, 2025

- Featured Image: Generated by AI

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.