Download Pintu App

Bitcoin Set to Soar? BTC Could Skyrocket to $135K by Q3 and Hit $200K Before 2025 Ends!

Jakarta, Pintu News – Global banking giant Standard Chartered is turning heads in the crypto world with its Bitcoin (BTC) price predictions for the third and fourth quarters of 2025.

According to the bank’s head of crypto research, Geoff Kendrick, Bitcoin is expected to surge to $135,000 by the end of the third quarter and potentially break $200,000 by the end of the year. Will BTC reach this ambitious mark?

Standard Chartered Forecasts Exponential Growth in Bitcoin Price by 2025

Standard Chartered projects a potential upward trend for Bitcoin in the next few months, reinforcing its consistently bullish price predictions.

Read also: Bitcoin Surges to $108,000 Today — Will BTC Hit $120K This Month? Bitwise Thinks So!

Geoff Kendrick, head of digital assets at Standard Chartered, believes that the price of BTC will reach $135,000 in the third quarter and break the astounding $200,000 mark in December.

In a post on X today, journalist Wu Blockchain revealed the banking giant’s ambitious Bitcoin price prediction.

Interestingly, the bank’s projections are based on an analysis of current market dynamics and the possibility of increased institutional participation in cryptocurrencies.

Although this prediction comes amid high BTC price volatility, the bank believes that the crypto’s underlying fundamentals put it in a position to grow further.

Earlier this year, Kendrick even predicted that BTC could reach $500,000 by the end of Donald Trump’s term.

At the time of writing this report (3/7), BTC is worth $109,461, up 2.33% in the last 24 hours. Over the past week and month, the pioneering crypto has recorded slight gains of 1.55% and 3.96%, respectively.

BTC Deviates from Previous Halving Cycle Patterns

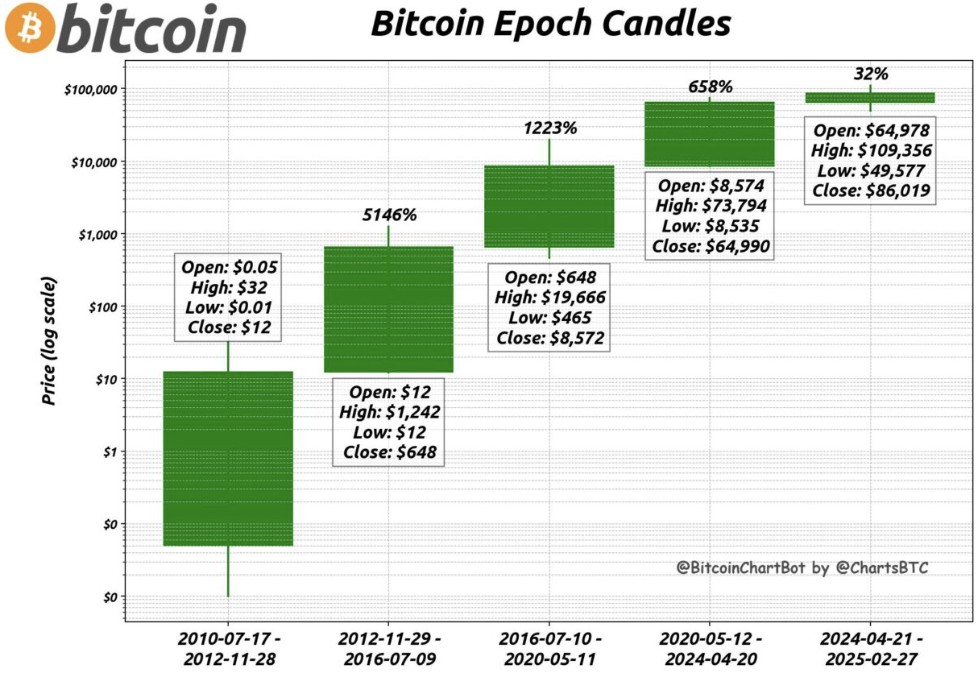

Interestingly, Kendrick analyzed the potential impact of Bitcoin halving on the crypto ‘s price. Bitcoin halving is a significant event that occurs every four years, which reduces the block reward by 50%.

Typically, BTC prices experience a significant spike after a halving event, but tend to decline about 18 months afterward.

Furthermore, Kendrick noted that this year’s Bitcoin trend is expected to deviate from previous patterns. Historically, the halving pattern predicts a price drop in September or October 2025.

Read also: 3 Cryptos Whales Are Snapping Up — Are They About to Skyrocket?

However, he stated, “Thanks to increased investor inflows, we believe BTC has moved beyond the previous dynamic where prices fell 18 months after the halving cycle.”

Additionally, the Standard Chartered analyst highlighted optimism based on increasing institutional adoption of Bitcoin as well as positive sentiment towards ETFs.

According to Coingape, nine corporate companies have purchased 6000 BTC for their financial reserves in the past week.

Kendrick stated, “We expect the price to resume its uptrend, supported by continued strong ETF and Bitcoin treasury buying.”

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Bitcoin Price to Hit $135K in Q3, $200K by Year-End, Says Standard Chartered. Accessed on July 3, 2025

- Cointelegraph. Standard Chartered: Bitcoin Price $135,000 Q3 2025. Accessed on July 3, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.