Download Pintu App

Solana Wallets Are Booming — Is a Massive Price Surge to $184 on the Horizon?

Jakarta, Pintu News – Solana (SOL) fell by 2.61% on July 1, erasing some of the weekly gains it had made.

However, market insights suggest that this decline may be temporary. Wallet balances are increasing significantly, accumulation remains strong, and price movements are showing bullish tendencies.

ATH in Wallet-What is it?

As reported by AMB Crypto, the number of addresses with balances ≥ 0.1 SOL jumped to an all-time high of 11.44 million on June 28, according to data from Glassnode.

Read also: SOL Staking ETF Ready to Launch in the US, How Will Solana’s Price Recall?

This coincided with the SOL price rising to $150.76. Naturally, this surge in activity from small holders hints at increased grassroots confidence.

In addition, Spot Netflow data from CoinGlass shows continued outflows from centralized exchanges, totaling $525.32 million as of July 1.

If these outflows continue to increase, it could contribute to a supply squeeze-acondition where demand exceeds supply, potentially leading to price spikes.

The possibility of an SOL rally remains strong, as Futures investors join spot investors in exhibiting bullish sentiment.

Futures Traders Begin to Show Market Direction

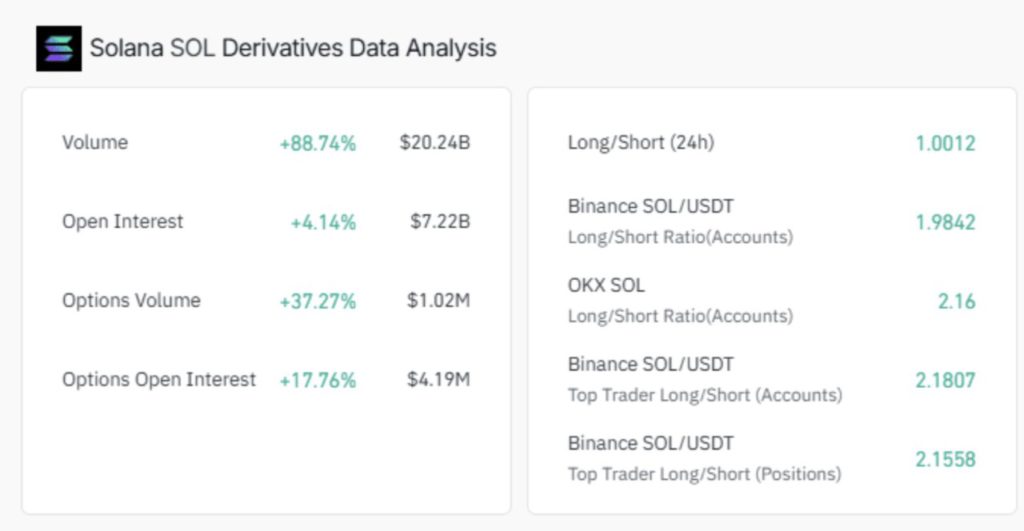

There has been a significant spike in open interest in both the options and futures markets, according to data from CoinGlass.

SOL Futures volume surged by 88.74% to $20.24 billion, while Futures Open Interest rose by 4.14% to $7.22 billion.

The options market also showed bullish movement-Options Volumeincreased by 37.27%, and Options Open Interest rose by 17.76%.

The rise in Open Interest in both types of derivatives indicates a confident and growing market attitude. In fact, the Taker Buy/Sell Ratio confirms this: buying activity dominates, with the metric hovering above 1.

The overall market recorded a ratio of 1.0012, while traders on Binance and OKX showed higher optimism, with a ratio of 1.9842 and 2.16 respectively.

If this trend continues, it has the potential to further boost demand for SOL and lift its price higher.

Read also: Shiba Inu Lead Dev Shytoshi Kusama Teases Major July Reveal — “Get Ready for Something Big!”

SOL Attempts Price Breakout, but Encounters Resistance

The AMBCrypto page analyzes the price prospects of SOL after the increase in demand. Here are the results of the analysis:

In the short term, SOL is trading in a bullish triangle pattern and has broken the nearby resistance level, putting SOL one step away from a major breakout.

If the price bounces off the key support levels at $144.87 or $139.88, then there is potential to retest the $184.88 level-a nearly 27% increase from the current level.

In the medium-term view, SOL is also in a similar bullish technical structure, but with a higher price target.

In this scenario, SOL has not managed to break the descending resistance line (black line) and was rejected at that level.

If it manages to break out, SOL will likely head towards three major targets: $181.46, $203.98, and $244.00.

Given the price action and the mild decline, a move towards the demand zone followed by a break of the resistance line could trigger a broader rally towards these targets.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Solana wallet activity hits ATH: Can growing demand help SOL reach $184? Accessed on July 3, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.