Download Pintu App

Bitcoin Holds Strong at $109K on July 7 — 93% of Holders Are Cashing In!

Jakarta, Pintu News – Bitcoin (BTC) price rallied again and hovered around $109,000 today, July 7, 2025, reflecting the market sentiment that is still quite optimistic.

Interestingly, the latest data shows that 93% of BTC owners are now in a position of profit as Bitcoin’s market capitalization has broken the fantastic figure of $2 trillion.

Amidst the lack of sharp movements, the dominance of large investors and declining retail interest created its own dynamics in the consolidation phase of the largest crypto asset.

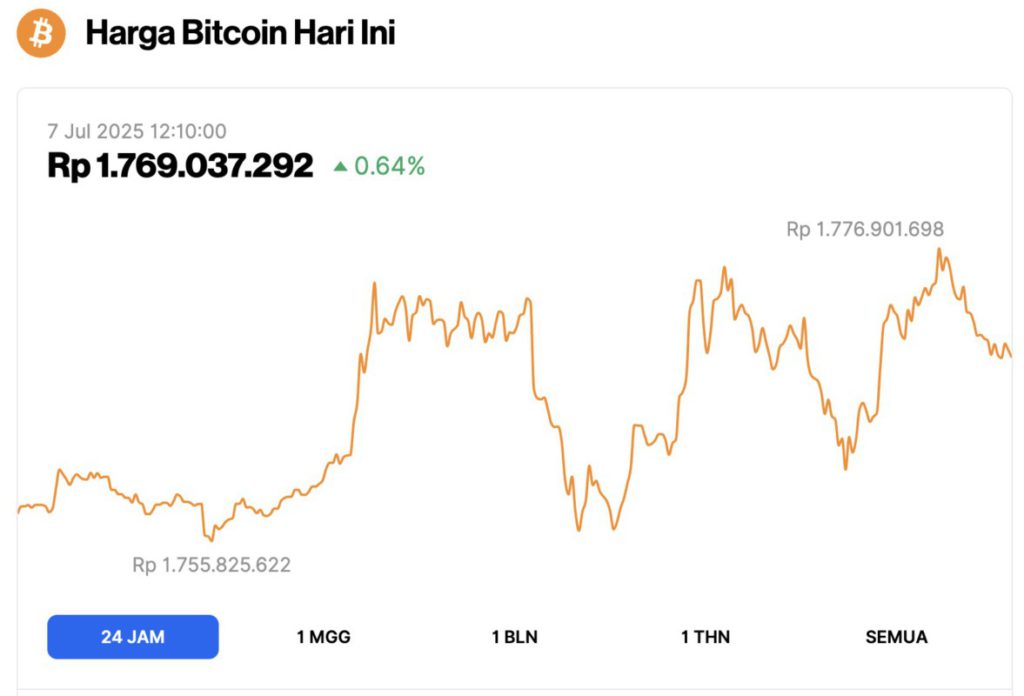

Bitcoin Price Up 0.64% in 24 Hours

On July 7, 2025, Bitcoin was trading at $109,142, equivalent to IDR 1,769,037,292, marking a 0.64% increase over the past 24 hours. During this time, BTC dipped to a low of IDR 1,755,825,622 and peaked at IDR 1,776,901,698.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $2.17 trillion, with trading volume in the last 24 hours up 31% to $39.29 billion.

Read also: Ethereum Surges to $2,500 — But a Hidden Liquidity Imbalance Could Shake Its Entire Economic Model!

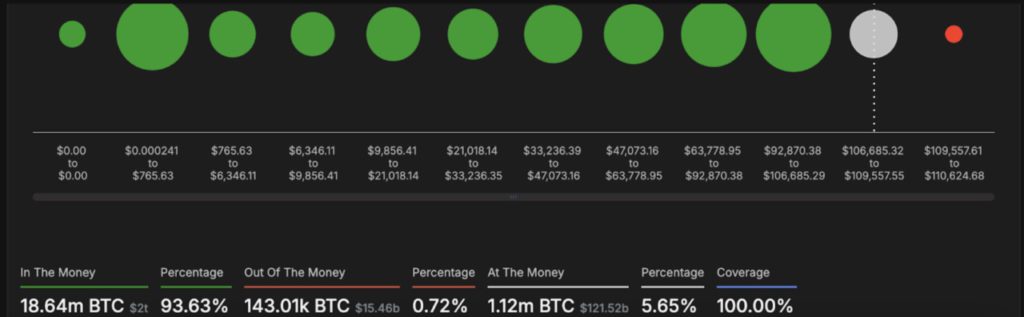

93% of BTC Holders Are In the Money

Despite the market’s recent short-term correction, Bitcoin price continues to show strength. Based on data from IntoTheBlock, over 93% of BTC holders are In the Money.

