Download Pintu App

Is XRP About to Smash Through $2.35? Smart Money Sparks Massive Bullish Surge!

Jakarta, Pintu News – Since plummeting to a two-month low on June 22, Ripple (XRP) has started to rebound slowly, moving in an ascending parallel channel.

This price recovery, although accompanied by persistent declines, appears to be driven by renewed investor confidence, especially from experienced market participants.

XRP displays bullish signals as smart money eyes further gains

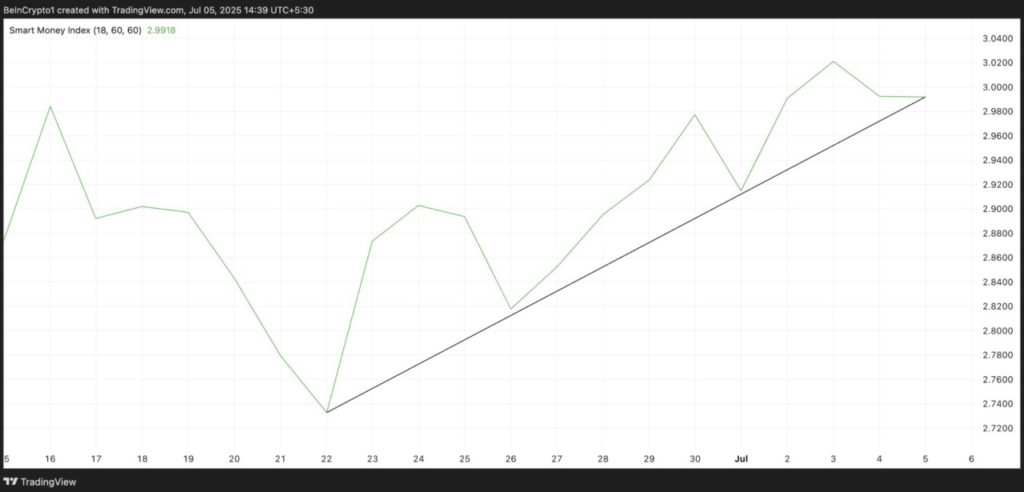

Since late June, the steady rise in XRP’s Smart Money Index (SMI) suggests that smart money is starting to come back into the market and position itself for a potential price increase. Readings from this indicator show that its value has increased by 10% since June 22.

Read also: Cardano Hits 111 Million Transactions — Is a Massive ADA Rally Just Around the Corner?

Smart money refers to capital controlled by institutional investors or experienced traders who have a deep understanding of market trends and timing. SMI tracks the behavior of these investors by analyzing intraday price movements.

Specifically, it measures selling activity in the morning (when retail traders are more dominant) compared to buying activity in the afternoon (when institutions are more active).

A rise in the SMI like this indicates that smart money is accumulating assets, often as a preliminary step before a major price movement occurs.

In the case of XRP, the increase in SMI since June 22 suggests that seasoned investors are quietly accumulating the token. This is likely in anticipation of a larger rally, as speculation around a spot XRP ETF continues to strengthen.

In addition, XRP’s Parabolic Stop and Reverse (SAR) indicator also confirms this bullish outlook. As of July 5, the dots forming the indicator are below the price of XRP, providing dynamic support at the $1.99 level.

The Parabolic SAR indicator is used to identify trend direction and potential reversals. When its dots are below the price of an asset, it indicates that the market is in an uptrend. This indicates that an asset is experiencing bullish momentum, and its price could continue to increase if the buying pressure continues.

Smart Money Accumulation Could Trigger Breakout

As of July 5, XRP was trading at $2.21, recording a decline of 0.14% in the last 24 hours in line with the general market correction.

Read also: 3 ‘Made in USA’ Crypto Coins to Watch, Ready to Rise Tens of Percent?

If buying activity from experienced investors strengthens further, XRP has a chance to reverse its downtrend and rise towards the $2.35 level.

However, if the pressure from the bears remains dominant, they could push the price of XRP down further to $2.14. In fact, they could also potentially push the price to break below $2.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. XRP Eyes $2.35 as Smart Money Fuels Bullish Momentum. Accessed on July 7, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.