Download Pintu App

Pi Network in July 2025: Is a Massive Price Surge Just Around the Corner?

Jakarta, Pintu News – As July 2025 begins, Pi Network is faced with both opportunities and challenges.

Although the community has built more than 7,900 AI-based applications, indicating increased participation from developers, the token’s price movement reflects growing caution.

With only 7 billion tokens in circulation, therich list is dominated by early adopters and whales, with the top 100 holders accounting for 96.37% of the total supply.

On the other hand, the scheduled unlock of 276 million PI – equivalent to 3.7% of current supply – has the potential to exert short-term downward pressure.

So a key question arises: is the power of utilities and communities enough to offset the threat of supply inflation? Is the Pi price under threat? Check out Pi Network’s price predictions for July 2025.

Social Media Popularity Fails to Maintain Momentum

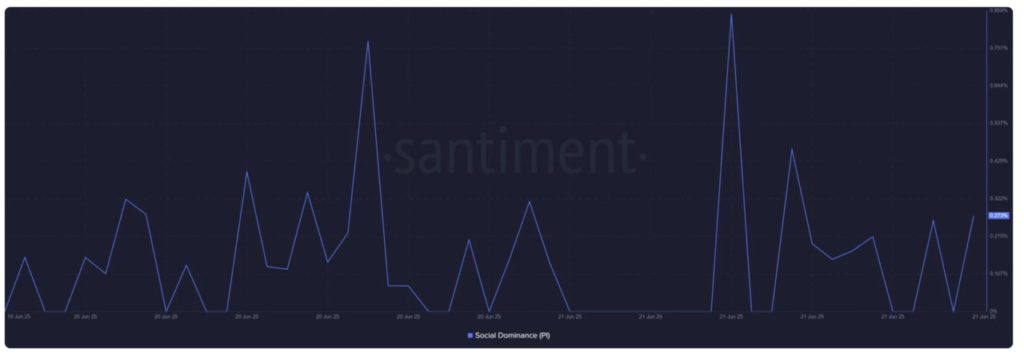

Based on Santiment’s Social Dominance chart, Pi Network experienced a sporadic but inconsistent spike in attention in late June.

Read also: Pi Mining Rate Up 0.93% — 4 Hacks to Max Out Your Pi Coin Earnings!

The metric peaked, but failed to stay above average, suggesting that interest from retail investors is still reactive and news-driven, rather than sustained enthusiasm.

With current social dominance at 0.273%, Pi has yet to show the consistent community buzz commonly seen in large price spikes. This weakens its natural upside potential, unless it is driven by significant project development or a catalyst in the form of a large listing.

Pi Network Price Analysis

On July 2, Pi Network briefly traded at $0.4861, down 0.1% in 1 day and 17.78% in the last 7 days, indicating a sharp shift to a bearish direction.

The RSI indicator is at 34.67, signaling the asset is approaching oversold territory, which could mean the downside potential is limited – though not completely covered.

Read also: Pi Network Latest News: AI-Based Pi App Studio Launches 7,932 Apps in an Instant!

Meanwhile, the Bollinger Bands indicator shows prices continuing to move near the lower line, with resistance levels at $0.586 and $0.64, and strong support around $0.40.

With the upcoming token unlock and trading volume declining to $91.84 million (down 1.93%), the bulls are facing quite a challenging situation. If the price of Pi breaks below $0.40, the bearish momentum could strengthen further.

However, in case of a bounce from this support zone, there could be a brief recovery towards $0.50 to $0.586.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. Pi Network Price Prediction for July 2025. Accessed on July 4, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.