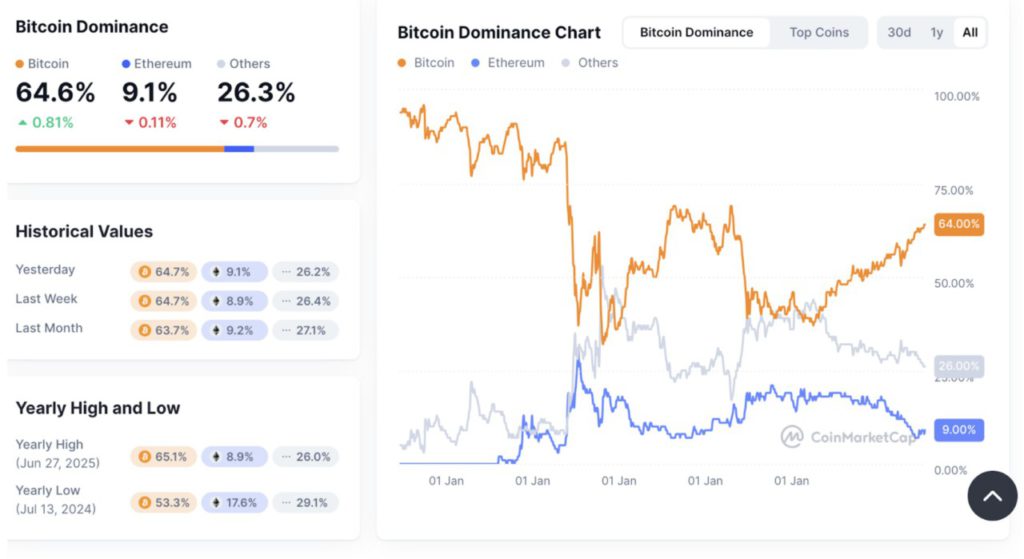

Meanwhile, Bitcoin dominance has surged to 64%, according to data from CoinMarketCap. Bitcoin dominance is a metric used to measure the relative market share or dominance of Bitcoin within the cryptocurrency sector as a whole.

It shows the percentage of Bitcoin’s total market capitalization compared to the combined market capitalization of all cryptocurrencies.

An increase in dominance indicates that Bitcoin is rising in value or at least declining less than altcoins, reflecting a preference for investments that are considered safer.

Overall, demand for Bitcoin has shrunk significantly, with a drop of around 895,000 BTC in the last 30 days, according to data from CryptoQuant. This decline has effectively neutralized the positive impact on price that institutional buying typically drives.

Read also: 3 ‘Made in USA’ Crypto Coins to Watch, Ready to Rise Tens of Percent?

While there are still large purchases in the spotlight, the net growth in demand is starting to slow down, which ultimately limits Bitcoin’s upward momentum.

Instead of encouraging breakouts, this stagnant condition keeps the asset in a consolidation phase.

BTC Price at a Crossroads

Although the S&P 500 index and Nasdaq Composite both closed at all-time highs on Friday, Bitcoin failed to follow suit.

Despite recording a 15% increase throughout the first half of 2025, this result is still far from the explosive growth that crypto investors have come to expect in recent years.

One of the main factors behind this lackluster price movement may be the declining interest from retail investors. Currently, most of the price movement seems to be driven by large holders, or whales, such as Strategy (formerly MicroStrategy), who continue to add to their Bitcoin reserves.

Currently, Bitcoin is trading at $109,142. From a medium-term point of view, the weekly chart will close in the neutral zone.

If this remains the case, then it is likely that Bitcoin will trade sideways in a narrow range between $107,000 and $110,000.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- U Today. 93% of Bitcoin Holders in Profit as BTC Market Cap Exceeds $2 Trillion. Accessed on July 7, 2025

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.